CFO Panel: Generating Value in a Post-Pandemic Market

The COVID-19 pandemic, economic turbulence, and global conflict have wreaked havoc on financial processes, and resulted in far greater pressure on CFOs to generate meaningful insights to guide their business. But as market predictions become more consistent, giving CFOs some time to catch their breath, new priorities start to emerge.

Earlier this year, insightsoftware sat down with a panel of four prominent CFOs to explore their successes amidst recent market turbulence. These four featured CFOs have not just survived, but thrived, in the face of this adversity. But where are they turning their focus now? What are the top CFO priorities for 2023 and beyond?

Watch the full panel discussion here.

Meet the CFOs

- Regan Garrett, CFO, Numerator: With vast experience in finance, strategy, and business operations, Garrett leads Numerator’s global finance function. She previously held roles at Vista Equity Partners and served as SVP of Business Operations at Mediaocean.

- Peter van Tiggelen, CFO, FE fundinfo: Joining FE fundinfo in February 2022, van Tiggelen oversees finance, legal, and business intelligence. He brings international finance expertise from leadership positions in healthcare and financial technology, most recently as CFO at Itiviti.

- Ron Angelillo, VP of Tax, EnPro Industries: An accomplished tax executive, Angelillo excels in resolving complex challenges through leadership and collaboration. He specializes in process reengineering and risk reduction.

- John Lawrence, Partner & CFO, Wavecrest Growth Partners: Lawrence, a Partner & CFO at Wavecrest since 2017, previously ran a consulting firm and served as CFO for private equity and venture capital firms. He also held financial leadership roles at Quail Piping Products and Asahi/America, Inc.

The Q&A

What is your company doing to strengthen its position in 2023 and beyond?

John Lawrence: We’re looking really at the broader economy and across our portfolio of companies, assuming we will have a recessionary period in 2023 or thereafter. The days of highly available capital, excessive spending on sales and marketing, and ultra-high growth rates, we view that as really being in the rearview mirror. We are telling our teams to make proactive cuts, focus on growth retention, and keep your existing customers. Do not assume that you’re going to have ever-increasing price increases for the current year. Focus on customer success.

Peter van Tiggelen: There’s a lot more scrutiny around cost and the capital deployed on the ROIs of the investments we are making. Those easy years with cheap funding and market tailwinds are definitely behind us. That said, we also are quite opportunistic. We are a company that is looking to make two or three acquisitions every year and the valuations for those have come down and we see this as an opportunity to strike right now. I’ve seen, in terms of risk appetite within our business, maybe more focus and a renewed focus on realizing internal efficiencies to achieve profit growth.

Ron Angelillo: I think one thing that we’re going to focus on big time, especially in tax, is how do you automate redundant processes, non-value add to give members of the team more opportunity to do work in more value-added areas, whether it’s M&A work, tax planning, or research because we certainly want our folks to be challenged … Technology, specifically automation, is going to play a big part in bringing those hours down and trying to reshape our brand so that folks in college can actually be interested in the accounting profession or tax profession and not shy away from it because of the stereotype, those stereotypical long hours that we may have.

For 2023 and beyond, what are the top goals for your company?

Regan Garrett: My top priority, which guides every other priority across the business, is to ensure that the company is on a path to double our valuation over the next couple of years … We don’t want to generate value entirely through revenue growth or entirely through margin expansion. We want it to be balanced. So I am focused on ensuring that we are supporting that 25-ish-plus-% revenue growth as well as margin expansion into the 30s. That goal, like a whole lot of other goals across the business, trickles down from that one … We need to see the return on those investments, and we need to make sure we’re controlling our costs around those investments.

JL: We are waiting to see how the broader economy reacts to having multiple quarters of interest rate hikes. Now that there’s the realization out there that big banks are cutting people, the realization that all the big tech companies are cutting people, we see a new normal in place. We want to be able to understand what type of retention rates or churn or down sale rates we are seeing and how that can allow us to pivot for the balance of the year.

As we look at our opportunities, we see that wage rates are down, and the availability of people is down, and the valuations of companies are also down. All this gives our companies the wherewithal to go out and acquire businesses that might have a good base of customers, a good base of technology, or a good base of people, and be able to acquire those businesses at good pricing.

PvT: From a tax perspective, the effective tax rate, ETR is always a top priority. The US has put in place a 50% minimum tax under President Biden. You have the OECD pushing their global minimum tax. There’s going to be a lot of focus on how we manage that … But I will say that we’re also working closely with the Treasury Department to focus on assisting the broader company with its objectives, mainly around cash, and being able to move cash efficiently around the globe at a moment’s notice, whether it’s for debt service or acquisitions … It all boils down to data. Knowing where your cash is, and what is the excess cash. Has it been previously taxed? Can we repatriate it back to the US? Those are all difficult questions to ask and answer when you don’t have the data at your fingertips.

