Longview Transfer Pricing Software Boosts Visibility and Inspires Action

"*" indicates required fields

Does Your Team Commonly

Struggle with These Transfer Pricing Challenges?

Gaps in targeted profitability

Outdated and highly manual processes in static spreadsheets

Analyzing profit scenarios and implementing pricing changes

Trusted By

Avoid Year-End Surprises by Making Timely Adjustments

Rather than waiting until year-end to make large retroactive adjustments, take the reins and reduce your audit risk by proactively monitoring and adjusting prices throughout the year. Longview Transfer Pricing provides fully burdened P&Ls and up-to-date finance data to facilitate the timeliness, accuracy, and granularity you need to take decisive and strategic action.

Standardize and Automate Your Processes to Support Better Decision Making

With scalable data management capabilities that can organize and segment large volumes of data, harness Longview Transfer Pricing to create a single source of truth with higher quality assurance standards. Automated calculations reduce the need for manual data manipulation, freeing up more time for your organization to run segmented profitability analyses and model potential pricing changes.

Improve Stakeholder Relationships Through Better Reporting

Avoid unsettling year-end surprises for your internal stakeholders by circulating clear reports with actual profitability numbers as well as suggested changes. And, if the authorities ever come knocking, share your transparent and auditable trails with the utmost ease so you can keep focusing on the true work at hand: hitting your targeted profitability across the group.

Key Features of the Top-Rated Transfer Pricing Software

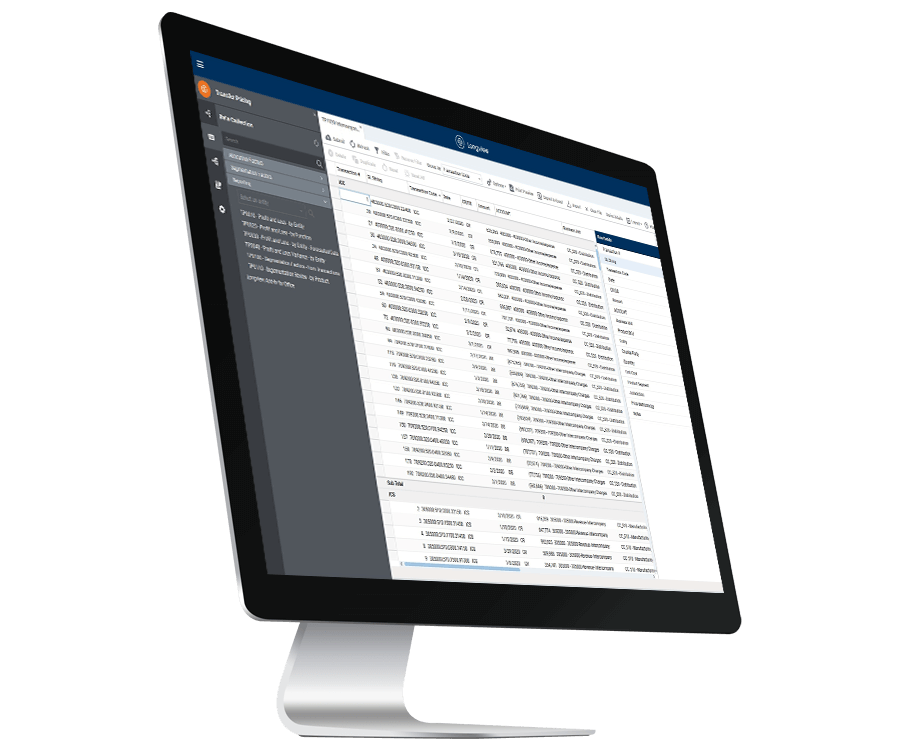

Data Collection

Improve analysis and decision-making processes:

- Access data from any existing financial or ERP application.

- Validate and manipulate data to support data-driven transfer pricing analysis.

- Track data to their source, improving transparency for internal and external oversight.

- Leverage non-financial data to improve decision-making processes and optimize transfer pricing.

