Step-by-Step Guide to Month-End Close + Free Checklist

What is Month End Close?

Month-end close refers to the accounting process undertaken at the end of each month to finalize a company’s financial transactions for that period. This ensures that the company’s financial statements are accurate, complete, and ready for review or reporting.

Month-end close can often be a stressful time for people on the finance and accounting team. In most companies, there’s a good deal of pressure to produce accurate financial statements as quickly as humanly possible.

Enterprise resource planning software automates many of these processes, making month-end closing procedures faster and easier than they were in years past. Nevertheless, organizations must contend with a series of reconciliations, accruals, and validations to ensure that their month-end statements are accurate and complete.

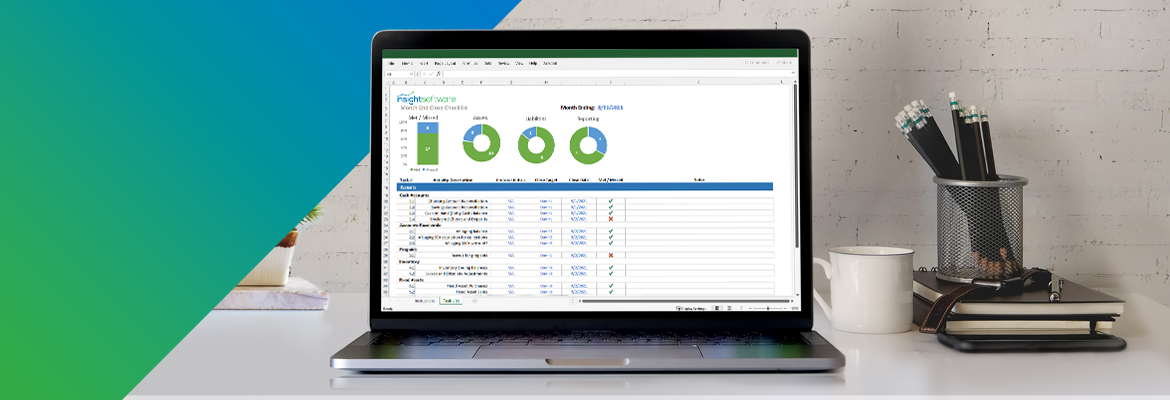

In this article, we’ll explore the process of month-end close step-by-step and even provide an Excel-based month-end checklist to help you through it. Although every company is unique with respect to month-end closing, this guide should serve you well as a general framework.

Month End Close Process

Your month-end process should begin a week or two before the actual closing date. To make sure things go smoothly, it’s best to send out a standard set of communications to remind people of the need to submit key information as soon as possible–preferably before the end of the month.

These communications should include brief reminders as to exactly what needs to be done and a due date for completion. For example, it can be helpful to set parameters pertaining to employee reimbursements, wherein employees must submit expense reports by the last day of the month. You might stipulate that anything submitted without adequate documentation or sent in after the deadline may result in delayed reimbursement. This reminds employees that timely submissions are critical and that accuracy is important. As a result of such reminders, you can recognize these expenses in the proper accounting period, without the need for accruals or adjustments after the fact.

It’s also a good practice to send similar notices to any employee responsible for approving incoming invoices for payment and to anyone in the organization responsible for recording income (for example, consultants who enter their billable hours for invoicing to the company’s clients). By sending these important reminders in advance, you can ensure greater accuracy in your month-end reports and limit the time spent managing exceptions at the end of each accounting period.

Some ERP systems allow for selectively closing subledgers (such as A/R and A/P) to prevent additional transactions from being entered during the month-end closing process. This ensures that your efforts to reconcile subledgers aren’t rendered more difficult by the addition of new transactions during the process. If your ERP system has this capability, use it to your advantage.

A Better Way to Conduct Month End

Access ResourceReconcile Bank Accounts

One of the first things to tackle is bank reconciliation, especially for the operating accounts and payroll accounts through which you process most of your transactions. During this step, you will sometimes uncover transactions you previously overlooked, such as deposits that were not recorded as cash receipts in the ERP system. Incoming bank transfers or wire transfers often show up in this process. The bank reconciliation will bring these to the surface and ensure that they get recorded properly in the appropriate ledgers.

During the bank reconciliation process, you can also post interest income, bank fees, or other adjustments that impact your cash balances.

Tackle Credit Card Reconciliation

If your organization makes purchases using a corporate credit card, it’s often a good idea to reconcile those statements early in your closing process as well. Again, this is a common area in which you may find transactions not previously recorded. Employees who make purchases using the corporate card may often fail to report such transactions or turn in their receipts; which can lead to a discrepancy between the expected balance and your monthly credit card bill.

