Accounting & Treasury Software: Infuse Agility into Your Financial Process

If you are an accounting or treasury professional, you know how challenging it can be to manage complex financial data, comply with regulations, and optimize your business performance. insightsoftware offers Certent Equity Management, FastPost, and Viareport Lease to meet all your needs. Our solutions give you reliability and up-to-date visibility to support compliance and strategic decisions on everything from your day-to-day accounting needs to developing long-term financial strategy and policies.

"*" indicates required fields

Capabilities

Supercharge Your Accounting & Treasury Processes

Accounting and treasury professionals have a lot on their plates. From ensuring compliance with the latest accounting rules and regulations, and managing equity and debt instruments, to providing timely and accurate reporting to stakeholders – these professionals are at the forefront of a company’s financial success. So why not make their lives a little easier? With the right tools and expertise, navigating this complex environment can be a breeze.

insightsoftware offers a suite of products that can help you simplify and automate your accounting and treasury activities, improve data quality and visibility, and enhance decision-making and performance. Whether you need to handle equity management, financial accounting, or lease accounting, we have a solution that fits all your needs.

Use Cases

Unleash the Power of Your Financial Data

From managing eligibility to processing purchases, employee stock purchase plans (ESPP) carry significant administrative and accounting burdens. Effective communication with participants, payroll and your broker is paramount. Proper records must be kept, and files need to be coordinated with payroll for tax reporting. Dispositions must be identified and handled properly. You need tools to track activity and ensure compliance requirements are met.

Cumbersome spreadsheets and disconnected systems can leave you sifting through old records and trying to reconcile data between multiple systems. You need a solution designed to handle the challenges you face at this stage of your business and can grow with you as your cap table evolves.

Capitalization and equity management software offers a cost-effective solution for private companies that allows you to start with the tools you need for cap table management, equity management, waterfall analysis and employee/shareholder communication.