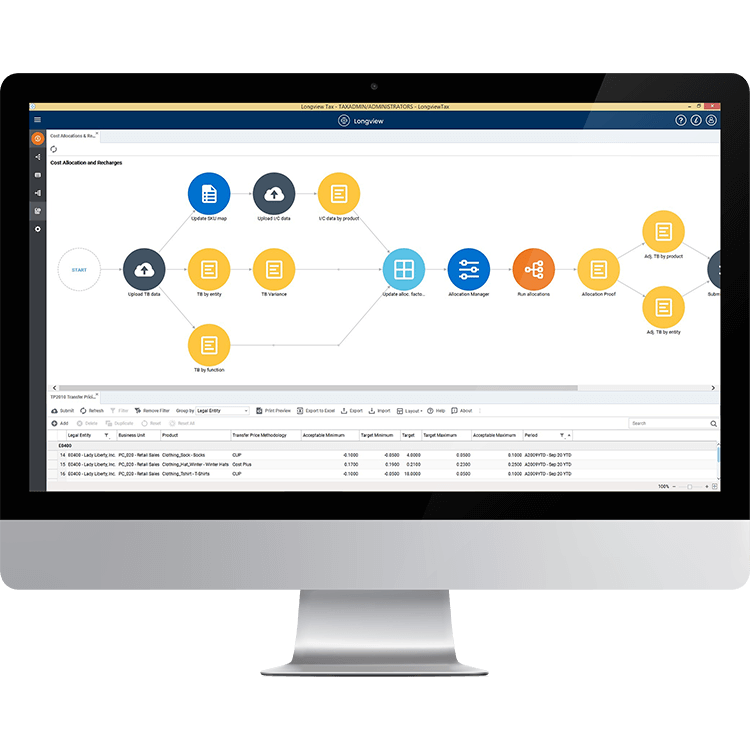

Cost Allocation

Enable more intelligent financial reporting:

- Gather and pool cost amounts, and then calculate re-charges based on cost data.

- Identify all variables affecting each allocation.

- Link supporting information and documentation to each allocation for both internal and external review.

- Generate invoices or journal entries to document allocations in financial ledgers.

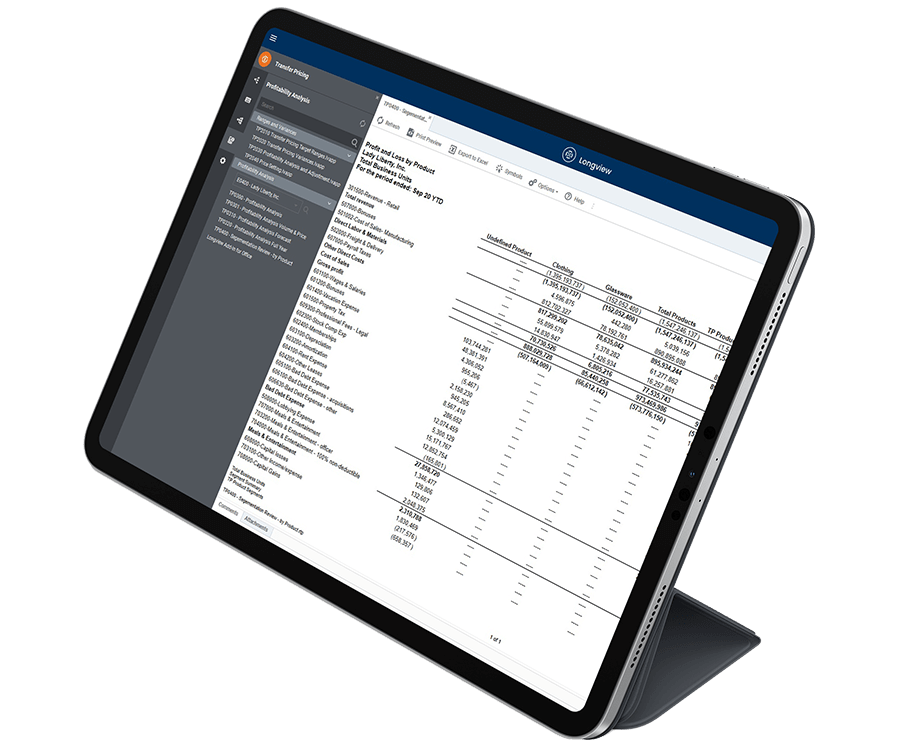

Segmented Reporting

Gather and organize data for accurate profitability analysis:

- Segment P&Ls by business function, product, and other criteria.

- Define business rules to dictate segmentation.

- Use standard reports for financial forecasting and strategic decision-making processes.

- View data reports at various organizational levels, enabling granular analysis and enterprise-wide strategy.

