Longview Tax Software & Dashboard Reporting

Elevate Corporate Tax to a Strategic Function with Longview Tax Software and Dashboard Reporting

Automate your organization’s tax data collection and processing, freeing up time to refocus your efforts on more proactive and strategic initiatives.

"*" indicates required fields

Does Your Enterprise Tax Team

Commonly Experience These Challenges?

Close and reporting efforts require large amounts of manual work in static spreadsheets

Lack of integration with finance systems means you have to manually rekey data

You often cannot see your group’s effective tax rate (ETR) until it’s too late to take steps to improve it

Trusted By

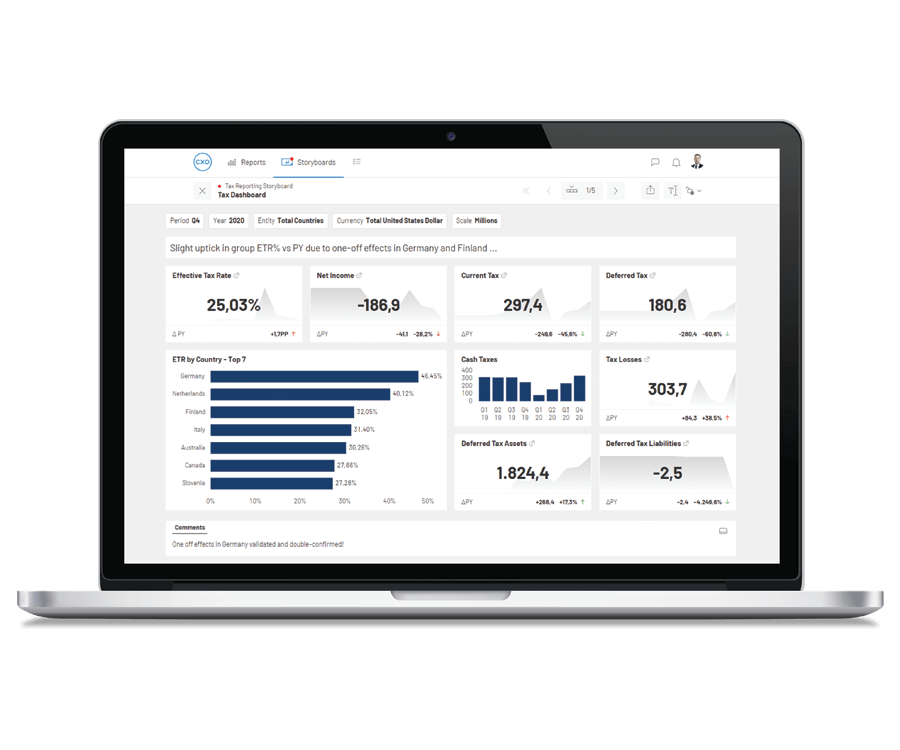

Close faster while reducing dependencies on other departments

With automated data collection and processing from all departments within your organization, your tax team doesn’t have to wait for consolidation from the finance team for the book income to be transferred manually. Thanks to this reduction in time and manual demands, you gain greater agility to accelerate your tax completion timeline while simultaneously boosting your department’s autonomy.

Eliminate the costly consequences of error-prone manual tax management

End your reliance on error-prone spreadsheets that require countless hours to check and re-check for accuracy. Instead, there’s a better way: standardize your data and processes, which allows for automated calculations and reporting with improved internal controls. Automating as much tax data collection and calculation as possible improves your data consistency and prevents manual errors.

