Ditch Manual Tax Processes: Automate With Insightsoftware Tax Solutions

Escape manual tax complexities. insightsoftware’s tax solutions liberate you from manual tasks, offering streamlined workflows, accurate data, and time for strategic growth.

"*" indicates required fields

Capabilities

Automate Tax Management. Reduce Errors. Gain Insights.

Automate tax workflows, standardize processes, and unlock strategic tax insights through unified data analysis. Experience the power of a frictionless tax management solution, boosting efficiency and accuracy for informed decision-making.

Use Cases

Optimize Efficiency with insightsoftware’s Tax Solutions: Streamlined, Centralized, and User-Friendly for Enhanced Accuracy and Governance.

Elevate your data analysis. Ensure accurate streamlined reporting with insightsoftware's tax solutions. Meet regulatory challenges while reclaiming time through automation.

Centralized calculations help you reduce manual processes, ensure integrity, and promote transparency. Monitor subsidiaries for profitability deviations early and proactively address underlying causes. Easily measure with consolidated financial data and gain detailed visibility into jurisdictions, entities, and timeframes. Enhance coordination among FP&A, tax, and operations teams for timely action and year-end surprises prevention.

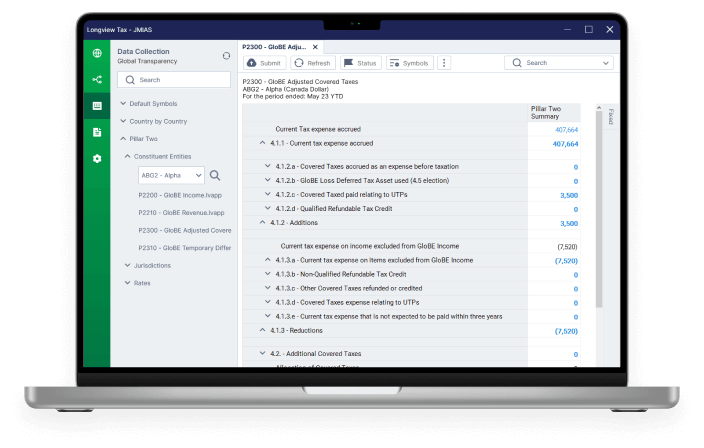

Reclaim lost hours and gain valuable time for tax analysis with insightsoftware’s automated tax provisioning solutions. Leverage seamless calculations and embrace new levels of efficiency for multi-jurisdictional compliance.

