BEPS Pillar 2 Software Solutions

Streamline Your Pillar 2 Tax Provisioning

- Connected Systems – Enhance your provisioning through a centralized application. Eliminate inconsistencies in tax data and reports by having a single source of truth.

- Optimized Tax Processes – Optimize tax processes with real-time data without consolidation delays. Faster reporting can rebalance your workload and free your time for strategic tasks.

- Flexible Solution – Experience the versatility of a solution that seamlessly integrates with various sources and offers comprehensive support.

See What Pillar 2 Solutions Work for Your ERP

Tax Reporting

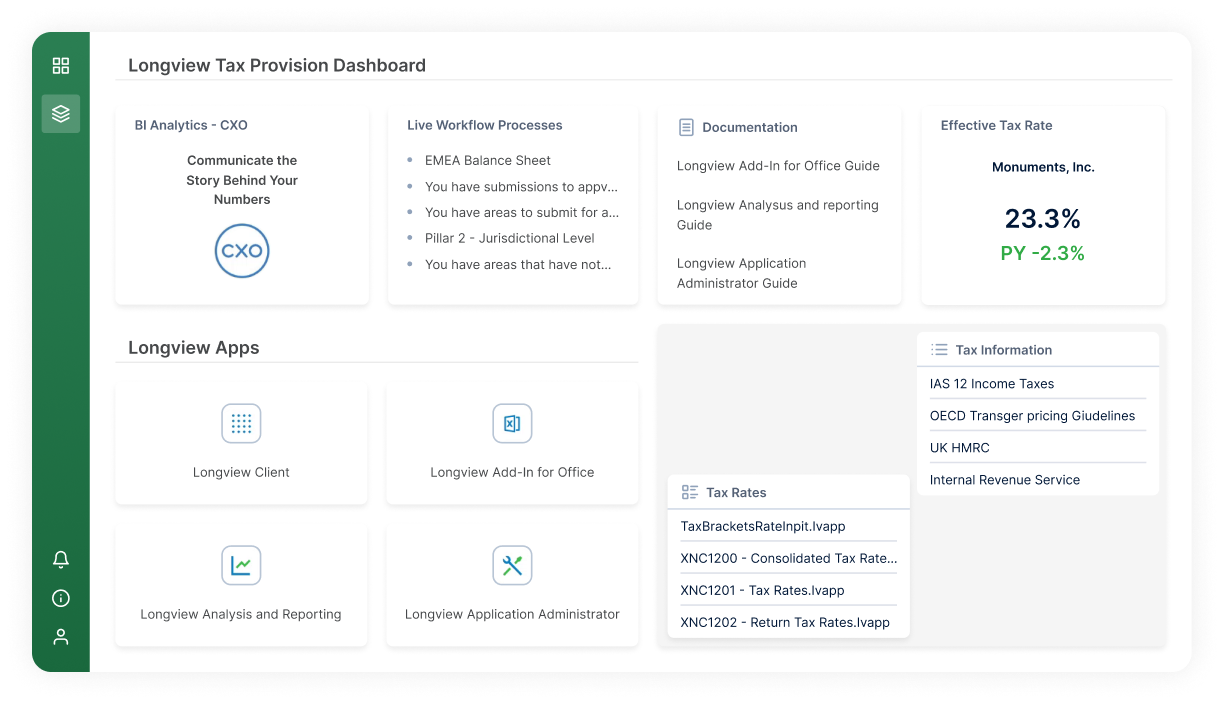

Longview Tax enables more frequent reporting, better tax forecasting, and faster responses to ad-hoc queries improving visibility and governance.