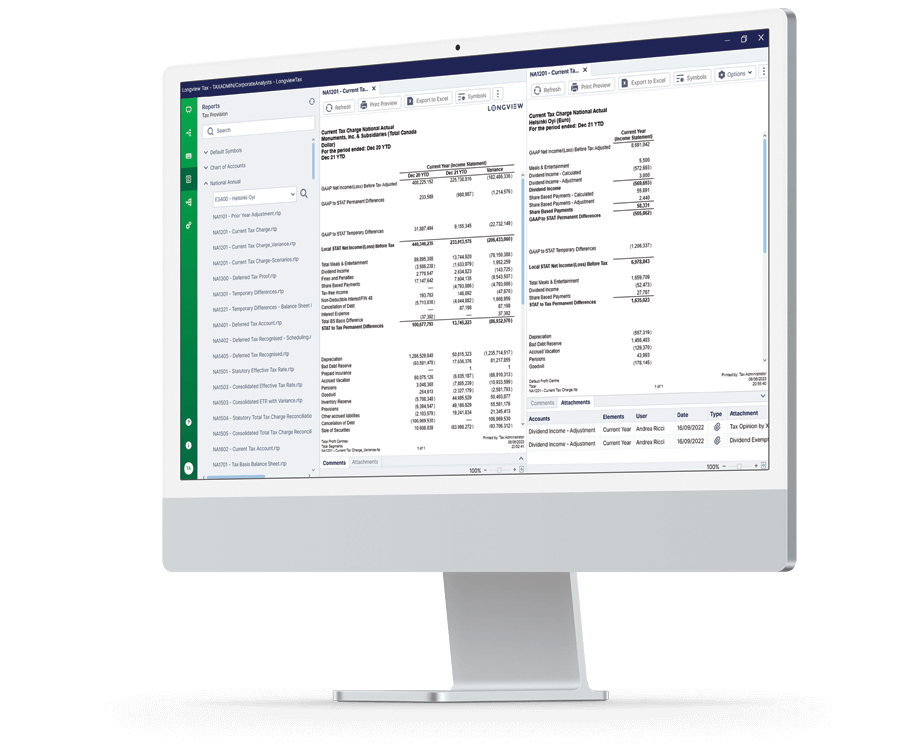

Establish a single source of truth that promotes strategic analysis

Standardizing your data allows for much deeper analysis. When you’re finally able to compare apples to apples across jurisdictions and business units, it becomes much easier to identify and understand your main rate drivers. This timely and comparative reporting is exactly what you need in order to see your group’s ETR much earlier on and take action if needed.

