Automate and Standardize Tax Reporting to Reduce Operational Costs and Risk

The Role of Tax Software Has Changed

There’s Increased Pressure to Close the Books Faster

The inability to directly integrate with financial systems can leave business tax departments waiting to get started until the finance data are consolidated and ready. Then, having to rekey data into tax-specific spreadsheets can take even more valuable time.

Manual Tax Data Entry is Seen as Risky and Error Prone

Static spreadsheets requiring manual tax data manipulation can introduce errors that require time to catch and fix. Organizations are increasingly viewing these workflows as an avoidable risk and are looking for a better way forward with modern business tax software.

The Tax Department is Evolving into a Strategic Partner

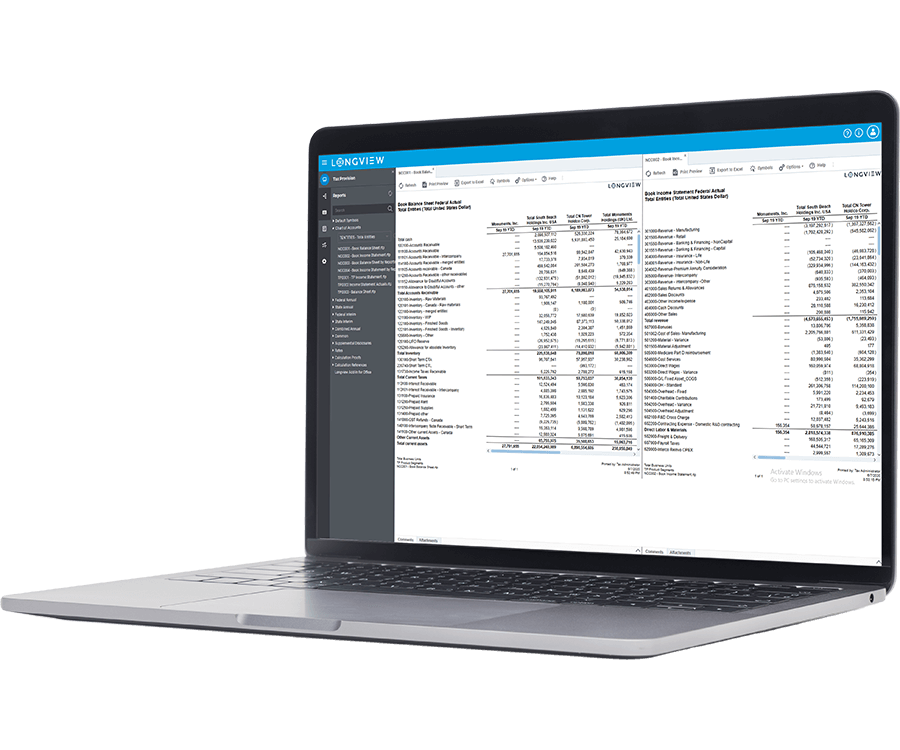

The savviest tax professionals now spend the majority of their time on strategic analysis, such as reviewing and understanding results, considering their implications, and feeding these insights into future tax planning and forecasting.

