Budgeting vs Forecasting: Similarities and Differences

What’s the difference between budgeting and forecasting? In essence, it’s the difference between an intention and an expectation. When you’re heavily invested in the outcome, it can be difficult to clearly separate goals (that is, the thing you are aiming for, or budget) from an objective estimate of what will actually happen (forecast).

In this article, we’ll look at budgeting vs. forecasting, along with some advice about how to remain mindful of the distinctions.

The Budget: A Company’s Plan for the Future

Budgets are plans for the company’s future. Although they should be realistic, budgets might be better characterized as “hopes” or “intentions” rather than actual expectations. After all, executives have limited visibility to what the future might hold. Budgets may account for potential fluctuations in economic activity, but at their core, they tend to be optimistic and aspirational. The budget is all about what company leaders want to make happen.

Finance teams typically create budgets once a year using a fairly comprehensive process. This involves collecting input from many different stakeholders, resulting in a budgeting process that usually takes somewhere between a few weeks and a few months to complete. Typically, budgeting also involves a good deal of negotiation, with expectations and commitments established between management and department heads throughout the negotiation process.

Budgeting for Better Outcomes: How to Take Control of the Fiscal Planning Process

Download NowThe Forecast: “Are We on Target?”

Whereas budgets are about what the company wants to make happen, forecasts are about what companies believe will happen. Theoretically, these two approaches should match up (or should at least be fairly close to one another) at the time when you finalize the budget. After all, it would be imprudent for company leaders to build a plan for their future that is far out of line with their realistic view of what is likely to happen.

In this respect, forecasts function as a kind of monitoring mechanism. Throughout the year, you may adjust forecasts to reflect changing conditions. If a new competitor has emerged, or if an existing competitor has expanded their market share, it may result in downward adjustments to the revenue forecast. If demand for the company’s product has changed significantly due to trade policy, quality problems, or viral popularity, then you must likely adjust sales forecasts as well. Volatility in the price of raw materials or other major cost factors can likewise lead to changes in the forecast.

Is It Subject to Change?

Generally speaking, companies produce a single budget for the year. It is certainly not unheard of to adjust budgets throughout the year, or to freeze spending based on tightening market conditions. You may often need to reallocate funds from one budget line to another based on shifting priorities. As a general rule, however, budgets tend to be relatively static. A yearly plan that changes on a whim would not truly be a plan because it would lack substantive meaning.

There are, however, some innovative new budgeting techniques that allow for considerable flexibility based on a predetermined set of business rules established at the beginning of the year. Driver-based budgeting (DBB) is gaining widespread attention as business leaders look for ways to enhance agility and responsiveness in the midst of a rapidly changing environment. DBB ties budget allocations to the factors that influence business performance most strongly, then uses flexible models to calculate adjustments based on changes to those variables. Nevertheless, budgets tend to be relatively fixed, or in the case of driver-based budgets, they rely on a relatively stable set of business rules agreed upon in advance.

In contrast to budgets, you can update forecasts at any time. In fact, whenever new information emerges that could impact business results, it makes sense to update forecasts to reflect those changes.

What’s the Scope?

Budgets are generally comprehensive in their scope. They typically cover the entirety of an organization’s financial activities, including all profit and loss (P&L) accounts (revenue and expenses). Balance sheet accounts aren’t necessarily the focus in many budgets, although the budgeting process at a majority of organizations also encompasses a plan for capital investments, financing activities, and cash flow analysis.

Forecasts, on the other hand, are sometimes more limited in their focus. Updates to sales forecasts, for example, are common because they tend to be more difficult to predict than overhead expenses such as rent or utilities. If a particular expense category is especially volatile, or if unpredictable factors have impacted spending, it may make sense to develop forecasts that are more comprehensive in their coverage.

What’s the Time Horizon?

Although we frequently think of budgeting as an annual exercise, you can adjust budgets throughout the year. However, in most organizations that information remains relatively static. It doesn’t necessarily have to be the case, though. Business leaders sometimes aim to develop longer-term budgets that span several years. However, these are generally still updated annually, with annual budgets being created alongside the longer-term budgets to serve as a management tool for controlling expenses and monitoring revenue for the coming year.

Forecasts tend to address both short-term and long-term scenarios. The shorter the time horizon, the more accurate they tend to be. Long-term forecasts tend to be helpful for strategic planning exercises.

Many organizations are embracing a rolling forecast strategy in response to times of economic uncertainty. A rolling forecast is a sliding window of performance (typically 12 months). As a new month is added, the oldest month drops off. Organizations that adopt rolling forecasts often see increases in accuracy, speed, and agility.

You should generally use budgets and forecasts in conjunction with one another to provide management with a side-by-side view of the company’s goals (as expressed in the budget) and its expectations about what will actually happen (as articulated in a forecast). By understanding the differences, stakeholders throughout the organization will be better positioned to benefit from the control and insights that these tools provide.

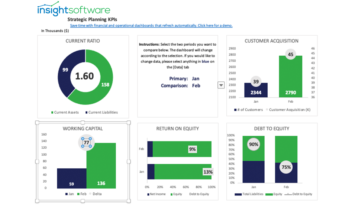

At insightsoftware, we provide financial planning and budgeting tools that provide maximum flexibility and enable efficient collaboration. Our financial reporting, budgeting, and analysis tools make the budgeting process faster, easier, and more accurate and support forecasts and updates that help managers to monitor performance and respond to external changes. To learn more about how your organization can streamline and improve budgeting and forecasting, contact us today for a free demo.