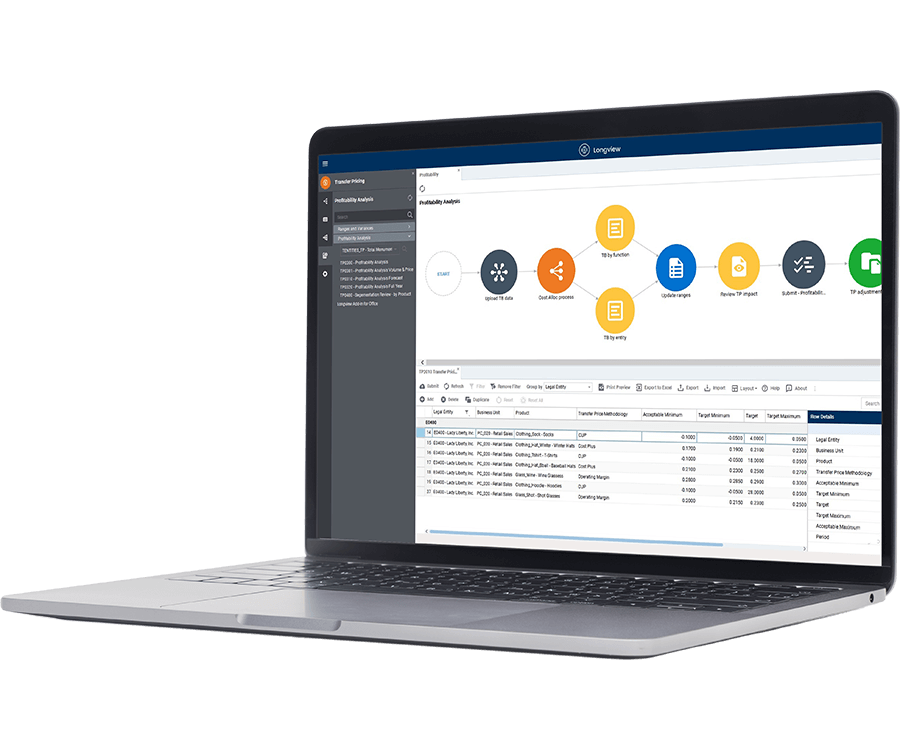

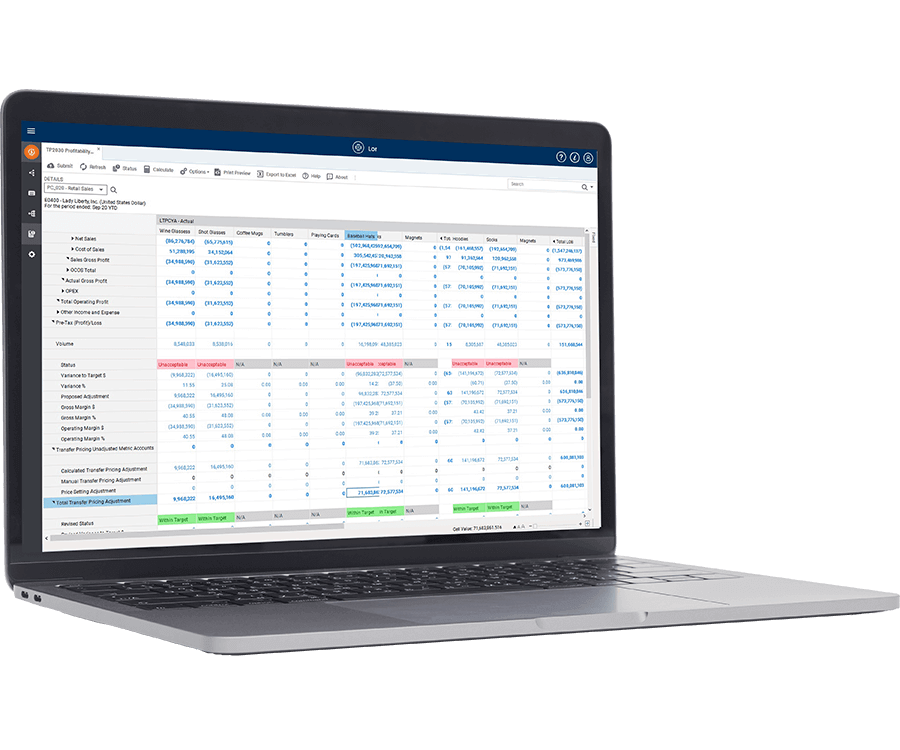

Profitability Analysis

Optimize your transfer pricing process:

- Define profitability ranges, including profit goals.

