End-to-End Financial Close and Consolidation Solutions

Enhance your financial performance with an automated, streamlined close and consolidation process. Ensure accuracy, compliance, and transparency for confident reporting.

"*" indicates required fields

Capabilities

Optimize Finance for Trusted Results

Unlock financial agility with insightsoftware’s leading close and consolidation solutions. Reduce error-prone manual processes to boost efficiency. Seamlessly consolidate data with built-in automation for global and regional regulations. Deliver real-time, trusted insights across your business.

Use Cases

Automate Compliance for a Simplified, Trusted Financial Close

Adaptable close and consolidation software that scales with your business. Navigate evolving accounting standards with ease, and expedite your financial close for faster decision-making.

insightsoftware’s close and consolidation solutions automate and streamline your data collection, consolidation, reconciliation, and reporting processes, eliminating manual tasks, errors and bottlenecks. Enjoy real-time visibility into your financial performance for enhanced business intelligence.

Overcome complex consolidation challenges involving multiple entities, currencies, and changing compliance regulations with one flexible, agile solution. insightsoftware’s solutions can handle any type of consolidation logic and configuration and deliver consistent, reliable financial statements.

Gain a deep understanding of your financial performance across entities, products, and markets. Identify key drivers of profitability, growth, and risk with insightsoftware’s comprehensive and flexible reporting and analysis tools. Uncover valuable insights to empower strategic decision-making.

Products

Drive Accuracy and Efficiency and Eliminate Error-Prone Processes

Streamline workflows and automate data collection for consistent and reliable results. Enable your team to make data-backed decisions and meet all compliance requirements.

