Tax Reporting

Ditch Manual Tax Processes: Automate With insightsoftware Tax Solutions

Escape manual tax complexities. insightsoftware’s tax solutions liberate you from manual tasks, offering streamlined workflows, accurate data, and time for strategic growth.

"*" indicates required fields

The Complete Solution for Your Global Tax Needs.

insightsoftware’s suite of tax and transfer pricing solutions enable you to optimize your tax reporting with faster processing and a single source of truth.

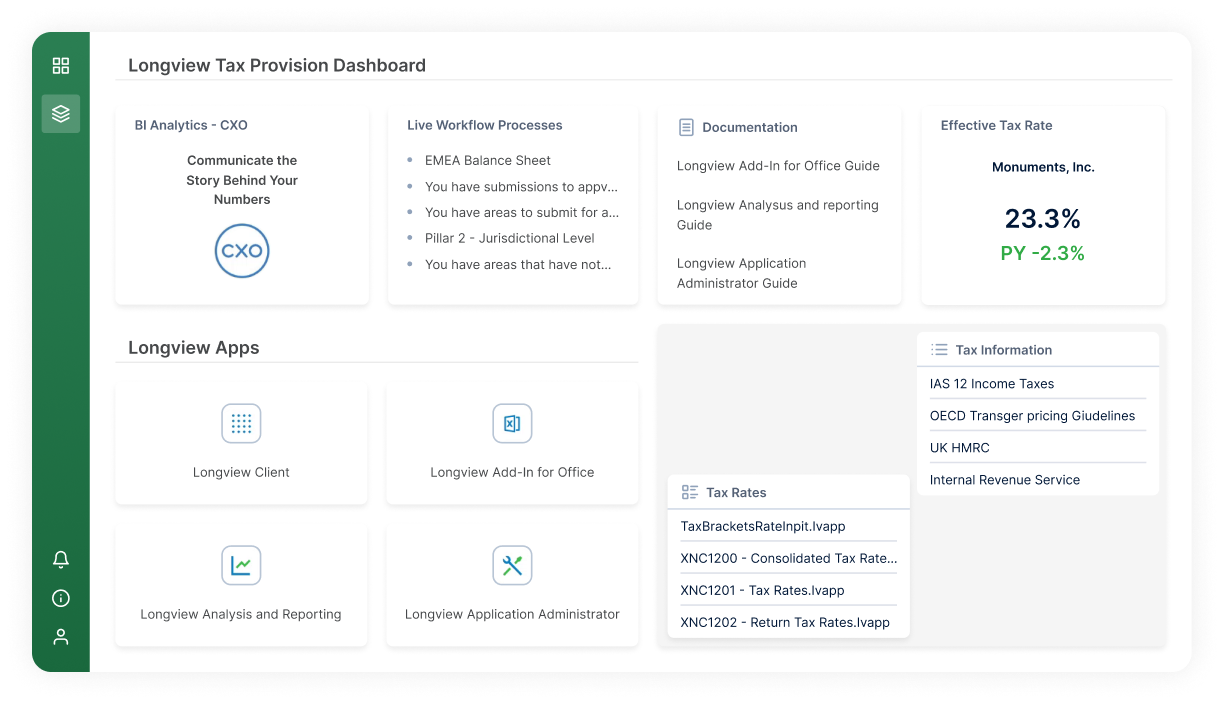

Tax Reporting

Longview Tax enables more frequent reporting, better tax forecasting, and faster responses to ad-hoc queries improving visibility and governance.

