BEPS Pillar 2 is Coming.

Prepare now with Longview

What Challenges Await Your Pillar 2 Efforts?

Tools Can’t

Scale to Pillar 2

Demands

BEPS regulations pose a significant challenge for your tax calculations. You need to handle more data and more complexity than ever before. How can you ensure your tax team works efficiently and effectively in this changing environment? How can you prepare for the new requirements of Pillar 2? You need a flexible system that supports your data and analytics needs while enabling your team to collaborate.

Disconnected

Systems Risk Data

Errors

Don’t let Excel and outdated systems ruin your tax compliance. They can cause data errors and inconsistencies that could lead to fines and bad reputation. With the new Pillar 2 rules, accurate filing is more crucial than ever.

Overwhelming Potential Pillar 2 Implications

Pillar 2 will add another layer of complex and time-consuming tax reporting to your already overloaded tax team. You will have to deal with new processes, tight deadlines, and increased scrutiny. If you don’t act now, your team could be facing a tax nightmare that puts your compliance and reputation at risk.

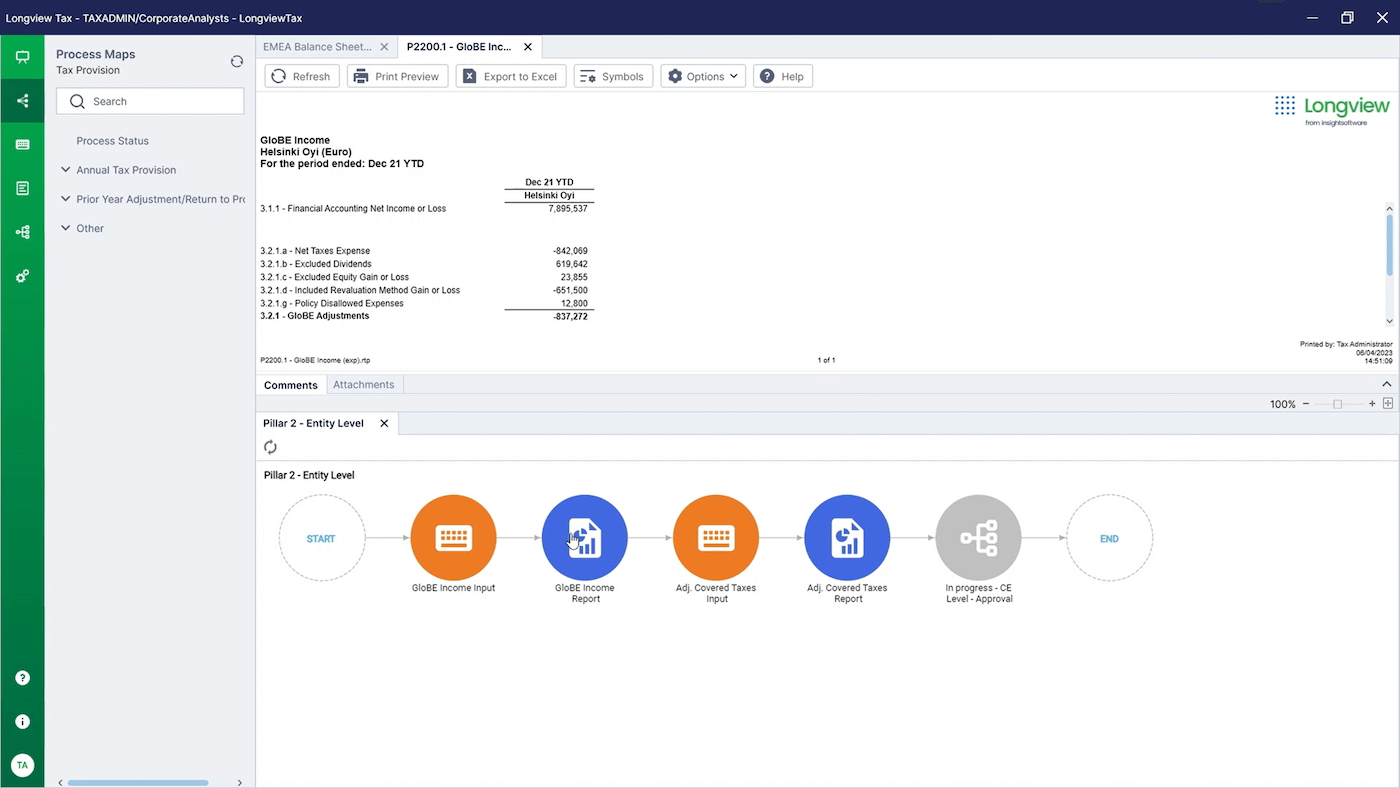

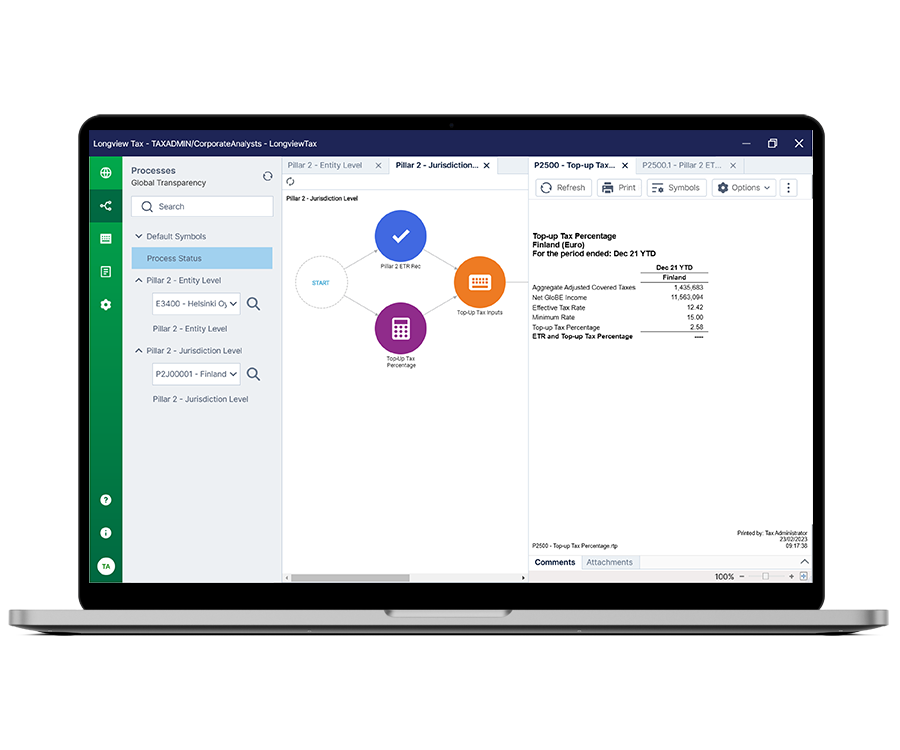

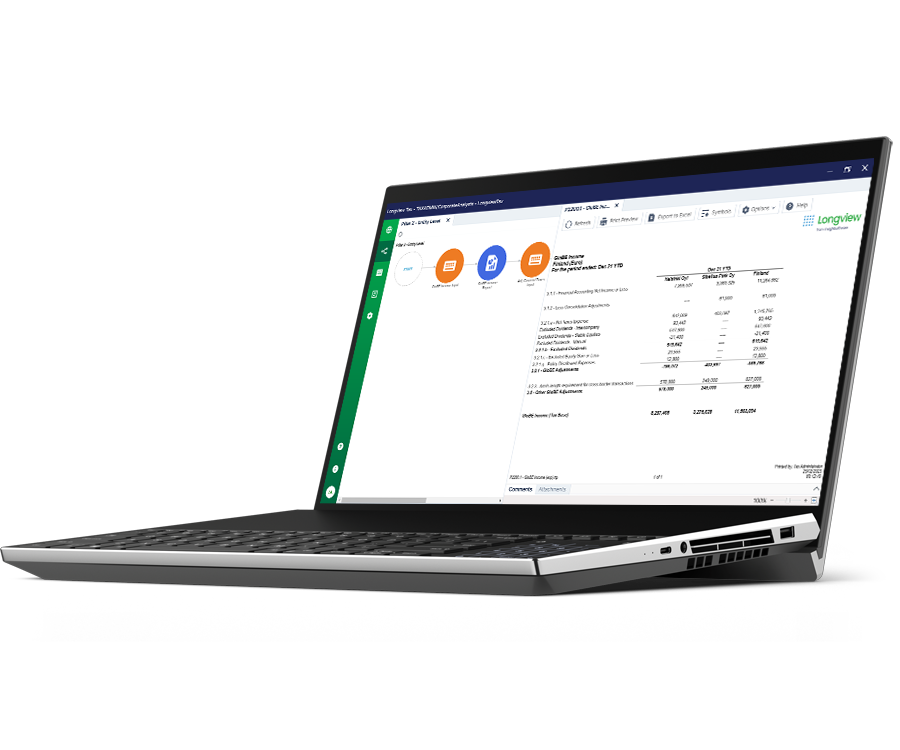

Get a Jump Start with Out-of-the-box Pillar 2 Functionality

insightsoftware is your trusted partner for tax reporting. Our Longview Tax solution has new features that empower your tax team to handle modeling, accruals, and data automation with ease and confidence. This will ensure you are ready for the upcoming challenges with BEPS and that you stay ahead of the curve. Plus, you can look forward to future functionality that will provide you with return-ready data, data visualizations to spot jurisdictions at risk of top-up tax, and a tool to help you manage your Pillar Two elections effectively.

