LeaseAccelerator: Lease Management Software

Simplify Lease Management to Drive 8% Average Cost Saving

Centralize lease data, automate compliance checks, and optimize costs across your entire portfolio. LeaseAccelerator is enterprise lease management software built to easily manage complex lease obligations, from accounting to administration to asset intelligence, under ASC 842 and IFRS 16.

10-Point Drop in Evergreen Payment

I felt more confident with LeaseAccelerator because the team was always transparent, and it was easy to understand how the software works. Automating our lease accounting has helped us achieve sustainable compliance.

Lead Your Leasing Strategy

Competitive sourcing across 26 countries, better end-of-term management, readiness for new lease accounting standards, and smoother M&A integration capabilities.

8% Average Cost Savings

ASC 842 reporting is one of the areas where LeaseAccelerator really shines.

Lease Management Sorted. Stress Less & Save Time.

Welcome to LeaseAccelerator.

Simplified Lease Management

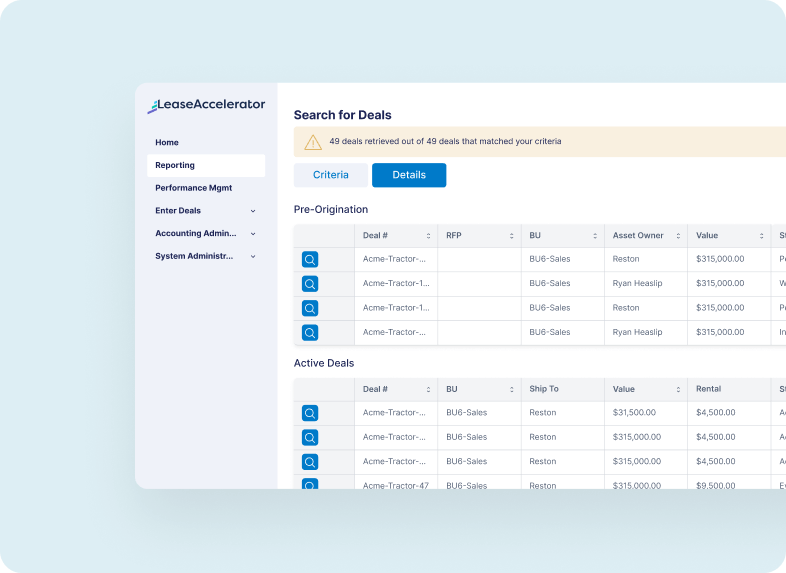

LeaseAccelerator’s integrated workflows help execute lease exits, transfers, and restructures with confidence. Move from analysis to action without switching between disconnected systems and reconciling spreadsheets.

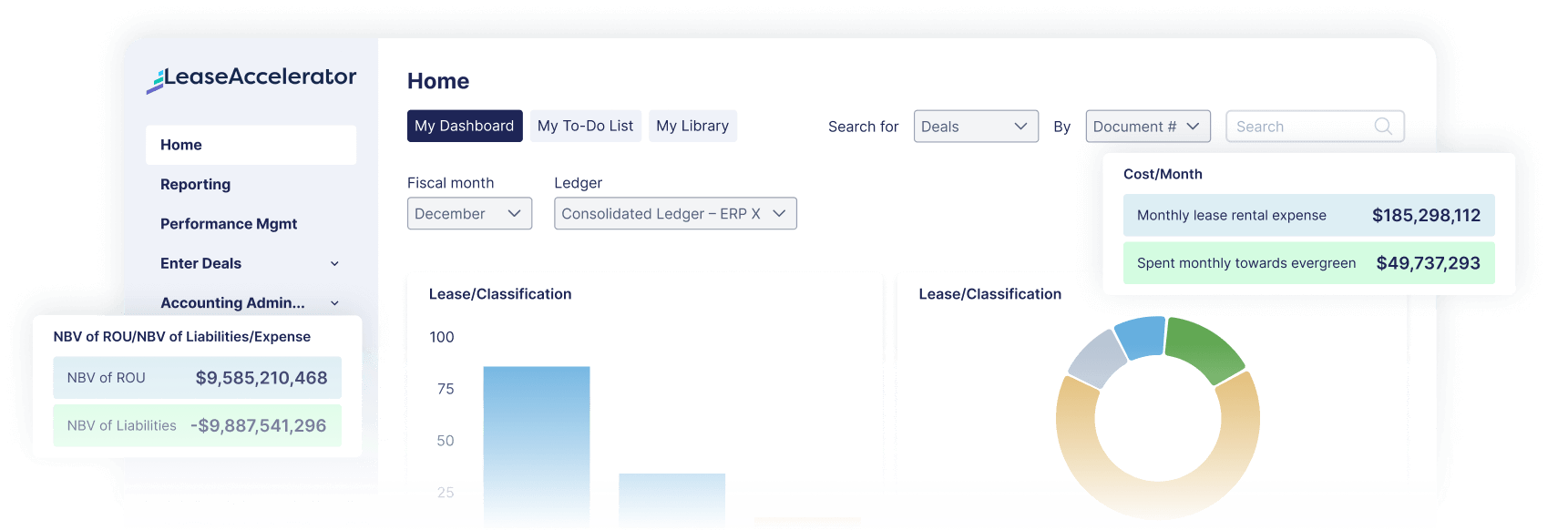

A Clearer View

LeaseAccelerator centralizes accounting, administration, and procurement, allowing them to work together from a single source of truth rather than competing for your attention. Immediate visibility into obligations, risks, and opportunities.