BEST-IN-CLASS FEATURES

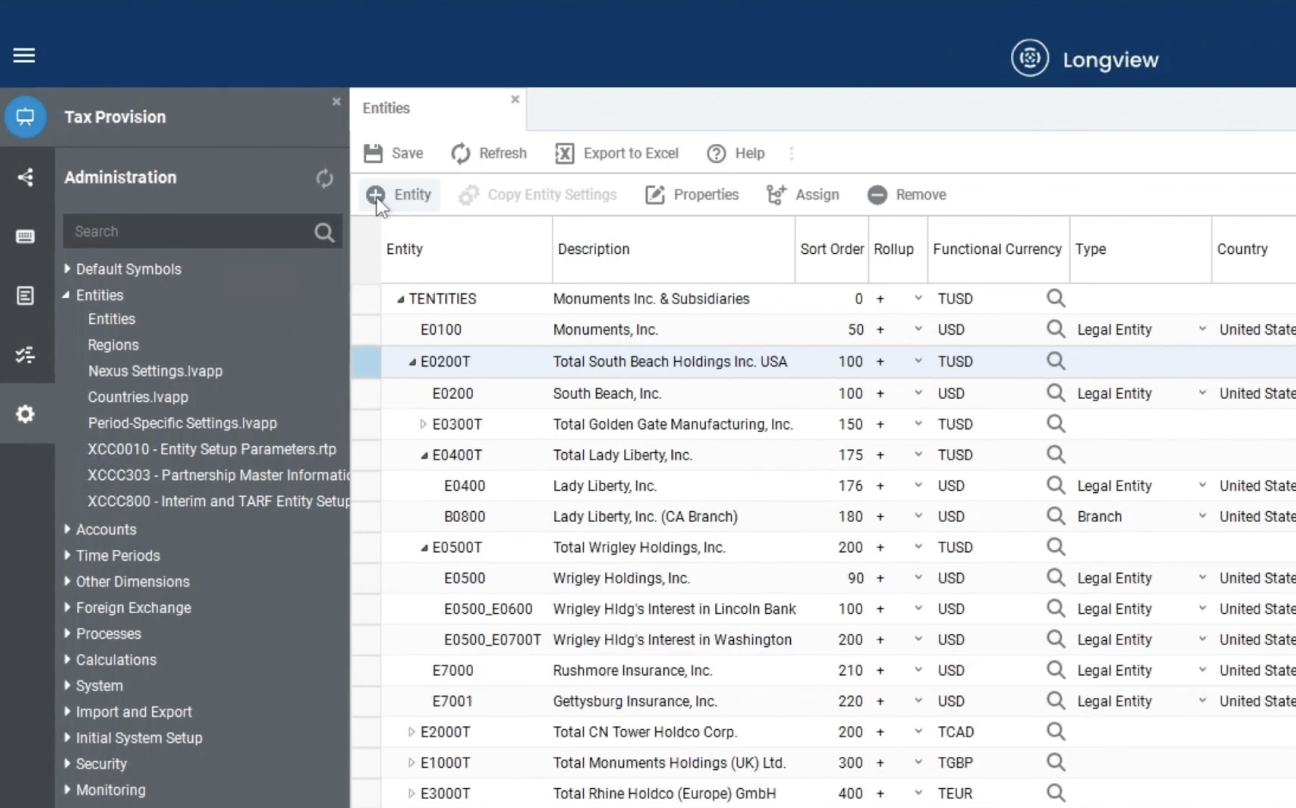

Reporting and Analytics

Unlock the strategic power of your tax data:

- Base business decisions off reliable, up-to-date information.

- Analyze tax data for scenario building, forecasting, and other strategic processes.

- Generate easy-to-digest reports offering data visualization that supports decision-making processes.

Seamless Integration

Keep your tax software connected with finance solutions such as Longview Close:

- Take advantage of the efficiencies created by seamless data sharing across solutions.

- View the full life cycle of data, from book to tax, to improve tax knowledge and address errors at the source.

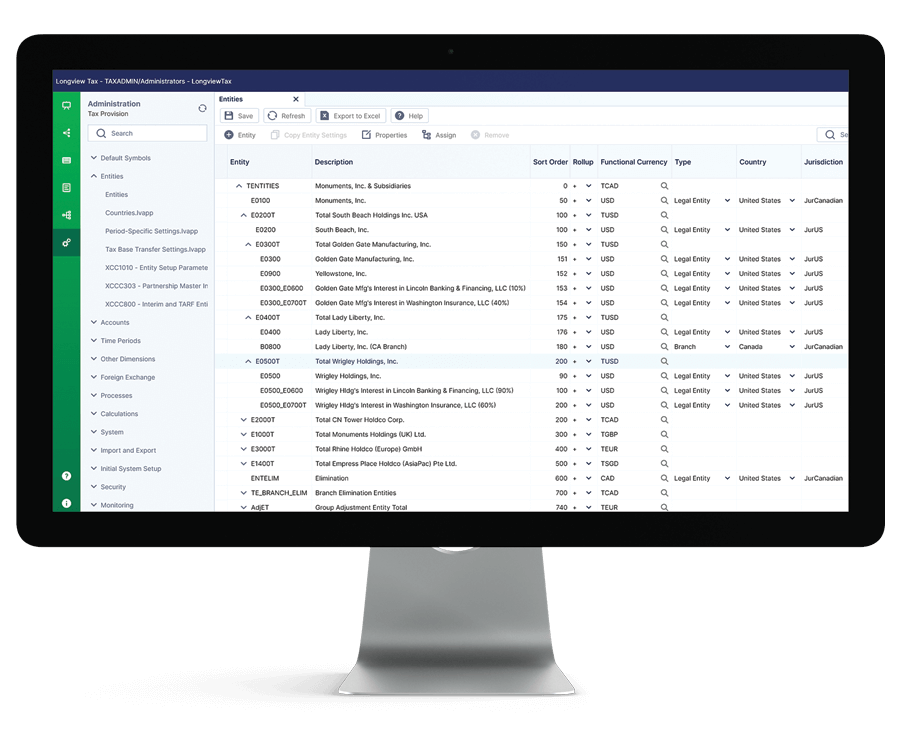

- Manage your software without support from IT thanks to an intuitive user interface.

Simple, Flexible Functionality

Create your own functionality, or choose a standard approach:

- Implement your tax software quickly with an out-of-the-box approach, or tailor your solution to your organization’s needs.

- Generate custom reports based on key metrics and strategic goals for your company.

- Integrate with Excel to retain tax agility while improving your day-to-day capabilities.

Country By Country Reporting and Tax Transparency

A one-stop-shop for your country by country reporting needs

- Capture table 1, 2, and 3 data and produce XML files that meet the country-by-country reporting requirements that have evolved out of the OECD.