Take the Lead with Faster Processing and Simple Integration

Rebalance your time with faster, more accurate reporting. Work with real time data, so you can efficiently complete your provisioning without waiting on data consolidation or processing. Utilize intelligent automation aligned with your unique processes and workflows. Your team will enjoy automated data transfers to increase data integrity and eliminate manual processes, boosting their confidence and reducing error-anxiety. Easily integrate with multiple sources of data.

Reduce Compliance Risk With Real Time, Accurate Data

Enjoy a streamlined, centralized application to optimize your tax processes, and dramatically reduce risk of data errors. Spend more time on strategic, value-add activities and less time double checking error prone data. Align your process with quarterly, interim and year end reporting and leverage all the relevant data you need.

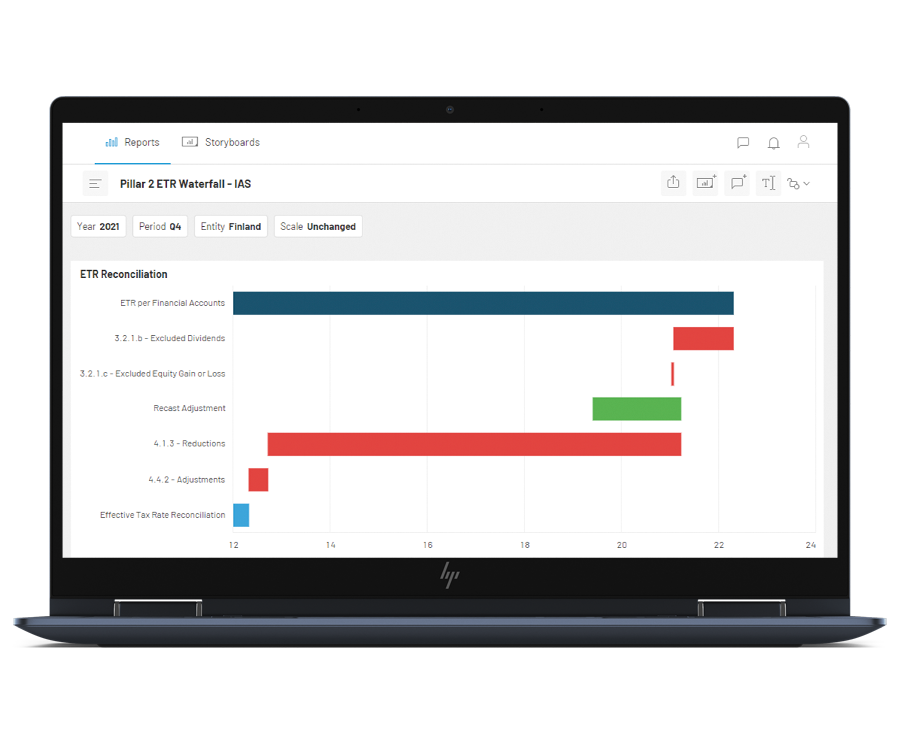

Create Meaningful Data Stories With Dynamic Visualizations

Together, Longview and CXO provide dynamic storyboards and enable users to package their raw data, visualizations, and graphics into a presentation for C-Suite executives, so you can ensure your team is presenting the information in a meaningful way. Generate easy-to-understand analysis that is connected directly to source data. Your stakeholders will love being able to dive deeper into the results, confident in the data.

Tied to an existing tax vendor?

Don’t settle for less. Choose insightsoftware’s Pillar 2 standalone solution that works flawlessly with any tax solution and gives you the flexibility you need.

The Only Integrated Solution with Transfer Pricing and Tax

“We found a lot of value in the automation because of our tight reporting timelines. At the end of the process the disclosure notes are all fully automated, resulting in a more controlled outcome because of the validation checks that are built into Longview Tax. Ultimately, we aim for a holistic approach to our tax processes, with one source for multiple users.”

Speak to an Expert