What are your thoughts about automation and the process improvements it creates for outputs and outcomes?

PvT: There are people in finance who work too hard and that means they’re not very productive because they spend a lot of time on data-gathering instead of analyzing data. I think the difference-maker is the development of new tools, the software that has just dramatically changed the role of finance. But the demands on the teams have also gone up. What we are doing in our organization, and this is very driven by the current inflation in Europe that is well over 10 %, is we have made good use of that inflation this year … A couple of years ago, we might have been taking 1 or 2% inflation increases but this year it is well into the double-digit space.

RA: We’d like to see data down to the product level where we can manage transfer pricing margins at a discrete level like that, which helps out our overall margin in general. We do want to also focus on areas out of the gate that reduce man hours significantly. I think looking at the non-value-added work where we’re just putting too much time in, using too many resources in a given year, we’re going to hit those hard out of the gate. We need to look at how can we automate those areas to reduce man hours to be able to redeploy those hours in other areas.

We’ve got to do more with less with our people. How are you balancing that?

RG: Our biggest focus, because we are a growth company, is that we also want to see margin expansion. One of the ways that we’ve focused on tackling that is by ensuring that we are increasing capacity across our team. We are not cutting teams. Our teams are not shrinking this year. The big push that started a few years ago and will continue even more aggressively in 2023 and beyond, is shifting work to the right location. In our world, that is India. And each year it’s like peeling layers of the onion in terms of first we started by moving BPOs to our employees in India. That saved us costs.

PvT: My company has a lot of resources in continental Europe. I’ve been pushing a lot of the lower-level, more routine things to our office in India. We had a big footprint already of close to 500 people. So, it helps that we have an infrastructure there so you can attract better talent. But there’s still a lot of work that you cannot offshore for the simple reason that they need to be close to the business partners here in the UK, close to their clients, and be in the same time zone.

What challenges are ahead for the near future and how are you working through them?

PvT: What you see in our organization is a lot of legacy systems. We finally got everybody on NetSuite and Salesforce, but there are still data systems that we are struggling with. I don’t think that we’re unique since there are a lot of companies struggling with data integrity … We’ve tried to build interfaces between Salesforce and NetSuite, but it hasn’t got the attention in terms of the support from a CIO like some of our production environment systems have for the simple reason that that’s where the client has interfaces with and what your core products run on. I think we’ve got some ways to go. We’ve hired a client system specialist … to have somebody on our team who understands finance and has an accounting background and the systems background to optimize that.

RG: I think we’re very lucky in the sense that it was probably five years ago when we did a full rip and replace of all our systems, a cleanup of all our data. Since then, we’ve only made two acquisitions. We’re moving through 2023 with clean systems that everyone is familiar with, as well as clean data. But that doesn’t mean we don’t have challenges … Our data is reported in Excel … And I think that is challenging … because in today’s high-tech business world, not only is there more data to handle, but there’s also the need to dig deep into it for insights into markets, trends, inventories, and supply chains so that your organization can understand where it is today and where it will stand tomorrow. This requires access to data that’s real-time.

These Solutions Solve Today’s (and Tomorrow’s) Challenges

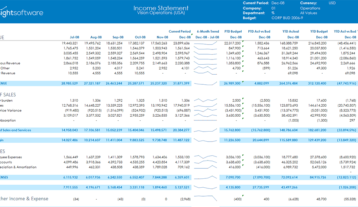

Your team needs to move faster and smarter real-time, accurate, functional views of transactional data enabling rapid decision-making.

Angles Enterprise for Oracle delivers a context-aware, process-rich business data model, a library of 1,800 pre-built, no-code business reports, and a high-performance process analytics engine for Oracle Business Applications, including EBS and OCA. This integrated solution helps you unlock your enterprise data and deliver actionable insights to support decisiveness in an uncertain and quickly changing world. Angles allow users to do more with less, automate processes, realize data integrity, and more.

For accelerating financial processes, your Oracle team may find that Wands for Oracle solves their challenges. Wands allows users to build refreshable reports, with real-time, drillable data, without having to understand Oracle’s row and column sets in FSG. Teams can support and accelerate their daily reporting activities with easy access to EBS data in Excel. Wands provides deep integration that leverages the Oracle data dictionary and does the heavy lifting for table joins, queries, and calculations means fast, accurate reporting with no technical knowledge required.

To learn how Angles Enterprise for Oracle or Wands for Oracle can drive future efficiencies for your finance team, schedule a demo today.