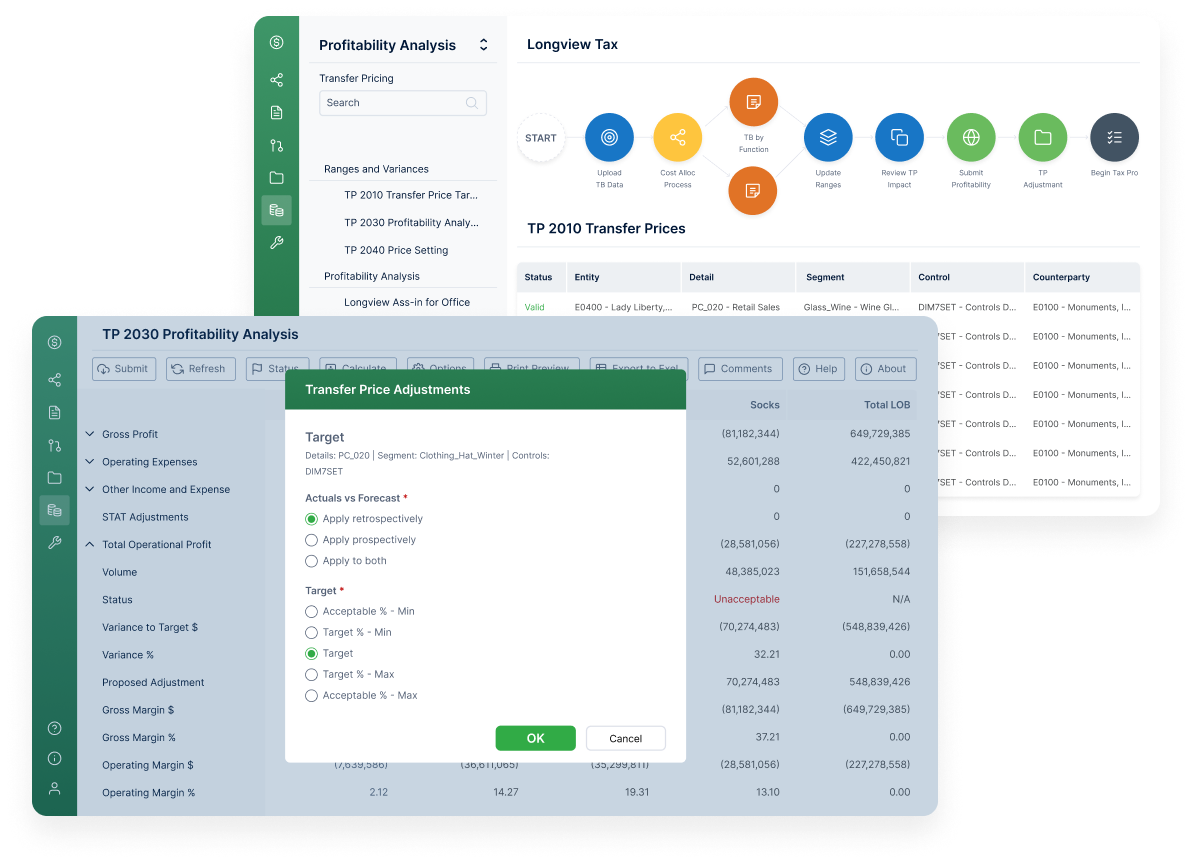

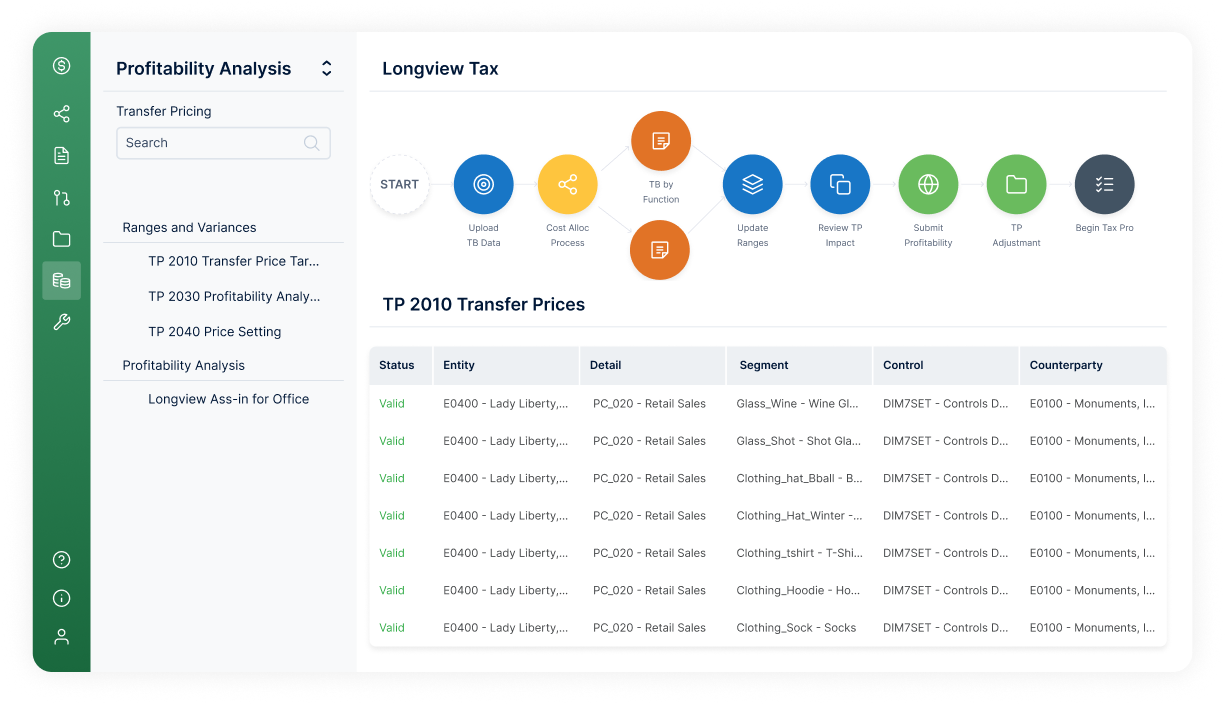

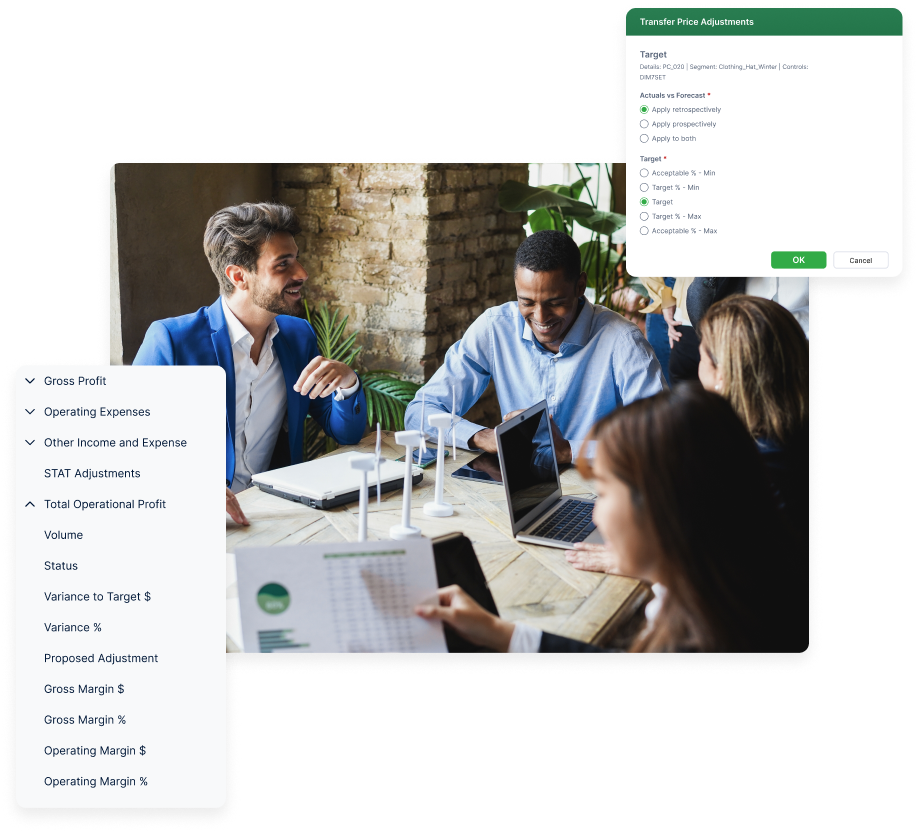

Operational Transfer Pricing

Longview Transfer Pricing connects your enterprise strategy and tax policy with transfer pricing execution, enabling modernization with lower risk.

