Tax Resource Center

Tax professionals have a lot to deal with right now. From challenging global headwinds, jurisdictional variances and complexity, to the senior leadership needing data even faster. If you are looking for ways to elevate tax to become more of a strategic enabler within your organization, these resources will help you focus less on the back office functions and more on value-add activities.

How We're Helping

Longview Tax allows you to focus on harnessing tax data so you can uncover critical insights to support strategic decision-making. With the automated collection, consolidation and calculation of tax data within a single source, you streamline tax activities, have confidence in your data, reduce operational costs and risk, and achieve financial intelligence.

Preparing for BEPS 2.0

As you’ve likely heard, there have been significant changes to the global tax and transfer pricing landscape in the past few years. On July 1st, 2021, 130 countries agreed to the global minimum tax for corporations in a historic OECD deal. The agreement set forth the key terms of a “two pillar” approach, under which a minimum 15% global corporate tax rate will be set.

This agreement will also empower governments to tax multinational companies in the countries where their goods or services are sold, regardless of whether the company has a physical presence there or not, with the goal of eliminating tax havens. The overall aim of the two-pillar package is to bolster certainty and the stability of the international tax system. It is estimated that these changes will generate over 150 billion USD in additional global tax revenues annually.

Adoption for BEPS 2.0 is anticipated for 2023, although there is still uncertainty around the specific date. As such, we are currently waiting on more information regarding how the countries will draft and enact Pillar Two legislation that will introduce an “income Inclusion Rule” and provide details of the associated compliance requirements.

In the meantime, companies should start planning now to combat potential challenges that BEPS 2.0, and in particular, Pillar 2 may soon introduce. One of the best ways to do this is by having the right tax provisioning and reporting tools in place.

Here’s how Longview can help.

insightsoftware is investing heavily in Longview Tax to build upon the existing, powerful solution.

Get Prepared for BEPS Pillar2

With the tax landscape changing so quickly, have you considered how Pillar Two might affect your organization?

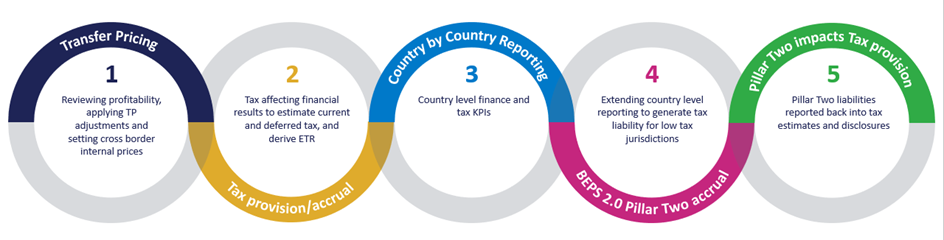

Longview Tax and Pillar Two are intrinsically interrelated, and Longview has a common dataset to support integration of data and comparability of results. Longview Tax already improves tax reporting and forecasting across your enterprise by replacing disconnected systems, manual spreadsheets, and error-prone email communications with a single source of truth, purpose-built for centralized tax provisioning and reporting, analytics, and comprehensive tax management. It is an end-to-end solution for Pillar Two, enabling organizations to calculate Pillar Two estimates for accounting purposes as well as support businesses in producing their Pillar Two tax returns.

In addition, over the course of the next year , we will be developing further out of the box Pillar 2 capabilities to support your organization in understanding the impact of BEPS 2.0. This will include greater capabilities with regards to modeling, accruals in financial statements, and improved reporting for figures required for Pillar 2. As we learn more about what the OECD requirements will be and how they will be enacted worldwide, we are utilizing a phased approach to ensure we support our customers through every step of the way.

Empowering Enterprise Tax Teams in Changing Global Times

Constantly shifting tax policy changes have lately been adding considerable challenge for corporate tax teams. With the recent COVID-19 crisis, large and multinational enterprises face an ongoing struggle to stem the impacts of the economic fallout while staying ahead of potential regulatory changes in taxation.

Resources to Help

Tips to Achieve Tax Agility in 2020

Finding ways to alleviate manual processes is one of the best ways to not only keep up, but excel in a fast-changing environment. Doing so will allow your tax team to spend more time providing strategic input from a tax perspective on how your organization can move forward during these fast-changing times.

There are good opportunities for tax teams to make provisioning and reporting more agile. Here we’ll explore:

- How to establish a framework to promote consistency in tax reporting across your organization’s entire portfolio of entities

- How in-house reporting, if set up correctly, can be more agile and easier to maintain than relying on outside consultants or the IT department

- How having one central source of data makes your job easier, even when tax complexities spike your database and processing needs