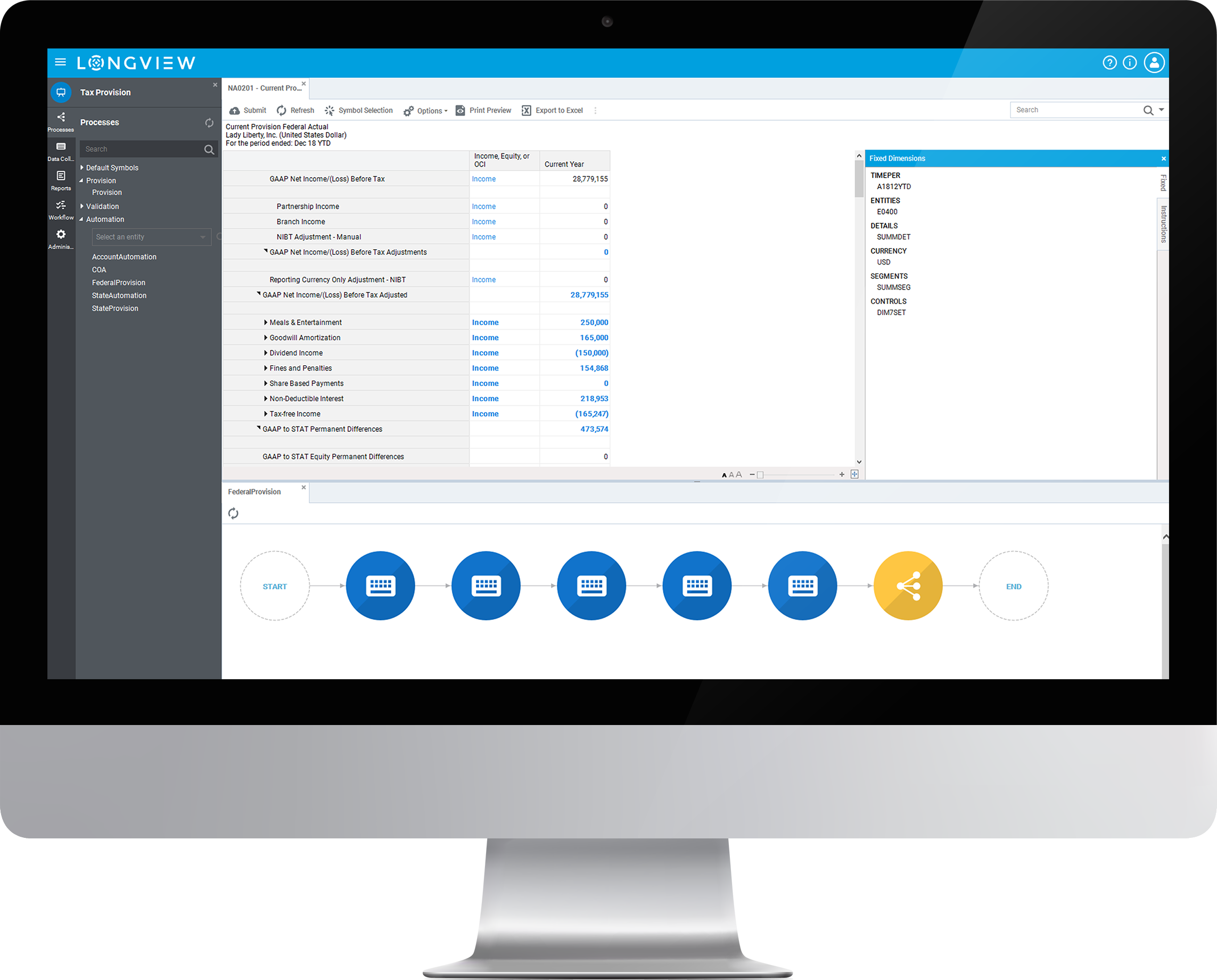

Build a Foundation of Standardized Tax Data

When the data you need are spread across silos throughout your organization’s subsidiaries, it’s hard to quickly pull together a coherent view of your tax position. Building your department on a foundation of central, standardized data opens up productivity gains though automation, enables you to dive deeper into the numbers, and unlocks the ability to run comparative reports to understand your largest rate drivers.

Alleviate Your Tax Reporting Burdens

It’s unfair both to you and your organization if all your time is spent chasing after data, manually entering them into your spreadsheets, running calculations, and then checking over the results for errors. There is a better alternative. Automating these core processes with specialized tax software alleviates many of your reporting burdens, thereby allowing you to put your skills to better use.

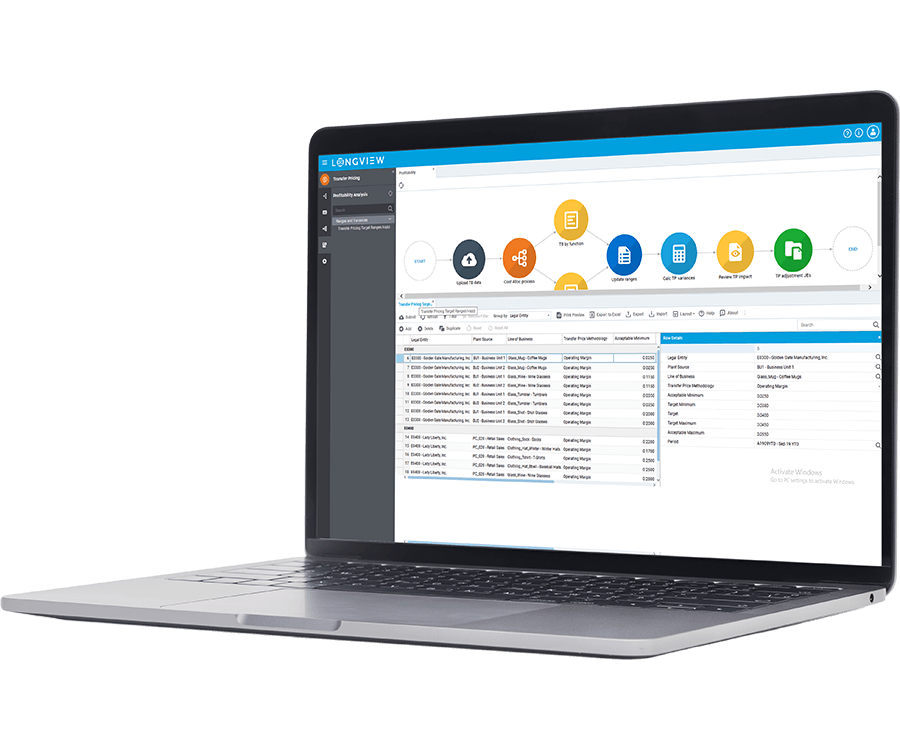

Transform Your Tax Department into a Value Driver

Elevate your role to that of a strategic partner within your organization. You can achieve this through more proactive responses to statutory changes in tax regimes, pinpointing your group’s tax position earlier on, and identifying your largest rate drivers. This allows your organization to take decisive action much faster to strengthen its overall tax position. As a result, your department will be seen less as a cost center and more as a value driver.