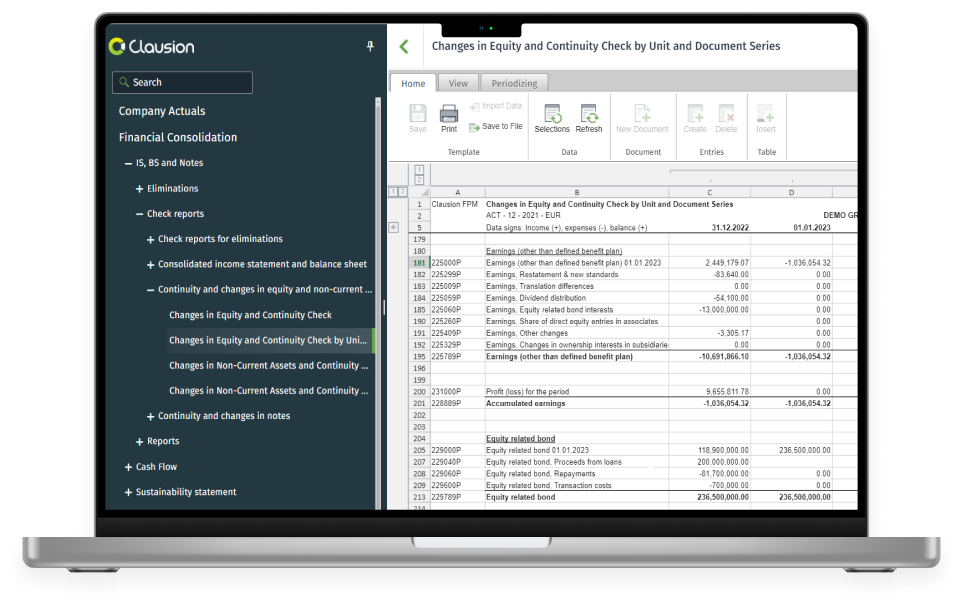

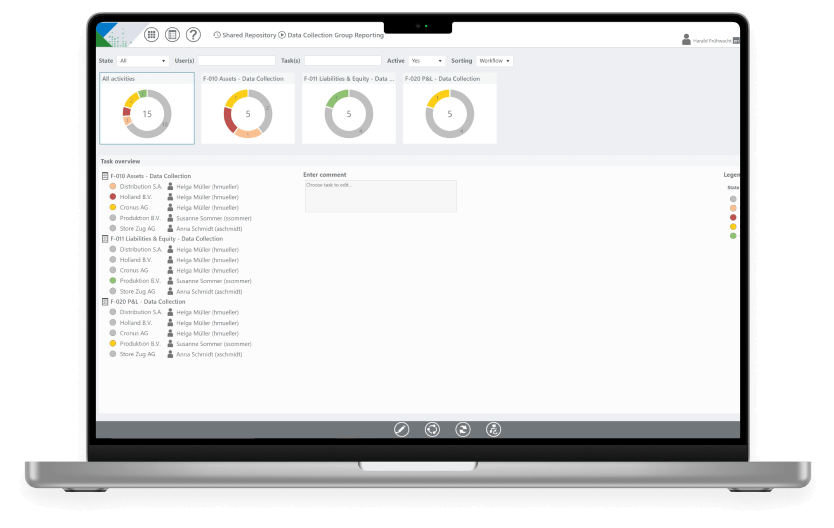

Clausion Consolidation

Automate Financial Consolidation with One Intuitive Solution

- Experience Trusted End-to-End Financial Consolidation

- Accelerate Productivity with Ready-Made Templates

- Simplified IFRS and GAAP Compliance for Confident Reporting

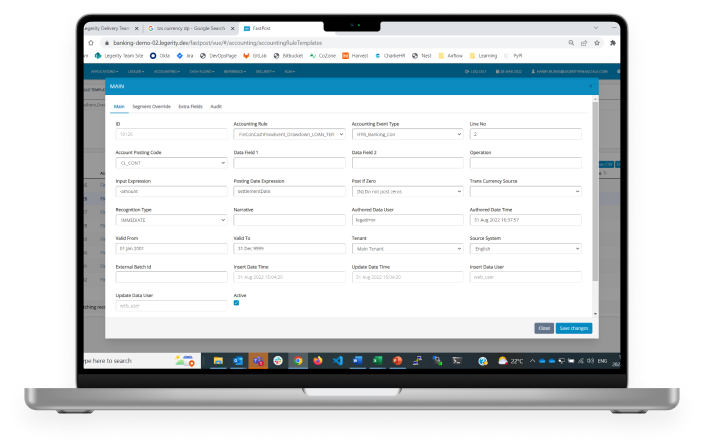

FastPost

Capture, classify, and record financial information associated with any transaction.