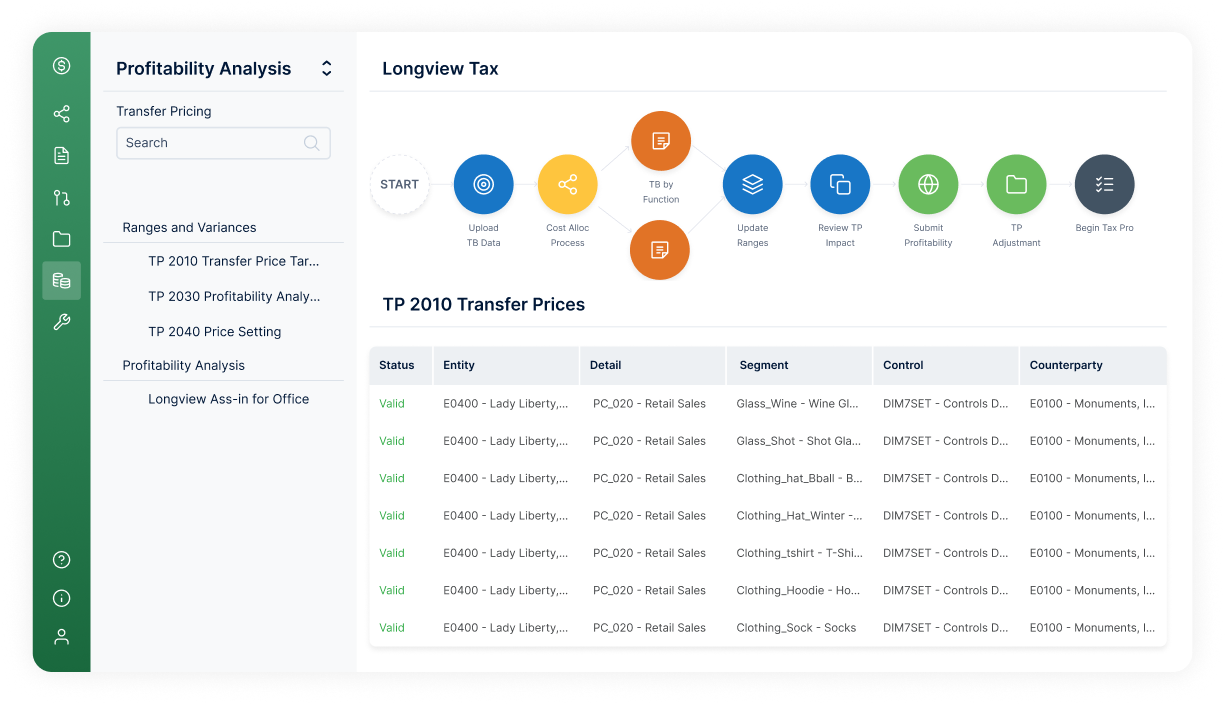

Operational Transfer Pricing

Longview Transfer Pricing connects your enterprise strategy and tax policy with transfer pricing execution, enabling modernization with lower risk.

Overcome Pillar 2 Data Challenges

Difficulty Capturing the Right Data

Ensuring alignment with quarterly, interim, and year-end reporting cycles is crucial to effectively leveraging relevant data and supporting reconciliation efforts. Unfortunately, challenges in capturing data accurately hinder precise calculations and automation.

Aligning Across Teams

Collaboration between tax and finance departments suffers due to disparate systems that result in fragmented data and hindered effectiveness. This lack of cohesion not only creates inefficiencies but also undermines accuracy and transparency in tax reporting.

Increased Scrutiny With Strained Resources

Aligning processes with quarterly, interim, and year-end reporting becomes increasingly challenging with heightened disclosure scrutiny. The need to efficiently utilize relevant data and streamline reconciliation efforts adds to the strain on already stretched tax resources.

Streamlined Pillar 2 Tax Provisioning With Longview Tax

Optimized Tax Provisioning

With Longview Tax, your tax team is equipped with the tools and capabilities to efficiently complete provisioning tasks. Longview Tax offers real-time access to data and advanced automation features, significantly reducing the time traditionally spent on manual processes. This automation streamlines workflows, allowing your team to allocate more time and resources toward strategic activities that drive business growth and innovation. By leveraging Longview Tax’s capabilities, your team can optimize efficiency, enhance productivity, and achieve greater success.

Get Instant Demo

Streamlined Processes

Transform your tax provisioning processes with Longview Tax by leveraging intelligent automation tailored precisely to your unique processes and workflows. Experience a seamless transition as it enables effortless data transfers, eliminating the need for manual tasks. By harnessing the power of automation, Longview Tax enhances data accuracy while eliminating redundancies that have historically hindered tax teams. Our innovative solution empowers your team to work more efficiently, freeing up valuable time and resources for strategic initiatives that drive business growth.