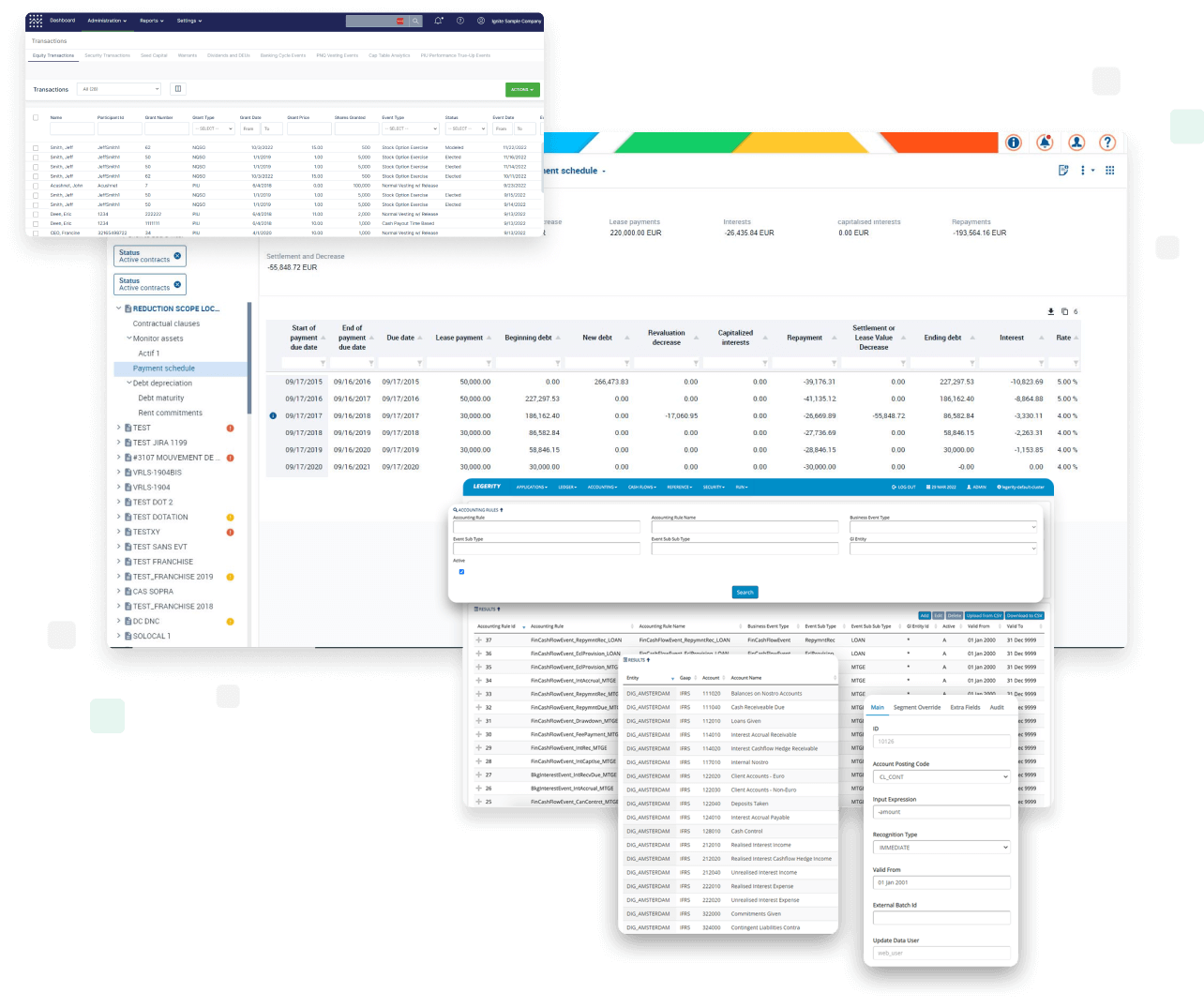

If you are struggling with complex and changing accounting standards and regulations, you need a software solution to simplify and automate your accounting processes. Financial accounting rules software lets you create and apply your own accounting rules and methods to any source system and transaction and generate accurate, compliant, and traceable accounting entries. You can also easily handle errors and exceptions, update rules as needed, drill down to the source data, and track every change with audit trail functionality. This saves time, reduces errors, and improves your financial reporting quality.

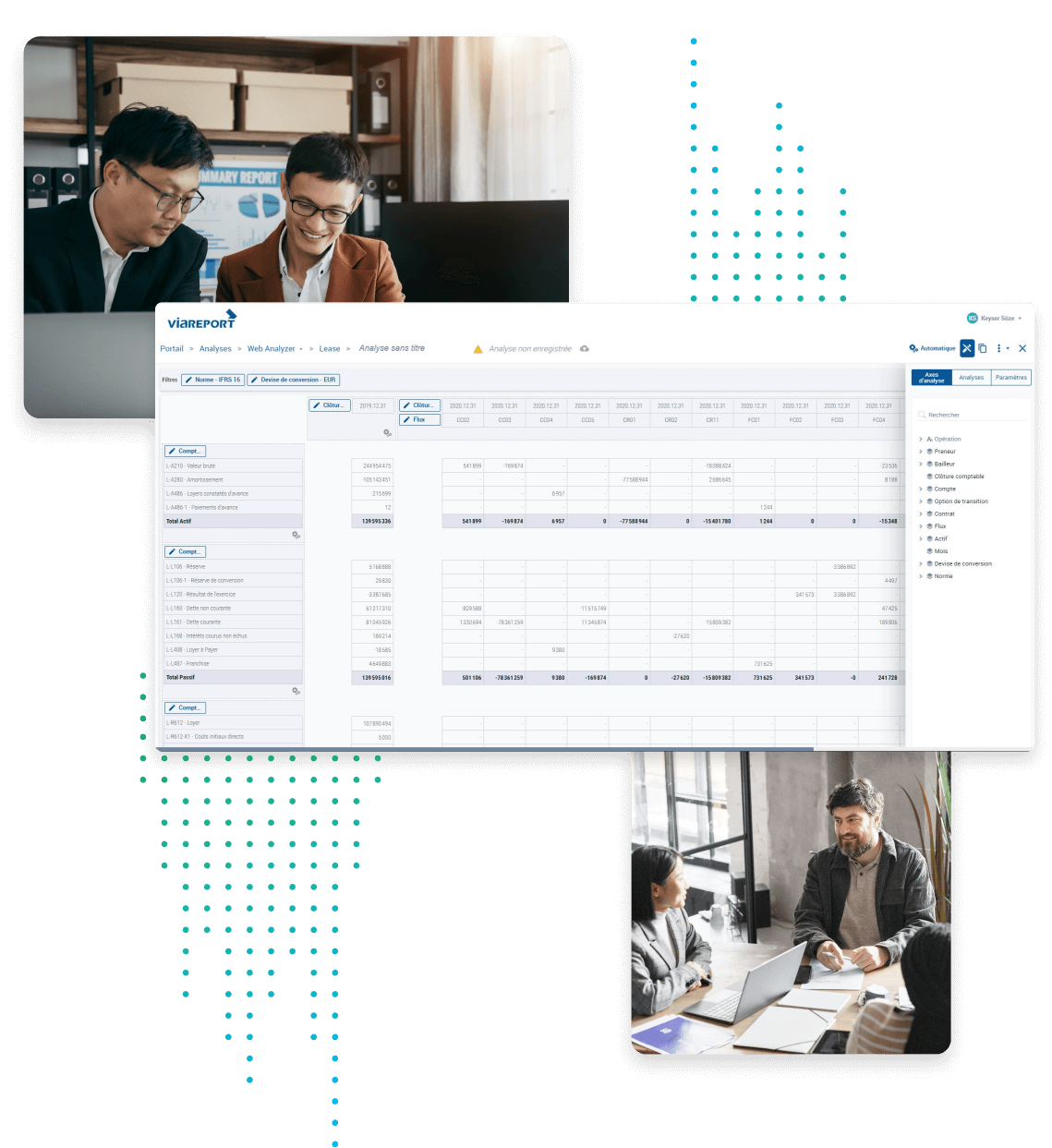

The new lease accounting standards (ASC 842 and IFRS 16) require that you report your leases on your balance sheet. To do this, you need to gather and verify lease data from different sources, compute lease liabilities and right-of-use assets, produce journal entries and disclosures, and more. With insightsoftware, you can make your lease accounting process easier and faster. You can consolidate your lease data in a safe cloud platform, measure lease accounting metrics precisely, and create compliant financial statements and reports.