- High-speed, cloud-native accounting rules platform

- Create your own rules without code

- Complete, granular-level control over your financial data

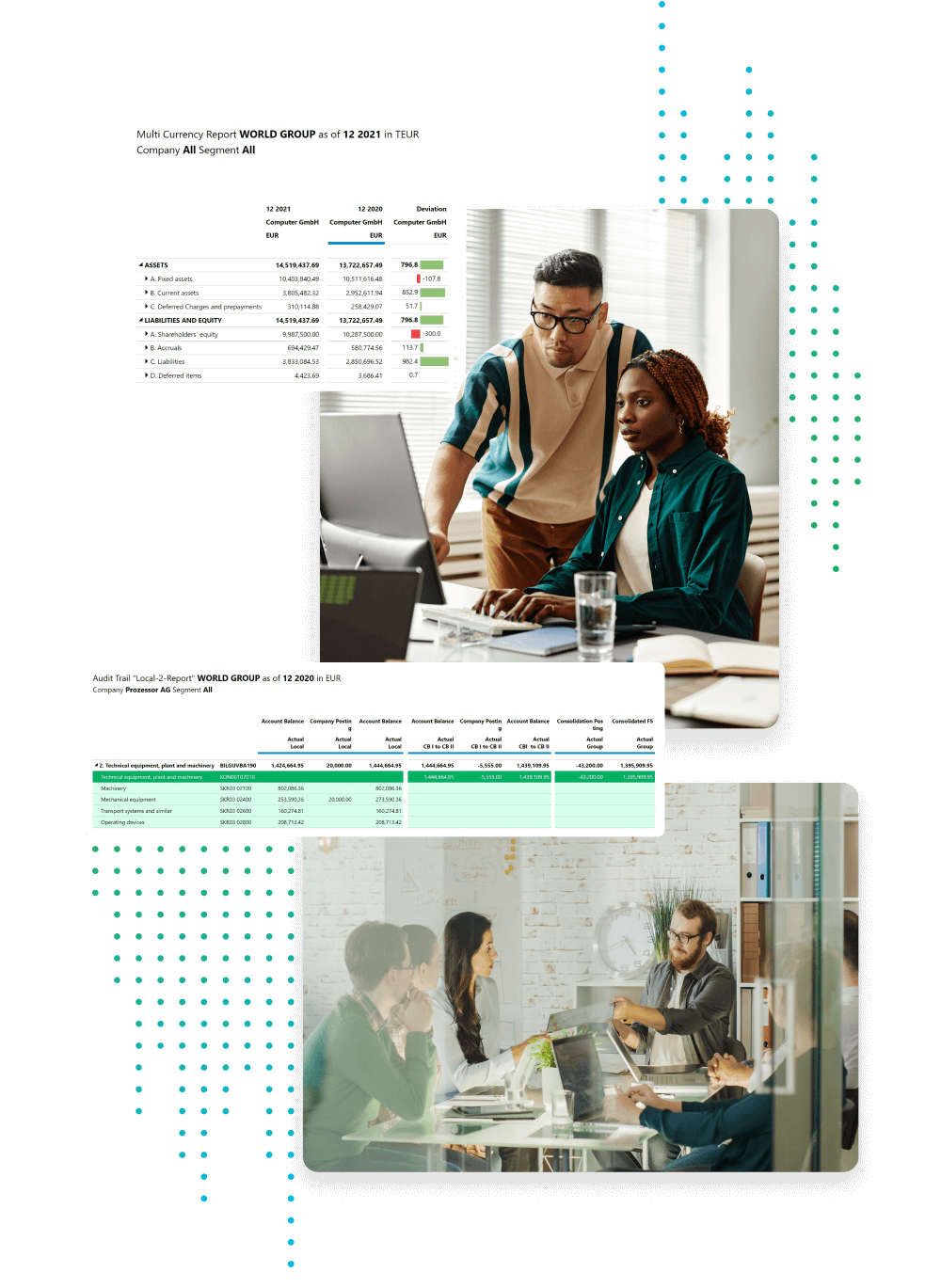

IDL Konsis

Fast and reliable financial consolidation and reporting designed for mid-sized to large enterprises with complex corporate structures and multiple reporting standards.