Smart Scenario Modeling

LeaseAccelerator’s scenario modeling enables you to simulate restructuring, early termination, extensions, and consolidations using real lease and accounting data. Understand the precise impact to support decision-making.

Our Proven Results Speak for Themselves

Easier Lease Close With Direct SAP Connection and Automation

Month-end close just got easier. Our SAP connection automatically moves your lease data from LeaseAccelerator to SAP through simple Excel templates via Process Runner — no IT help needed. What used to take days now takes hours, so your team can focus on analyzing numbers instead of just moving them around.

Extra Lease Management Resources

- Must-Have Features of Lease Management Software

- Must-Haves of Lease Accounting

- Guide to Lease Accounting Standards

- Lease Accounting Standards by Public Industry, Private Industry, & Region

- Lease Accounting Examples

- Guide to ASC 842

- Guide to IFRS 16

- Differences Between ASC 842 & IFRS 16

- 2026 Lease Management Trends

LeaseAccelerator FAQs

LeaseAccelerator’s defining trait is how it combines lease accounting, lease administration, and asset lifecycle intelligence in a single, unified, purpose-built platform. While other lease management tools focus primarily (and narrowly) on compliance reporting, LeaseAccelerator goes above and beyond to support lease-vs-buy analysis, end-of-term decisioning, asset-level visibility, and more. This turns leasing into a strategic finance function instead of a compliance burden.

The platform’s key differentiators include a full lease sub-ledger that protects the GL, automated validation and classification, roll-forward analytics with drill-down transparency, and deep ERP integrations with most systems. LeaseAccelerator also has decades of experience and Big 4 partnerships, making it ideal for scalability, scrutiny, and complexity that other lease management software can’t match.

LeaseAccelerator is built for continuous compliance, not one-time compliance. After adoption, it continues to automate the accounting treatment of lease modifications, remeasurements, impairments, renewals, and terminations. These are critical areas where manual processes often break down, but LeaseAccelerator automates them and ensures ongoing compliance. Its built-in validation rules, automated classification logic, and standardized workflows all contribute to this continual compliance as well.

Streamlining your lease management should start by simplifying and unifying fragmented and disparate systems, like manual spreadsheets and department-specific processes. Thankfully, LeaseAccelerator centralizes all of this for you, from contracts and assets to accounting schedules and events. The result is a single source of truth that spans the entire lease lifecycle. Its automation further reduces cycle times and manual effort, for improved efficiency, consistency, control, and decision-making.

LeaseAccelerator cuts down on close times by automating recurring lease accounting activities that are often manual and error-prone. For example, it generates system-calculated amortization schedules, interest accretion, right-of-use asset balances, and lease liabilities — all in accordance with ASC 842 and IFRS 16. Automated journal entries flow directly into your ERP via secure integrations, while roll-forward analytics offer clear explanations of period-over-period changes. All of these LeaseAccelerator capabilities help automate and streamline your monthly closes.

As the name suggests, lease management automation is the use of software and processes to standardize, calculate, track, and report on leases without relying on spreadsheets or significant manual intervention. This might include lease classification, accounting calculations, event tracking, approvals, reporting, and ERP integrations (all performed automatically). Automation isn’t just about speed, it also enhances accuracy, compliance, and decision quality.

LeaseAccelerator was acquired by insightsoftware in July 2024. It has bolstered our portfolio of financial and accounting software, and continues to evolve and improve via increased investment in integrations, scalability, security, and global compliance capabilities.

Lease administration (a.k.a. lease management) is the process of supervising and overseeing the operational and contractual aspects of leases throughout their lifecycle. This encompasses tracking lease terms, payments, renewals, options, assets, vendors, and critical dates, as well as coordinating lease-related actions across departments. Lease administration/management goes beyond simple record-keeping, it bridges the gap between accounting and asset data.

By extension, lease management software includes the digital tools that enable effective lease administration/management. They help organizations track, manage, and report on leases without extreme levels of manual data cleaning and analysis. By replacing manual spreadsheets and disconnected systems, lease management software helps finance leaders manage risk, optimize cash flow, and make more informed leasing decisions.

Implementing modern lease administration software can provide:

- Higher accuracy

- Better efficiency

- More control

- Enhanced visibility

LeaseAccelerator extends these benefits even further via automated compliance, even faster close cycles, stronger audit readiness, improved lease-vs-buy decisions, and asset-level insights. These support capital planning, ESG initiatives, and long-term cost optimization.

While the “best” tool for you will always depend on your complexity, scale, and strategic goals, we recommend looking for a platform that goes beyond simple compliance checklists. LeaseAccelerator is widely recognized as a leader in the lease accounting software space, offering automated accounting, a full lease sub-ledger, ERP integrations, audit-ready reporting, and lifecycle intelligence. It’s purpose-built for finance teams working with ASC 842 or IFRS 16 and need reliable accuracy, scalability, and strategic insights. It has also received strong 3rd-party reviews from Capterra, G2, and TrustRadius.