3 Best Practices for Streamlined ESMA Filings

Accuracy and consistency are two key challenges for your finance team tasked with wrangling disparate data sources into a compliant annual ESMA filing. The number of teams involved, the complexity of regulatory requirements and the vast amounts of financial data involved, make this a formidable project. Ensuring consistency demands aligning diverse financial information across departments and subsidiaries, while accuracy hinges on the precision of numbers, disclosures, and adherence to stringent reporting standards. Any discrepancies or errors can have far-reaching consequences, impacting investor confidence, regulatory compliance, and potentially triggering audits or penalties.

Thankfully, there are a few best-practice tips that can boost your team’s filing process efficiency and their confidence in the end result. Automated, connected processes and tools are key to success, especially when the project spans the whole business, and the punishment for inaccuracy is so high.

1. Choose the Right Conversion Option for Your Business

When selecting the right ESEF iXBRL conversion option, your finance team might face compatibility issues collecting data from various financial systems, seeking integration without compromising data accuracy. Balancing cost-effectiveness and quality are crucial, especially for smaller firms, necessitating a solution that aligns affordability with accuracy. The complexity of iXBRL taxonomy can require specialized expertise, and the evolving regulatory landscape demands adaptable solutions for sustained compliance.

The two most common options are hiring a third-party service provider or using a software solution like Certent Disclosure Management (CDM) to do it in-house. The right choice depends on the resources and skills you have available:

- Third-Party Service Provider: Suitable for resource-limited setups, offering expertise but potentially limited customization and control.

- In-House Software Solution: Provides control, customization, and enhanced data security, ideal for adaptable processes and long-term cost efficiency.

2. Automate Your XBRL Tagging

When tagging XBRL projects, your finance team might struggle to understand the complicated taxonomy and ensure accuracy within reporting standards. Maintaining consistency across diverse reports and periods can be challenging, requiring unwavering attention to detail. Adapting to evolving regulations and staying updated with changes in tagging practices only adds to the challenge.

If your team is using manual processes to tag XBRL projects, then you are leaving your filing wide open to human error and compliance penalties. The manual assignment of tags to financial data is tedious and often leads to inconsistencies and inaccuracies, especially in larger datasets or across diverse reports.

Instead, save time and effort on your XBRL projects by using an automated tag inspector tool to sort, group, and filter your tags in a few clicks. Using an automated tag inspector for XBRL projects offers several benefits.

- It significantly accelerates the tagging process, saving time and reducing the likelihood of errors compared to manual tagging.

- Automated tag inspectors also enhance accuracy by systematically identifying and correcting potential tagging issues, ensuring compliance with XBRL standards.

- Tools often provide features such as sorting, grouping, and filtering, streamlining the overall XBRL project management and contributing to a more efficient and error-free workflow.

3 Keys for Successful XBRL Filing

Download Now3. Connect Your Data and Reduce Manual Processes

Manual data handling processes have no place in modern finance, let alone for a task as sensitive as annual ESMA filings. The driving force behind manual processes is almost always disconnected data. ESMA filings demand data input from sources across your entire business. Collecting and aggregating this huge swath of financial information in standalone spreadsheets is a recipe for disaster.

Relying on manual methods poses a significant risk due to the potential for errors and inconsistencies, which could have far-reaching implications for compliance and financial reporting accuracy. Manual processes often result in a slower workflow, potentially jeopardizing the ability to meet tight submission deadlines imposed by ESMA regulations. Ultimately, the lack of automation can impede efficiency and hinder your ability to adapt quickly to changes in reporting requirements.

Leveraging automated data extraction and integration not only minimizes these risks but also empowers finance teams to operate with precision and efficiency. By linking diverse data sources directly to the filing system, your finance team can:

- Ensure not only accuracy and efficiency but also a seamless flow of up-to-date information.

- Reduce the need for manual intervention and expedite the reporting process, enabling swift adjustments in response to regulatory changes or updates.

- Align reporting with real-time data, ensuring that ESMA filings reflect the most precise and current financial status of the company.

Check out our on-demand webinar for more discussion about these best practices with Certent Disclosure Management.

Best Practices for Annual ESMA Filings with CDM

Download NowHow Certent Disclosure Management Enhances Your Disclosure Filings

Reduce disclosure risk with the only all-in-one, Microsoft 365-based, disclosure management solution. CDM addresses these challenges by offering a secure, collaborative platform for recurring, multi-author reports. Your users can seamlessly collect enterprise data from various sources, integrating it dynamically witch narrative analysis in a controlled and auditable environment.

- Seamless XBRL conversion through CDM’s integrated features and capabilities. Utilize CDM’s integrated platform that combines financial reporting, narrative analysis, and XBRL tagging within a single solution to ensure a seamless flow of data between different components of the financial reporting process.

- Fully automated XBRL tagging capabilities that utilize advanced algorithms and predefined taxonomies to automatically tag financial data and other relevant information, reducing the manual effort required for XBRL conversion.

- Connect multiple data sources via CDM, which facilitates the connection of multiple data sources through its integration capabilities. CDM is designed to integrate seamlessly with various data sources commonly used in financial reporting. including enterprise resource planning (ERP) systems, databases, spreadsheets, and other financial software.

- Reduce manual intervention and risks by automating critical processes and integrating CDM’s advanced algorithms, automated XBRL tagging to minimize errors and ensure regulatory compliance. CDM standardizes workflows and supports real-time data connectivity to keep financial information up-to-date.

CDM will halve the time spent creating internal and external narrative reports. Exercise control over high frequency, recurring, multi-author reports. Bring the accuracy and consistency your filing team needs, increasing confidence in the numbers and narrative – even for late changes. CDM ensures your teams can:

- Leverage the Power of Microsoft 365®: Take the calculation capabilities of Excel and the formatting power of Word and PowerPoint to the next level with an added layer of security and control.

- Preserve a Single Version of Truth with Controlled Collaboration: Eliminate version control nightmares with a single, secure environment and configured workflow allowing multiple users to view and edit reports simultaneously without causing versioning problems.

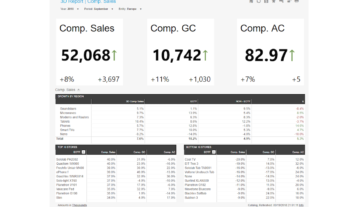

- Keep Reports On Track With Dashboards and Planning Tools: Manage the reporting cycle efficiently and with less risk by providing insight and visibility into the report creation process through the Certent 365™ web-based project hub.

- HD ReportingSM With Pixel Perfect Placement: Preserve the original layout of reports for the best viewing experience while maintaining regulatory XBRL and Inline XBRL standards.

- Link Source Data Directly to Report Outputs: Create dynamic reports that update automatically when the numbers change in underlying data sources such as HFM, TM1, Essbase, and more.

- Enhance Security Across Sensitive Data and Reports: Power a comprehensive set of internal security features with secure, user-based logins to prevent data leaks and control who can see what part of the document, and when.

- Integrate XBRL Tags into Presentation-Quality Reports: Employ high-volume tagging and roll-forward functionality to comply with global XBRL and Inline XBRL mandates set forth by regulatory bodies including SEC, ESMA, CIPC, EBA, EIOPA, and more.

- Select the Best Deployment Model for Your Business: On-premise or in the Cloud, CDM provides flexible deployment options to best support varying business needs across the globe.

Dig into our white paper to learn more about what Certent Disclosure Management software provides to your filing teams.