Is Your Company Ready for Transition to the 2021 US GAAP Taxonomy?

Earlier this year the Securities and Exchange commission began accepting the 2021 US GAAP Taxonomy (UGT) and many filers are getting ready for the switch now that their annual and first quarter filings have been successfully completed. Similar to prior years, the taxonomy updates include changes that not only address recently issued Accounting Standards Updates (ASUs), but also improve the usability of the taxonomy to promote consistent and accurate data across company filings. Read on to find out how this year’s UGT updates may affect your filing and how to address them.

ASUs and SEC Rules

As the Financial Accounting Standards Board (FASB) releases ASUs throughout the year, it simultaneously addresses the associated needs for these ASUs, as well as new SEC rules, in the UGT. Since the UGT is updated only once a year, these changes are housed in a “Pending Annual Updates” page and incorporated into a development taxonomy that FASB maintains between official releases. Now that the 2021 taxonomy has been released, changes from the prior year’s ASUs and SEC rules are available, including:

- ASU 2020-09 – Debt (Topic 470) – Amendments to SEC Paragraphs Pursuant to SEC Release No. 33-10762

- ASU 2020-06 Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40)

- ASU 2019-04 – Codification Improvements to Topic 326, Financial Instruments— Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments

- U.S. Securities and Exchange Commission Release No. 33-10835; 34-89835, Update of Statistical Disclosures for Bank and Savings and Loan Registrants

While some of these rules may not affect your filing for a while, it doesn’t hurt to plan ahead by getting familiar with the new ASU and the associated taxonomy updates. In addition to updating the taxonomy to support required US GAAP disclosures, the FASB incorporates changes based on topical projects.

Topical Projects

During a topical project, the FASB reviews taxonomy modeling for specific subjects, such as retirement benefits or variable interest entities. This year the taxonomy release includes changes based on the following topics:

- Asset Acquisitions

- Variable Interest Entities–Pledged Assets

- Accounting Changes

Asset Acquisitions

If your filing contains a disclosure for asset acquisitions (because the purchase did not qualify as a “business combination”) there are new elements available for this disclosure. Previously, the only elements available were specific to business combinations (e.g. BusinessAcquisitionEffectiveDateOfAcquisition1 or BusinessCombinationConsiderationTransferred1). Whether you decided to extend or use the existing business combination elements in previous filings, your asset acquisition disclosure should be reviewed when you migrate to the 2021 taxonomy to see if the new elements, such as AssetAcquisitionEffectiveDateOfAcquisition or AssetAcquisitionConsiderationTransferred, are appropriate.

Variable Interest Entities–Pledged Assets

Along with addition of new elements to the taxonomy for disclosures of pledged assets related to variable interest entities, the FASB updated tagging implementation guidance related to this topic. If your filing contains this type of disclosure, be sure to review the guidance as well as the new taxonomy elements.

Helpful Hint for Certent CDM Customers

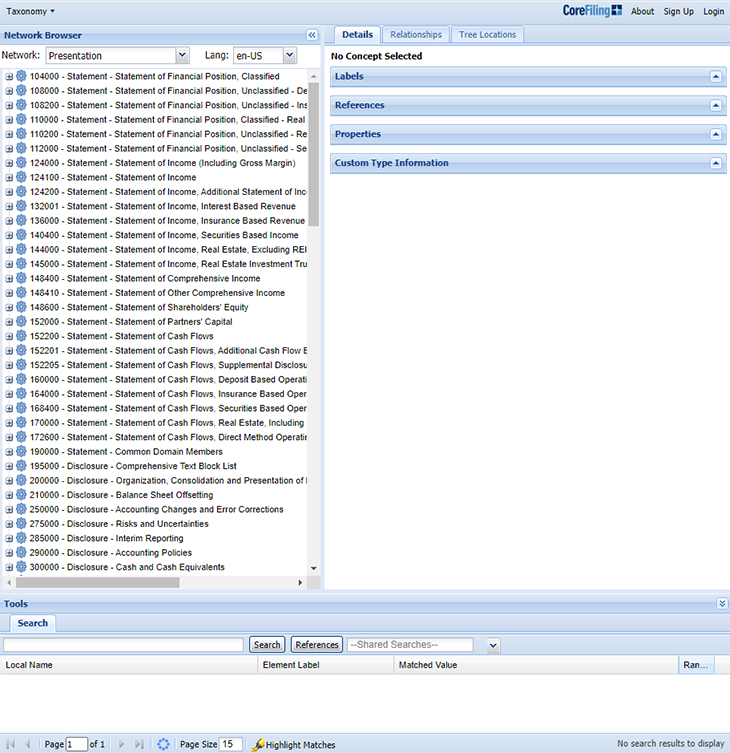

To review new elements in the taxonomy, use the shared search in the taxonomy viewer.

Accounting Changes

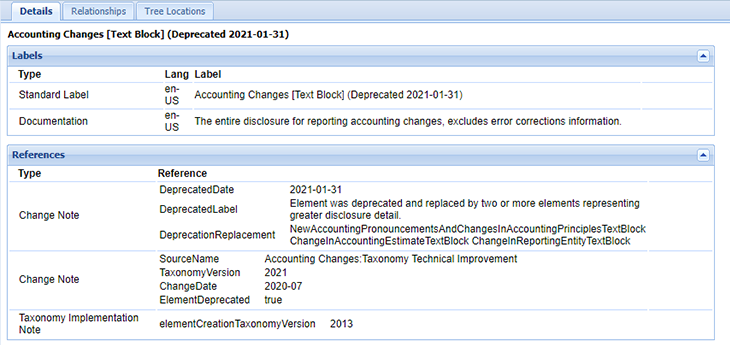

The main areas of change associated with this topic were deprecation of repetitive text block elements and additional tagging guidance on error corrections which can be found in the Accounting Changes Taxonomy Implementation Guide. If this topic applies to your filing, be sure to review your taxonomy structure.

Helpful Hint for Certent CDM Customers

If one of the elements in your company specific taxonomy is deprecated, check the change note for the FASB suggested replacement.

Reviewing Upcoming Taxonomy Changes

The FASB 2021 UGT website provides a number of tools that will assist you with the taxonomy transition. These include a narrative description of the taxonomy changes, Excel documents for both the changes to the taxonomy and the taxonomy itself, and perhaps the most useful tool, the “FASB Extension Taxonomy Change Application”. This downloadable program identifies the changes that will apply to your taxonomy when you transition to a new version. FASB also provides a number of Taxonomy Implementation Guides to assist with the implementation of the taxonomy with common disclosures such as accounting changes, equity method investments, and segment reporting, etc. These guides should be followed as closely as possible, so it is important to review them, if applicable, when you update your tagging during migration to the new UGT.

When you transition to the 2021 UGT, it is important to review all of the changes. Even if the topics above do not apply to your particular filing, there are likely to be definition/label, reference, and implementation note changes. These types of updates typically aren’t fundamental, but they still might determine whether a particular element is appropriate for the disclosure. These changes can be easily identified via the FASB application above, or your service provider should be able to identify them and provide guidance. Reach out to your XBRL consultant if you have questions.

Discover how to produce and format your regulatory, internal, and external reports with ease.