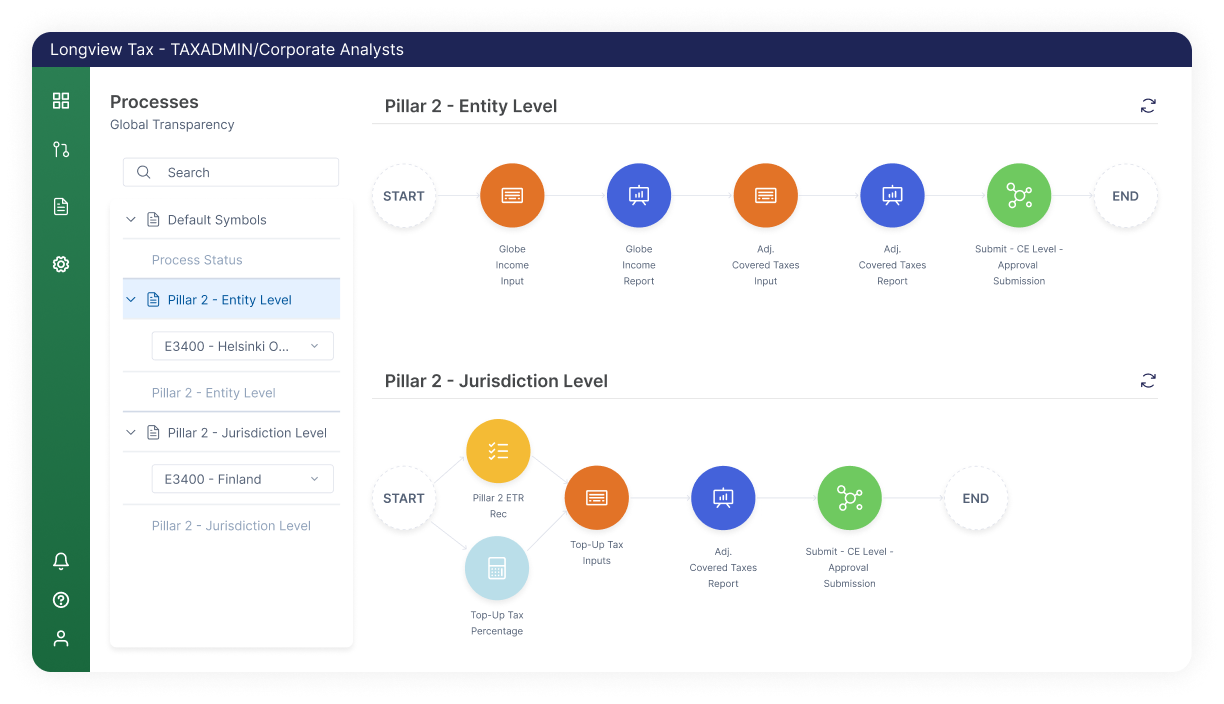

Tax Solution for BEPS Pillar 2

Longview Tax Pillar 2 solution offers out-of-the-box modeling, accruals, and data automation, reducing compliance risks with accurate, real-time insights.

Automate Tax Management. Reduce Errors. Gain Insights.

Automate tax workflows, standardize processes, and unlock strategic tax insights through unified data analysis. Experience the power of a frictionless tax management solution, boosting efficiency and accuracy for informed decision-making.

Optimize Efficiency with insightsoftware’s Tax Solutions: Streamlined, Centralized, and User-Friendly for Enhanced Accuracy and Governance.

Elevate your data analysis. Ensure accurate streamlined reporting with insightsoftware’s tax solutions. Meet regulatory challenges while reclaiming time through automation.

Centralized calculations help you reduce manual processes, ensure integrity, and promote transparency. Monitor subsidiaries for profitability deviations early and proactively address underlying causes. Easily measure with consolidated financial data and gain detailed visibility into jurisdictions, entities, and timeframes. Enhance coordination among FP&A, tax, and operations teams for timely action and year-end surprises prevention.

Reclaim lost hours and gain valuable time for tax analysis with insightsoftware’s automated tax provisioning solutions. Leverage seamless calculations and embrace new levels of efficiency for multi-jurisdictional compliance.

BEPS challenges demand evolved tax solutions. insightsoftware’s flexible tax solutions help you navigate increased data complexity. Ensure efficiency, prepare for Pillar 2, and foster collaborative analytics for your tax team’s success in this dynamic environment.

Close faster with insightsoftware’s tax solutions. Automated data collection across departments minimizes manual delays, reducing dependence on finance. Redirect valuable time and energy towards strategic initiatives. Gain agility, speed tax completion, and enhance department autonomy for efficient, independent operations.

Unify tax data, unlock strategic insights. Streamline analysis with insightsoftware’s centralized, standardized tax solutions. Ensure accurate entity comparisons and financial storytelling for confident decision-making.

See for yourself why 500K+ users are using insightsoftware to draw instant data insights, react swiftly to market changes, and outpace their competition

Enhance Your Tax Function with insightsoftware Solutions

Tax software empowers diverse roles, providing data insights for decision-makers, and streamlining processes for operational efficiency across your organization.

FAQS

Tax management software enhances efficiency, accuracy, and compliance in an organization’s tax processes. It saves time, cuts costs, and ensures regulatory adherence for better decision-making.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers flexible integration options to connect to the many and varied data sources required for tax, transfer pricing and tax transparency.