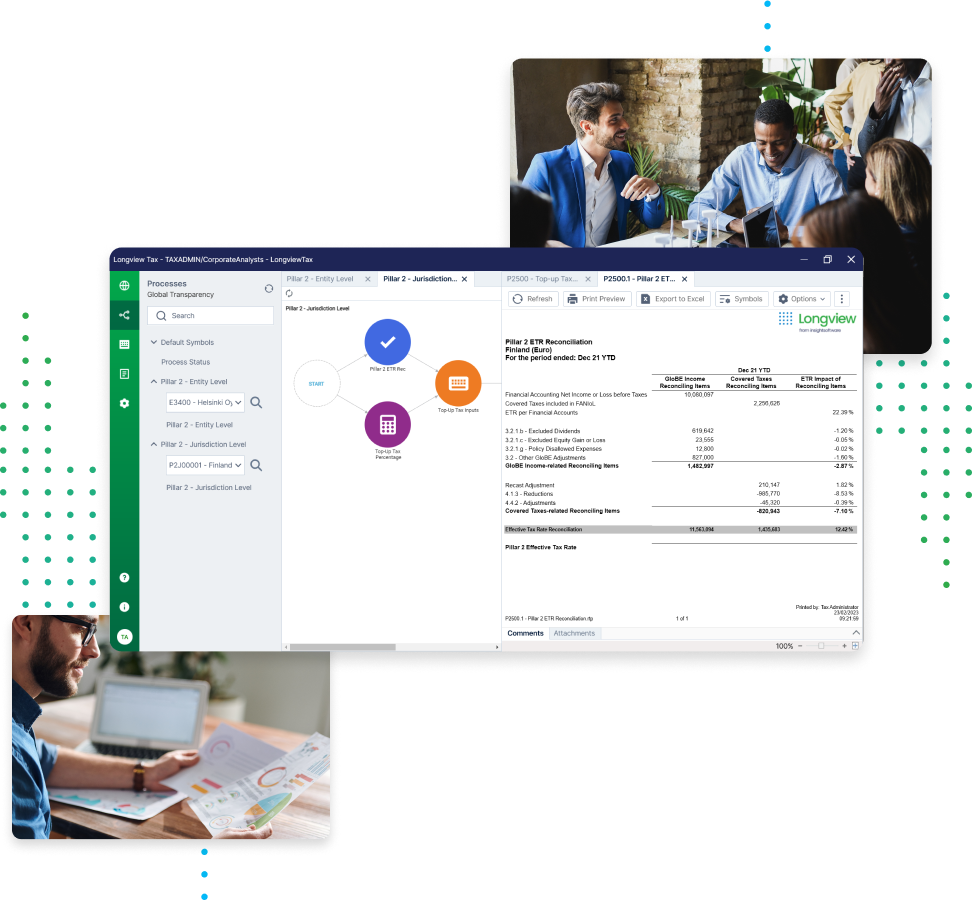

BEPS challenges demand evolved tax solutions. insightsoftware’s flexible tax solutions help you navigate increased data complexity. Ensure efficiency, prepare for Pillar 2, and foster collaborative analytics for your tax team’s success in this dynamic environment.

Close faster with insightsoftware’s tax solutions. Automated data collection across departments minimizes manual delays, reducing dependence on finance. Redirect valuable time and energy towards strategic initiatives. Gain agility, speed tax completion, and enhance department autonomy for efficient, independent operations.

Unify tax data, unlock strategic insights. Streamline analysis with insightsoftware’s centralized, standardized tax solutions. Ensure accurate entity comparisons and financial storytelling for confident decision-making.

Products

The Complete Solution for Your Global Tax Needs.

insightsoftware’s suite of tax and transfer pricing solutions enable you to optimize your tax reporting with faster processing and a single source of truth.

Longview Tax

Flexible, cloud-based corporate tax software that improves the tax function across companies, designed for large entities with complex needs in foreign exchange or complex organizational structures headquartered in North America, EMEA or elsewhere.

- Close faster while reducing dependencies on other departments

- Eliminate costly consequences of error prone manual tax management

- Establish single source of truth that promotes strategic analysis

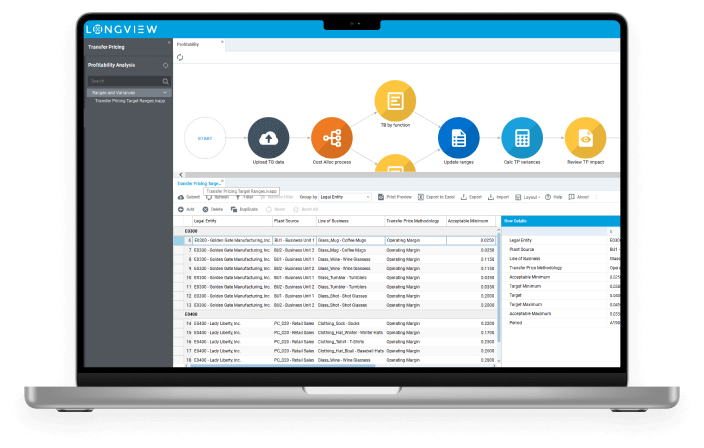

Longview Transfer Pricing

Navigating changes to supply chains and global tax regulations is a challenge. Longview Transfer Pricing boosts visibility and compliance posture.

- Automating manual tasks.

- Providing a centralized transfer pricing solution.

- Avoiding large, year-end adjustments while saving days’ worth of work at closing.

- Enabling teams to comply with tax regulations without having to rely on IT.

Roles & Industries

Enhance Your Tax Function with insightsoftware Solutions

Tax software empowers diverse roles, providing data insights for decision-makers, and streamlining processes for operational efficiency across your organization.

VP of Tax/Tax Reporting

VP of Tax manages global compliance, oversees tax returns, and analyzes tax obligations. Tax software aids in closing faster, reducing dependency, eliminating errors, and establishing a single source of truth for strategic analysis.

VP/Director of Audit

Tax software helps your Audit VP/Director by automating processes, enhancing accuracy, providing data visibility, saving time, ensuring compliance, and facilitating comprehensive reporting for efficient and strategic audit management.

VP/Director/Manager of Compliance

Tax software empowers your Compliance VP/Director/Manager by accelerating provisioning, ensuring timely data, simplifying trend analysis, offering robust reporting tools, and streamlining Country By Country Reporting for efficient compliance with evolving OECD requirements

FAQs

Tax management software enhances efficiency, accuracy, and compliance in an organization’s tax processes. It saves time, cuts costs, and ensures regulatory adherence for better decision-making.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers flexible integration options to connect to the many and varied data sources required for tax, transfer pricing and tax transparency.