- Automate your consolidation process

- Ensure data accuracy

- Comply with international and regional reporting standards

- Analyze your financial performance

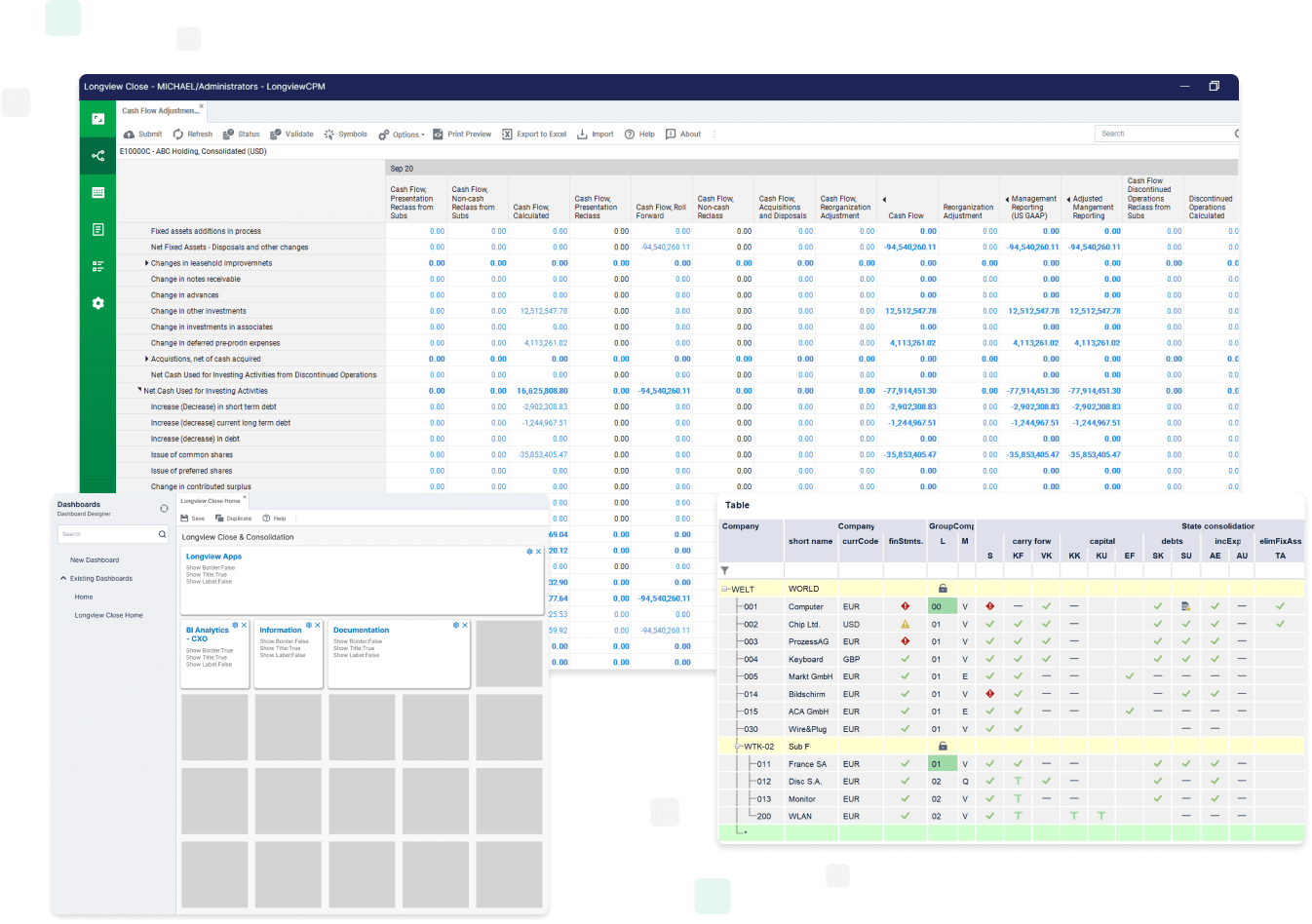

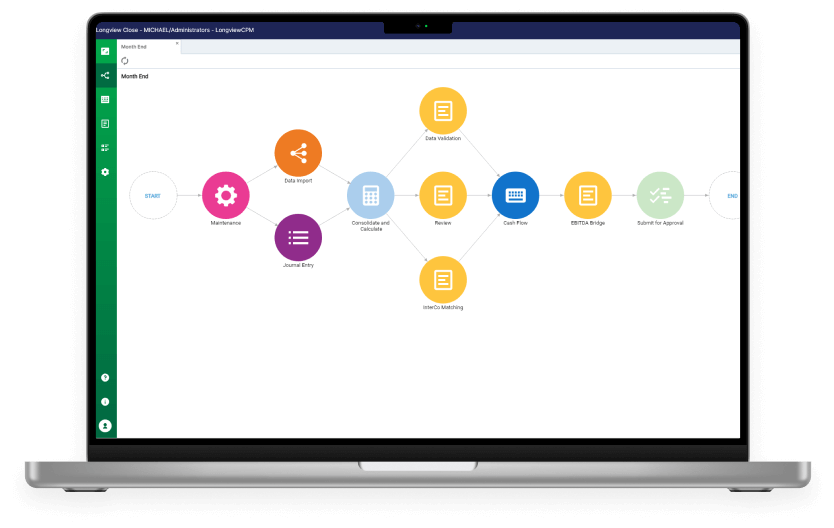

Longview Close

End-to-end financial close and consolidation for large enterprises with complex and dynamic business environments and multiple data sources.