- Leverage powerful reporting and analytical capabilities to identify and analyze potential areas of controversy.

- Review results in real time alongside the close process.

- Create, analyze and compare scenarios before finalizing reporting within a dedicated compliance period.

- Go from gathering and validating information to analyzing outcomes and preparing for inquiries.

- Leverage infrastructure established for other processes and share information through a central data repository.

Ready to go beyond Tax Reporting?

Longview Tax is one of insightsoftware's unified, modular applications. Select the capabilities you need across budgeting & planning, controllership, and reporting to get more done with less risk by bringing all your insightsoftware applications together in one place.

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

- 24SevenOffice

- A+

- AARO

- AccountEdge

- Accounting CS

- Accountmate

- Acumatica

- Alere

- Anaplan

- Aptean

- Assist

- ASW

- Aurora (Sys21)

- Axion

- Axis

- BAAN

- Banner

- Blackbaud

- BlueLink

- Book Works

- BPCS

- Cayenta

- CCH

- CDK Global

- CedAr e-financials

- CGI Advantage

- Clarus

- CMiC

- CMS (Solarsoft)

- Coda

- Coins

- Colleague

- CPSI

- CSC CorpTax

- Custom

- CYMA

- DAC

- Data Warehouse

- Datatel

- DATEV

- Davisware Global Edge

- Davisware S2K

- Deacom

- DPN

- e5

- eCMS

- Eden (Tyler Tech)

- Emphasys

- Entrata

- Etail

- Expandable

- FAMIS

- Famous Software

- Fern

- FinancialForce

- FireStream

- FIS

- FiServ

- Flexi

- Fortnox

- Foundation

- Fourth Shift

- Friedman

- Full Circle

- GEMS

- Harris Data (AS/400)

- HCS

- HMS

- IBM Cognos TM1

- IBS

- IBS-DW

- In-House Developed

- Incode

- INFINIUM

- IQMS

- iSuite

- Jack Henry

- Jenzabar

- JobBOSS

- Jonas Construction

- M1

- Macola

- MACPAC

- Made2Manage

- MAM

- MAM Autopart

- Manman

- Mapics

- McLeod

- MEDITECH

- MFG Pro

- MicrosOpera

- MIP

- Mitchell Humphrey

- Movex

- MRI

- MSGovern

- Munis (Tyler Tech)

- New World Systems

- Onesite

- Onestream XF

- Open Systems

- PDI

- Penta

- Plexxis

- PowerOffice

- PRMS

- Pro Contractor

- ProLaw

- Q360

- QAD

- Quantum

- Qube Horizon

- QuickBooks Desktop Premier

- QuickBooks Desktop Pro

- Quickbooks Enterprise

- QuickBooks Online

- Quorum

- RealPage

- REST API

- Retalix

- Ross

- SmartStream

- Spokane

- Springbrook

- Standalone DB with ODBC/DSN connection

- Standalone IBM DB

- Standalone Oracle DB

- Standalone SQL DB

- SUN

- Sunguard

- SunSystems

- Sys21

- SyteLine

- TAM (Applied Systems)

- Thomson Reuters Tax

- Timberline

- TIMELINE

- Traverse

- TripleTex

- Unit4

- Unit4 Agresso

- Unit4 Business World

- Unit4 Coda

- USL Financials

- Vadim

- VAI-System 2000

- Vantage

- Vertex

- Visma

- Winshuttle

- Wolters Kluwer CCH Tagetik

- WorkDay

- Xero

- xLedger

- Xperia

- Yardi

- Yardi-SaaS

Empowering Enterprise Tax Teams in Changing Global Times

The need for organizations to revisit their tax technology and processes has become ever more important in 2020 and beyond, both from a market standpoint and due to increasing tax authority scrutiny. Download this whitepaper to learn more about:

- How market disruptors and tax reform are having larger and larger impacts on organizations with global footprints.

- How COVID-19’s long term implications affect workforces, cash flows, and supply chains

- How to create a strong foundation in the tax department to more easily adapt to future market volatility

"While all provision solutions can produce a provision, Longview offered more flexibility and organized in a way that makes it easier to navigate and run calculations. We didn’t want to make many customizations, so the standard system just worked better for our team.”

Schedule a Live Demo to

See Longview Tax in Action