Five Types of Budgets: Which One is Right for You

Traditionally, most businesses approach budgeting as an adjustment to the status quo. The current year’s budget and year-to-date actuals usually serve as the starting point for next year’s budget. Although this is an entirely legitimate approach, it is only one of five main types of budgeting processes that business leaders have at their disposal.

In this article, we’ll explore all five methods of producing a budget, including the distinct advantages and disadvantages of each approach. We’ll also discuss the role of technology in facilitating a more efficient and thorough budgeting process for today’s organizations.

Incremental Budgeting

The traditional approach referred to above is also known as incremental budgeting. It generally starts with the previous year’s numbers as a baseline, often combining last year’s budget numbers with some year-to-date actuals and remaining projections. Those don’t necessarily become the budget per se; but they serve as a starting point from which you build the final budget.

The next step involves modifications to specific line items that involve predictable numbers, or line-items for which there are obvious, foreseeable changes. Interest expense on an amortized loan, for example, will steadily increase over time as the principal portion of each payment declines. Lease payments often remain steady over a period of years. In a few cases, managers may be aware of expense categories that will sharply decline or go away altogether.

After you make these more predictable changes, it’s common practice to apply a percentage of uplift across a range of accounts or departments. For example, if company leadership plans to roll out a new product, they may allow for a higher than normal increase in marketing expenditures. That would presumably call for an across-the-board uptick in budget for that department. Other departments, faced with status quo operations, might see a flat budget, or an increase intended only to keep up with inflation.

The primary advantage of incremental budgeting lies in its focus on what is changing. Broad-brush changes, such as increasing all personnel expenses by 3.1%, are relatively easy to make, and they don’t necessarily require a lot of thought or extensive discussion, which makes this method easier and less time-consuming.

The downside to this approach is that it tends to result in less discussion and debate. It doesn’t necessarily call upon business leaders to examine the details very closely. So although you can accomplish incremental budgeting relatively quickly when compared to the other four approaches in this article, it may be the least useful in terms of enforcing a highly disciplined approach to spending.

Activity-Based Budgeting

Activity-based budgeting (ABB) is a top-down approach that focuses on the key outcomes a business intends to achieve. It begins with the end in mind, then explores the question “What must we do as an organization to achieve our primary goals?” From there, ABB defines the necessary resources and activity levels required to support those objectives.

Consider an organization that has developed an innovative new technology, for example. They aren’t yet well-known in the marketplace, and their product requires a highly consultative sales process. If their goal is to produce $5 million in revenue in the coming year, they will need a direct sales force with the requisite technical experience, and they’ll need an outbound lead generation process to build an adequate funnel of prospective customers.

Working backward from the goal ($5 million in revenue), company leaders would establish the number of deals they need to close, the number of sales appointments they need to make, the size of the sales pipeline they need to generate, and so on. Each of those questions implies some amount of spending on staffing, services, technology, or other resources.

ABB tends to focus on strategic objectives and pays considerably less attention to expenditures that cannot be tied directly to high-level goals. As such, business leaders must be careful not to take the principles of ABB too far. You could discount or overlook departments that fail to produce specific, measurable outcomes in service of the company’s strategic objectives in the process. Nevertheless, ABB generally provides a higher level of strategic focus than the other approaches on this list.

Value Proposition Budgeting

The third approach is value proposition budgeting, which examines each line-item or budget category to ask the questions: “Why are we spending this money?” and “What value does it provide to our customers, employees, or other stakeholders?” This approach is a happy medium, fitting between incremental budgeting (which, it can be argued, scrutinizes too little) and zero-based budgeting (which calls for managers to justify virtually every line item in the budget, as does the approach used below). Unlike the activity-based approach, value proposition budgeting seeks to justify expenses for the value they create, without requiring a direct link to strategic goals per se.

Zero-Based Budgeting

Zero-based budgeting (ZBB) starts with a blank slate. With this approach, managers must establish their budgetary requirements for the coming year and justify each line item without regard to prior years’ numbers. Just because the company spent money on a particular thing in the past doesn’t mean it should necessarily continue to do so in the future.

The zero-based approach requires that budget owners justify virtually every proposed expense. In this respect, ZBB is an excellent means of eliminating wasteful spending. It helps company leaders to aggressively streamline inflated budgets and to bring costs under control while minimizing any negative impact on operations.

In effect, ZBB forces companies to prioritize and take a more intentional approach to managing their costs, focusing on the areas that generate the highest value for the business. Because it forces managers to carefully consider what they are spending and how much value that spending produces, ZBB often results in new innovations, helping companies to run more efficiently.

Driver-Based Budgeting

Driver-based budgeting (DBB) focuses primarily on the key variables that most dramatically impact business performance, and ties budget numbers to the physical resources necessary to achieve the company’s targets for each of those variables. These may include internal factors such as the total number of customers or subscribers, number of salespeople or distributors, or average revenue per customer. They might also include external factors such as total market size, commodity prices, or even weather conditions. DBB builds a budget based on key business objectives, baseline assumptions about external drivers, and a results-driven approach to internal business drivers.

If any of those input variables changes, you can adjust the budget relatively easily to suit those new conditions. For example, consider a ski resort business in which early-season and late-season business are especially dependent on weather conditions. An early onset of cold weather, especially if there’s an unseasonably large amount of snow early in the season, will undoubtedly affect revenue, as skiers flock to the slopes after a long off-season. That, in turn, impacts personnel requirements; not only for ski area operations, but also for lodging, restaurants, and other ancillary businesses that benefit from the good weather conditions. In this example, weather conditions constitute a key business driver that affects virtually everything else the company does.

DBB helps managers to identify the most important drivers that impact their business performance and to align budgeting and planning accordingly. It also ties business results very closely to outcomes as key drivers change. This results in greater accountability, and less room for managers to make excuses. DBB virtually eliminates the practice of “gaming the system” because it establishes a clear set of business rules in advance, which guides expectations and serves as a roadmap for performance as key variables affecting the organization change.

The Role of Technology

Most companies default to using incremental budgeting, partly because it is familiar, but also because it has historically required considerably less effort than the other methods. That’s especially true if your organization is still using spreadsheets and email to manage the process. Even so, the process of producing an annual budget can be complicated, time consuming, and often cumbersome if you’re using old-fashioned methods.

Fortunately, technology is making planning and budgeting easier than ever before and is helping to avoid common budgeting problems. Regardless of which of these budgeting processes you choose, there are common requirements for collaboration and discussion, version control, and automated workflows that simply cannot be duplicated by passing spreadsheet files back and forth by email. And because spreadsheets generally aren’t updated with live data from your ERP system, budgets are typically built on old information or must be manually updated periodically.

Today’s global economy calls for business agility. Most companies today are recognizing that planning and budgeting should no longer be annual processes. Instead, business leaders must constantly monitor external conditions and make rapid adjustments to stay ahead of the competition.

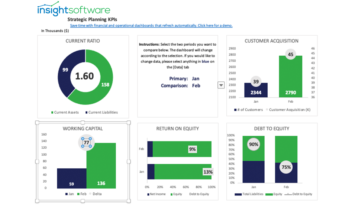

If your organization wants to take planning and budgeting to the next level, insightsoftware can help. To learn more, contact us to arrange a free demo.