- Simplify your close process

- Improve data governance

- Support multiple reporting scenarios and complex calculations

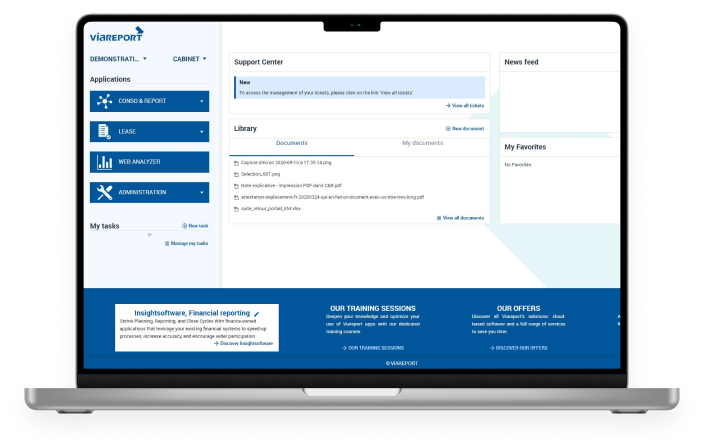

Viareport Lease

Viareport Lease – a flexible, cloud-based solution for managing your lease contracts

- One-stop cloud solution for centralizing lease contracts

- Comply with IFRS16, ANC 2020-01, and IAS17 Standards

- Flexible, user-friendly, scalable, purpose-built lease management application

Roles & Industries

Use Cases for Specialist Financial Close & Consolidation Software

Financial close and consolidation software empowers diverse roles across finance, group, and subsidiary functions in various industries to streamline financial processes.

Financial Controller

Financial close professionals wear many hats, overseeing the entire process from data collection to analysis. Close & consolidation software empowers them by automating and streamlining tasks, ensuring accuracy, efficiency, and valuable insights.

Financial Analyst

Financial analysts empower management teams with data-driven insights for informed decision-making. Close and consolidation software equips them with reliable, real-time data and customizable reports and dashboards.

Accountant

With close and consolidation software, accountants streamline tasks like recording transactions, reconciling accounts, and preparing financial statements. This automation frees up their time to focus on complex analysis and strategic contributions.

Auditor

Auditors play a critical role in safeguarding financial integrity by meticulously reviewing statements for accuracy and compliance. Close and consolidation software empowers them with easier data access, streamlining the audit process.

Financial Services

Financial firms are increasingly challenged in closing deals – currencies, structures, regulations shift constantly. M&A deals add more pressure. Close and consolidation software helps boost auditability, transparency, and confidence in reporting.

Manufacturing

Navigating global operations and complex regulations with vast data makes closing a challenge for manufacturers. Close and consolidation software automates and streamlines their financial close, delivering accurate data for informed decision-making.

Healthcare

Healthcare juggles costs, regulations, and evolving needs. Close and consolidation software helps them to spend more efficiently, streamline processes, and ensure data accuracy, leading to better performance and improved business intelligence.

FAQs

A cloud-based solution can offer several benefits, such as lower upfront costs, faster implementation, scalability, security, accessibility, and automatic updates.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers seamless integration that can easily connect to your primary data sources, such as ERP systems, spreadsheets, databases, or cloud applications, and that they are able to extract, transform and load this data into their software platform.

Choose close and consolidation software that is designed to be owned and managed by the finance team. Look for software that enables you to easily adapt workflows and templates to support data collection, validation, consolidation, and reporting, without needing IT or specialist help. Check that you can easily modify rules and validations to ensure the consistency and quality of your data.