Get Instant Demo

Enhanced Analysis

With Longview Tax, your tax team gains access to advanced analytics capabilities, empowering them to make data-driven decisions with confidence. We provide robust analytical tools and features, allowing your team to extract valuable insights from complex tax data sets. By centralizing tax processes within Longview, your team can access accurate and up-to-date information at any time. This centralized approach enhances your confidence in decision-making by providing a holistic view of tax-related data and trends. As a result, your team can improve overall efficiency and effectiveness in managing tax processes.

Get Instant Demo

Taming UTPs for a Flawless Pillar 2 Strategy

Pillar 2 introduces a complex balancing act for UTPs. New UTP expenses are excluded from calculations, but future payments are included, creating a management challenge. Learn how to navigate this in our Pillar 2 series and optimize your ETR for efficient compliance.

BEPS Pillar 2 Solution FAQs

As a quick refresher, BEPS Pillar 2 instituted a global minimum tax rate for MNEs that took effect in 2024. This was not a simple change — it requires new consolidated calculations like GloBE revenue/income, adjusted covered taxes, substance-based carve-outs, and more.

Pillar 2 established a global minimum tax (15% minimum effective tax rate) for in-scope multinational enterprise groups. This makes it so profits in each jurisdiction are taxed at a minimum level. In locations where the jurisdictional effective tax rate is below this minimum, a top-up tax is applied to bring the effective rate up to the floor. GloBE Rules define the scope, measure of income, covered taxes, and the ETR formula to calculate any top-up taxes. On top of this, a Subject-to-Tax Rule operates alongside GloBE for certain payments between treaty partners.

The rules mentioned above are multi-step, iterative, and jurisdiction-specific. This results in much more complexity, which can lead to significant compliance risks if handled manually. The biggest challenges we see arise from this are:

- Granularity and provenance: Many tax teams lack consistent trial-balance-level feeds from operating ERPs, making it difficult to provide GloBE-level information.

- Multi-currency, multi-jurisdiction mapping: Different chart-of-accounts, currency conversions, and local adjustments often lead to tedious manual transformation and mapping work.

- Provision vs. statutory tax reconciliation: Tax provision tools and Pillar 2 inputs are typically on different schedules and different systems, complicating reconciliation.

- Evolving rules and auditability: Pillar 2 rules and local implementations are not set in stone and continue to evolve, making traceability and version control critical.

To start, the administrations and incentives that had previously attracted investment have had to reassess against the new 15% floor to evaluate whether incentive tax rates get neutralized by the top-up taxes. There is also a greater focus on transparency and governance as a result of needing documented economic substance and defensible positions (e.g. QDMTT, elections, safe-harbour use). Pillar 2 also forces tax teams to become an operational function that works and coordinates more closely with FP&A, consolidation, and treasury.

These changes have led to the prioritization of software platforms that combine provisioning, scenario modeling, audit trails, and jurisdictional reporting. Tools like Longview Tax help tax leaders simulate outcomes and pick defensible policy positions before making strategic commitments.

Longview Tax has new features that empower your tax team to handle modeling, accruals, and data automation with ease and confidence. They ensure you’re ready for the ongoing challenges of BEPS and help you stay ahead of the curve. Longview Tax also provides you with return-ready data, data visualizations to spot jurisdictions at risk of top-up tax, and a module to help you manage your Pillar Two elections effectively.

Yes. Longview’s Pillar 2 module includes a “starter kit” and built-in apps that help support transitional safe-harbor deployment, jurisdiction settings, and the data flows to populate those values. This kit also includes deployment and adjustment apps, safe-harbor value reviews by jurisdiction, and events to move source values into the designated safe-harbor accounts. Instead of building one-off spreadsheets or custom ETL for each safe-harbor calculation, Longview Tax comes with pre-built, audited components that make it easy for tax teams to adopt safe-harbor logic consistently across entities and jurisdictions. Even better, this consistency preserves traceability and includes jurisdictional elections and settings to manage per-jurisdiction choices.