Verify your Subledger Balances

Your ERP system should be capable of providing aged payables and aged receivables reports as of the end of the month. Although the built-in reports that come with most ERP systems may lack some reporting flexibility, they should provide an accurate total and a detailed listing that you can use to validate your general ledger balances against the subledgers.

Verify that your total receivables from A/R match the appropriate GL account, and do the same for accounts payable. To prevent those numbers from being out of sync, you should avoid using those GL accounts for any transactions that you do not process through subledgers. Don’t post manual A/R accruals to the same GL account to which your accounts receivable module posts its transactions. The same applies to the general ledger account that you use for A/P.

Your inventory module should provide a detailed listing of your stock, along with a total that reflects your preferred inventory valuation method. If you have performed a physical inventory count, this is a good time to make the appropriate adjustments within the inventory module. Again, you should avoid making any direct entries in the general ledger unless you need to make an extraordinary adjustment.

5 Ways to Knockout Time from Your Oracle Subledger Reporting

Access ResourceDeal with Accruals

In most companies, there is a series of accruals that you must perform every month. You might pay payroll, for example, weekly or biweekly, which can cause you to overlap with the end of the month. You’ll need to calculate the portion of payroll expense you incurred in the month that just ended and make a reversing entry to payroll expense vs. accrued expenses. You should also recognize accrued PTO.

If your organization bills clients for progress against long-term projects, you may need to make accruals to recognize revenue earned but not yet billed. If you have received up-front retainers, likewise, you’ll need to record deferred revenue and reconcile any previously deferred amounts that you should now recognize.

If the company has made any deposits or pre-payments that aren’t accounted for via subledger posting, you should accrue those as well.

Review Fixed Assets, Depreciation, and Amortization

If your company has acquired any capital equipment, software, or similar items that you must depreciate, you’ll need to update the schedule of fixed assets, apply the appropriate depreciation schedule to those newly acquired assets, and make the appropriate adjustments to depreciation expense vs. accumulated depreciation. Very often, those types of purchases are erroneously posted to expense accounts when you process invoices, so you need to reclassify them to the fixed assets account in GL. This is a good time to review purchases for such exceptions and handle them proactively.

If your company has disposed of any fixed assets, you’ll need to make the necessary adjustments to general ledger accounts and note the change in the schedule of fixed assets.

The same steps may apply to amortized assets as well, such as goodwill, closing costs, or business startup costs.

Make Needed Adjustments to Notes Payable

In many companies, notes payable will also require adjustment at the end of the month. You should review payments against installment loans to ensure that you have properly recorded interest versus principle. This is especially true of amortized loan payments in which the interest and principal amounts are constantly changing, even though the total payment amount remains constant. Loans with deferred interest payments require an interest accrual.

It’s a good practice to maintain a loan amortization table for each note payable and to ensure that the ending balance, total interest, and total principal match the transactions recorded in the general ledger.

Finally, you’ll need to adjust short-term vs. long-term notes payable so that your balance sheet reflects these amounts in the appropriate categories.

Review Investments

If your company holds investments, record interest earned, and dividends paid or credited to your account. You should also review the market value of assets and make the necessary entries to record unrealized losses to reflect any decline in value.

Wrap-up and Review

After you have made all the appropriate entries, performed all reconciliations, and recorded accruals, it’s time to print your preliminary reports. At this point, it is important to review your reports for reasonableness. Look for any large or unexpected variances. It’s a good practice to distribute these preliminary reports to a few trusted reviewers who can assist you in checking for errors and raise questions when appropriate. Very often, this kind of review process will expose anomalies that you might have otherwise overlooked.

Before printing your final reports, ensure that you close your accounting system for the month, preventing anyone from posting to prior accounting periods and retroactively changing balances.

Look for Opportunities to Automate Closing Processes

When you’re finished with the month-end closing and you have time to take a few deep breaths, consider reviewing your closing processes to look for opportunities to automate and streamline them. Look for tasks that typically consume large amounts of staff time.

Typically, with account reconciliations, you must include accompanying worksheets that combine information from multiple sources. If a particular account reconciliation process bogs things down, consider shifting to near-real-time reporting and analytics tools that can make your life easier by extracting information directly from your ERP system and making it available in Microsoft Excel. Doing so can streamline your processes and save hours of intensive work.

insightsoftware helps organizations of all sizes with powerful analytics, planning and budgeting applications, and other tools designed to automate tasks, streamline processes, and increase accuracy. We’re offering a free month-end closing template to help you and your team get the job done efficiently, every time. Download the free template today.