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Dynamics 365 Business Central

- Dynamics 365 Finance and Supply Chain Management

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics NAV C5

- Dynamics SL

- SQL Server Analysis Services (SSAS)

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Viewpoint Spectrum

- Viewpoint Vista

- MRI Commercial Management

- MRI Financials

- MRI Horizon

- MRI Horizon CRE

- MRI Qube Horizon

- MRI Residential Management

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor Financials & Supply Management

- Infor Lawson

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

- 24SevenOffice

- A+

- AARO

- AccountEdge

- Accounting CS

- Accountmate

- Acumatica

- Alere

- Anaplan

- Aptean

- Assist

- ASW

- Aurora (Sys21)

- Axion

- Axis

- BAAN

- Banner

- Blackbaud

- BlueLink

- Book Works

- BPCS

- Cayenta

- CCH

- CDK Global

- CedAr e-financials

- CGI Advantage

- Clarus

- CMiC

- CMS (Solarsoft)

- Coda

- Coins

- Colleague

- CPSI

- CSC CorpTax

- Custom

- CYMA

- DAC

- Data Warehouse

- Datatel

- DATEV

- Davisware Global Edge

- Davisware S2K

- Deacom

- DPN

- e5

- eCMS

- Eden (Tyler Tech)

- Emphasys

- Entrata

- Etail

- Expandable

- FAMIS

- Famous Software

- Fern

- FinancialForce

- FireStream

- FIS

- FiServ

- Flexi

- Fortnox

- Foundation

- Fourth Shift

- Friedman

- Full Circle

- GEMS

- Harris Data (AS/400)

- HCS

- HMS

- IBM Cognos TM1

- IBS

- IBS-DW

- In-House Developed

- Incode

- INFINIUM

- IQMS

- iSuite

- Jack Henry

- Jenzabar

- JobBOSS

- Jonas Construction

- M1

- Macola

- MACPAC

- Made2Manage

- MAM

- MAM Autopart

- Manman

- Mapics

- McLeod

- MEDITECH

- MFG Pro

- MicrosOpera

- MIP

- Mitchell Humphrey

- Movex

- MRI

- MSGovern

- Munis (Tyler Tech)

- New World Systems

- Onesite

- Onestream XF

- Open Systems

- PDI

- Penta

- Plexxis

- PowerOffice

- PRMS

- Pro Contractor

- ProLaw

- Q360

- QAD

- Quantum

- Qube Horizon

- QuickBooks Desktop Premier

- QuickBooks Desktop Pro

- Quickbooks Enterprise

- QuickBooks Online

- Quorum

- RealPage

- REST API

- Retalix

- Ross

- SmartStream

- Spokane

- Springbrook

- Standalone DB with ODBC/DSN connection

- Standalone IBM DB

- Standalone Oracle DB

- Standalone SQL DB

- SUN

- Sunguard

- SunSystems

- Sys21

- SyteLine

- TAM (Applied Systems)

- Thomson Reuters Tax

- Timberline

- TIMELINE

- Traverse

- TripleTex

- Unit4

- Unit4 Agresso

- Unit4 Business World

- Unit4 Coda

- USL Financials

- Vadim

- VAI-System 2000

- Vantage

- Vertex

- Visma

- Winshuttle

- Wolters Kluwer CCH Tagetik

- WorkDay

- Xero

- xLedger

- Xperia

- Yardi

- Yardi-SaaS

Adapt to These Changing Global Times

The past few years have witnessed multiple global disruptions that accelerated many business trends. The largest among them? Rapid change is the new constant. Now, tax professionals need to keep up with constantly shifting tax regimes and organizations operating in even more jurisdictions.

Download this whitepaper to learn about:

- The largest disruptions affecting tax teams today

- Shifting US and global perspectives on tax

- How to adapt to the rapid changes in tax regimes both now and in the future

Over 28,000 businesses worldwide count on insightsoftware for their finance and tax software needs. See for yourself why we have a 94% retention rate!

Automating the transfer pricing journal entries was extremely helpful. We particularly loved utilizing FX within our system, making calculations centrally, and then layering all adjustments onto the provisions. The automated processes and tight integration with our provision proved much more impactful than what we were able to do before.

Speak to an Expert