We’ve partnered with Orbitax to combine the value of Longview’s tax provisioning, consolidation, and reporting with their jurisdiction-specific GMT/Pillar-Two calculation engine and compliance workflows. The result is an end-to-end path from trial balance through GloBE calculations to jurisdictional filing support and compliance proof points.

The value-add for users is that this strategic integration offers the best of both worlds, with Orbitax handling deep jurisdictional calculation nuance while Longview Tax manages provisioning, journal entries, consolidated disclosures, and the enterprise-grade workflow/audit trail for sign-offs. By linking Longview Tax to a specialist Pillar 2 engine, it reduces manual re-keying, speeds up time to compliance, and preserves calculation provenance for audits. Lastly, this integration is particularly beneficial for large groups because of its practical automation capabilities for repetitive tasks like data handoffs, allocations, and top-ups.

Pillar Two imposes new data gathering, calculation, and reporting requirements, and businesses need to have the proper systems to support them so they can identify, gather, and process the appropriate data. The calculations are similar but not identical to current tax reporting requirements, so tax/accounting teams need to collaborate to scale their reporting and data analytics. Furthermore, the new calculations must be digitally and securely stored, and also traceable and trackable for future calculations and potential audits from tax authorities.

Excel and other outdated systems might ruin your tax compliance. They can cause data errors and inconsistencies that could lead to fines and a bad reputation. With the new Pillar Two rules, accurate filing is more crucial than ever. Longview Tax helps prevent this by rebalancing your time with faster, more accurate reporting. You work with real-time data, so you can efficiently complete your provisioning without having to wait for data consolidation or processing. Longview Tax also uses intelligent automation aligned with your unique processes and workflows, so your team can enjoy increased data integrity and eliminate manual processes.

Jet Analytics provides an automated and governed data warehouse with purpose-built connectors for over 250 sources (such as Microsoft Dynamics, Oracle, and more). Its OLAP cubes and data model centralize your trial balances, ledger detail, and supporting dimensions so tax teams can easily build repeatable Pillar 2 feeds and reports. Jet Analytics is especially valuable because Pillar 2 requires a reliable single source of truth for constituent-entity incomes, tax inputs, FX, and mapping (which Jet provides). The platform automatically organizes and transforms source systems into reporting-ready cubes, enforces governance, and reduces the “flattening into spreadsheets” problem that causes reconciliation errors.

Yes. Jet Analytics’ OLAP cubes and data warehouse are specifically designed to work seamlessly with Power BI and Excel. Tax and finance users can build and refresh dashboards, run jurisdictional ETR rollups, and model scenarios (without heavy SQL or IT involvement for custom code). On top of this, we provide easy-to-follow guidance with Jet so it’s straightforward for Power BI to consume the cubes and for you to build visualization templates for Pillar 2 KPIs. All of this matters to tax teams because it shortens cycle times, enables users to instantly run “what-if” assessments on elections or the substance carve-out, and frees up IT from being the bottleneck for every reporting change.

Yes. Jet Analytics comes with purpose-built connectors and an automated data warehouse that integrates with your ERP, consolidation systems, and databases. Longview Tax also has an Excel add-in that many users leverage to push existing spreadsheet calculations into the Longview platform.

Our built-in audit and lineage features ensure traceability and transparency, even through complex calculations. Longview Tax includes a “Show Audit Trail” app and metadata audit tools to view underlying data changes and maintenance activity. Jet Analytics has data lineage and impact analysis so you can easily answer questions about “where did this number come from?” and “what breaks if I change this source?”

Longview Tax has FX rate input apps and built-in foreign-exchange support for period averages and translations. Longview’s scalability continues to improve with updates, making it an ideal fit for maintaining performance across many entities and currencies.

We publish product releases and Pillar 2 feature updates, such as release notes that highlight ongoing Pillar 2 enhancements (like jurisdictional QDMTT support, election management, etc.). Longview Tax also has configurable input apps and jurisdiction election apps so tax teams can change settings without having to re-engineer the entire platform. On top of this, our integration with Orbitax brings jurisdiction-specific calculation logic and compliance directly in your workflow, reducing the burden to encode every local nuance. All of this together makes it easier than ever to adapt to guidance changes.