Roles & Industries

How an Adaptable Solution Helps

Agility is a critical component of automation within accounting and treasury operations, ensuring that organizations can swiftly and efficiently react to ever-evolving market conditions and regulations, capitalize on new opportunities, and safeguard against potential risks.

CFO

As the CFO, you must oversee your organization’s financial performance and strategy. You must ensure compliance with accounting standards and regulations, manage risks and opportunities, and provide your executive team and board with strategic guidance and insights. Accounting and treasury software can help you automate and streamline your financial processes, improve data quality and reliability, and enhance reporting and analysis capabilities.

Financial Controller

As the financial controller, you need to manage your organization’s accounting operations and financial reporting. You need to ensure the accuracy and timeliness of your financial data, comply with internal and external audit requirements, and support the financial planning and analysis function. Accounting and treasury software can help simplify and accelerate your financial close process, ensure compliance with accounting standards and regulations, and generate accurate and consistent financial statements and reports.

Treasurer

As the treasurer, you need to manage your organization’s cash flow and liquidity. Your role includes forecasting cash inflows and outflows, optimizing working capital, managing debt and investments, and mitigating financial risks. Accounting and treasury software can help you automate and improve your cash flow forecasting, modeling, and reporting, integrate data from multiple sources, and provide visibility and control over your cash position.

Technology

Technology companies often offer equity compensation to their employees, which requires them to comply with ASC 718 and other regulations. They must also manage their cash flow effectively, especially if they have long sales cycles or high capital expenditures. Accounting and treasury software can help them automate and streamline their equity plan administration, ensure compliance with accounting standards and regulations, and improve their cash flow forecasting and analysis.

Manufacturing

Manufacturing companies often lease assets such as property or equipment, which requires them to comply with ASC 842 and IFRS 16. They must also manage their intercompany transactions efficiently, especially if they have multiple subsidiaries or locations. Accounting and treasury software can help them automate and optimize their lease accounting process, ensure compliance with accounting standards and regulations, and perform intercompany eliminations and allocations.

Real Estate & Property Management

Real estate and property management companies must manage complex financial data, such as rent payments and property expenses. To comply with IFRS16, accounting and treasury software can help centralize and capture lease data from various sources and systems; automate calculations and reporting of lease liabilities, right-of-use assets, interest, amortization, cash flow, and other disclosures; and handle complex scenarios such as lease modifications, impairments, incentives, break clauses, and extensions.

Financial Services

Using a cloud-based accounting rules platform can help financial services companies address regulatory challenges by enabling them to capture financial information associated with transactions and classify it according to their accounting rules. Accounting rules software can also accelerate the production of banking-specific reporting, which is often complex and time-consuming.

Construction

The construction industry uses lease accounting software to manage their leases and comply with new lease accounting standards. The software gives construction companies better visibility into lease data and financial performance while reducing the risk of errors and misstatements by helping them track their leases, calculate lease payments, and generate reports.

FAQs

Automation can help reduce the risk of errors in accounting and treasury by minimizing the need for excessive manual intervention, which is how many data entry errors are introduced. Using accounting software that includes error-reducing features, such as audit trails and workflow automation can also help mitigate data discrepancies.

Some of the most common challenges with equity management software include accessing the data required to create accurate ledger-based cap tables, modeling and comparing pre/post-round-of-funding scenarios, ensuring efficient and timely distribution of information to shareholders and plan participants, as well as contending with software that is unable to scale to support your growing business.

To ensure data accuracy in accounting and treasury processes, it is important to know where your data comes from and how it is collected, stored, and updated. Establishing clear and consistent data standards and rules for your accounting processes, as well as reconciling entity financial data with associated Treasury data, can also help ensure accuracy. Enabling non-technical business users to create their own accounting rules within an IT-approved environment is another method that can ensure data precision and compliance in this area. This approach can improve efficiency, reduce costs, and centralize the implementation of accounting logic.

Some of the most common challenges with lease accounting software include identifying embedded leases, finding all the lease contracts and ensuring accuracy of the data. Because many companies have a decentralized approach to leasing today, ASC 842 forces everyone to organize that data and allows for smarter business decisions. Implementing lease accounting software solves many of these challenges for your colleagues in other departments.