- Leverage data visibility to adjust your transfer pricing strategy quickly and with greater accuracy.

- Integrate pricing outcomes with ERP and finance applications, updating financial data and ensuring company data are prepared for an audit.

Ready to go beyond Tax Reporting?

Longview Transfer Pricing is one of insightsoftware's unified, modular applications. Select the capabilities you need across budgeting & planning, controllership, and reporting to get more done with less risk by bringing all your insightsoftware applications together in one place.

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

- 24SevenOffice

- A+

- AARO

- AccountEdge

- Accounting CS

- Accountmate

- Acumatica

- Alere

- Anaplan

- Aptean

- Assist

- ASW

- Aurora (Sys21)

- Axion

- Axis

- BAAN

- Banner

- Blackbaud

- BlueLink

- Book Works

- BPCS

- Cayenta

- CCH

- CDK Global

- CedAr e-financials

- CGI Advantage

- Clarus

- CMiC

- CMS (Solarsoft)

- Coda

- Coins

- Colleague

- CPSI

- CSC CorpTax

- Custom

- CYMA

- DAC

- Data Warehouse

- Datatel

- DATEV

- Davisware Global Edge

- Davisware S2K

- Deacom

- DPN

- e5

- eCMS

- Eden (Tyler Tech)

- Emphasys

- Entrata

- Etail

- Expandable

- FAMIS

- Famous Software

- Fern

- FinancialForce

- FireStream

- FIS

- FiServ

- Flexi

- Fortnox

- Foundation

- Fourth Shift

- Friedman

- Full Circle

- GEMS

- Harris Data (AS/400)

- HCS

- HMS

- IBM Cognos TM1

- IBS

- IBS-DW

- In-House Developed

- Incode

- INFINIUM

- IQMS

- iSuite

- Jack Henry

- Jenzabar

- JobBOSS

- Jonas Construction

- M1

- Macola

- MACPAC

- Made2Manage

- MAM

- MAM Autopart

- Manman

- Mapics

- McLeod

- MEDITECH

- MFG Pro

- MicrosOpera

- MIP

- Mitchell Humphrey

- Movex

- MRI

- MSGovern

- Munis (Tyler Tech)

- New World Systems

- Onesite

- Onestream XF

- Open Systems

- PDI

- Penta

- Plexxis

- PowerOffice

- PRMS

- Pro Contractor

- ProLaw

- Q360

- QAD

- Quantum

- Qube Horizon

- QuickBooks Desktop Premier

- QuickBooks Desktop Pro

- Quickbooks Enterprise

- QuickBooks Online

- Quorum

- RealPage

- REST API

- Retalix

- Ross

- SmartStream

- Spokane

- Springbrook

- Standalone DB with ODBC/DSN connection

- Standalone IBM DB

- Standalone Oracle DB

- Standalone SQL DB

- SUN

- Sunguard

- SunSystems

- Sys21

- SyteLine

- TAM (Applied Systems)

- Thomson Reuters Tax

- Timberline

- TIMELINE

- Traverse

- TripleTex

- Unit4

- Unit4 Agresso

- Unit4 Business World

- Unit4 Coda

- USL Financials

- Vadim

- VAI-System 2000

- Vantage

- Vertex

- Visma

- Winshuttle

- Wolters Kluwer CCH Tagetik

- WorkDay

- Xero

- xLedger

- Xperia

- Yardi

- Yardi-SaaS

Top Five Ways to Boost Operational Transfer Pricing Effectiveness

Empower your team with the tools they need to make potential auditable adjustments faster and with greater visibility.

This whitepaper will help you:

- Quickly and accurately collect and organize transfer pricing data

- Learn how to identify gaps in targeted profitability

- Make corrections before closing the books to ensure you are delivering on organizational goals

Automating the transfer pricing journal entries was extremely helpful. We particularly loved utilizing FX within our system, making calculations centrally, and then layering all adjustments onto the provisions. The automated processes and tight integration with our provision proved much more impactful than what we were able to do before.

Schedule a Live Demo to See

Longview Transfer Pricing in Action