Longview Tax

Elevate Corporate & Enterprise Tax Management for More Insightful Decision-Making

Longview Tax is your enterprise tax management platform for simplifying tax provisioning and reporting. It streamlines consolidation and automates tax workflows, reducing manual effort and improving data accuracy. With real-time consolidation, better insights, and seamless integration, Longview Tax provides teams with more data and deeper learnings for more informed decision-making.

See for yourself why 500K+ users are using insightsoftware to draw instant data insights, react swiftly to market changes, and outpace their competition

Is Your Tax Management Software Working for You?

Fragmented Data, Slow Tax Processes

Tax professionals face daily challenges with scattered data collection and time-consuming processes. Managing and updating numerous spreadsheets with thousands of rows by hand drains valuable time and increases the risk of errors or overlooked insights. On top of this, dealing with static data that quickly becomes outdated adds to this problem, grinding your tax management to a halt.

Tax is Stuck in Reactive Mode

Are your tax processes mired in reactivity rather than proactivity? Excessive hours devoted to manually consolidating and cleansing data across entities, leaving few resources and little time for value-added activities. Blindsided by a high effective tax rate at filing time, groups have no chance to adjust their strategies and minimize their tax burden. This results in under-informed and reactive decisions based on lagging data instead of proactive planning.

Manual Data Entry Overload

A lack of integration with finance systems puts tax teams into a constant cycle of manual, tedious data entry — taking valuable time and often increasing the risk of errors. This hampers productivity as teams deal with duplicative efforts, diverting focus from higher-value tasks instead of using efficient tools to automate lower-value tasks like data entry.

Tax Optimization & Automated Tax Management in a Single Platform

A Comprehensive Tax Solution

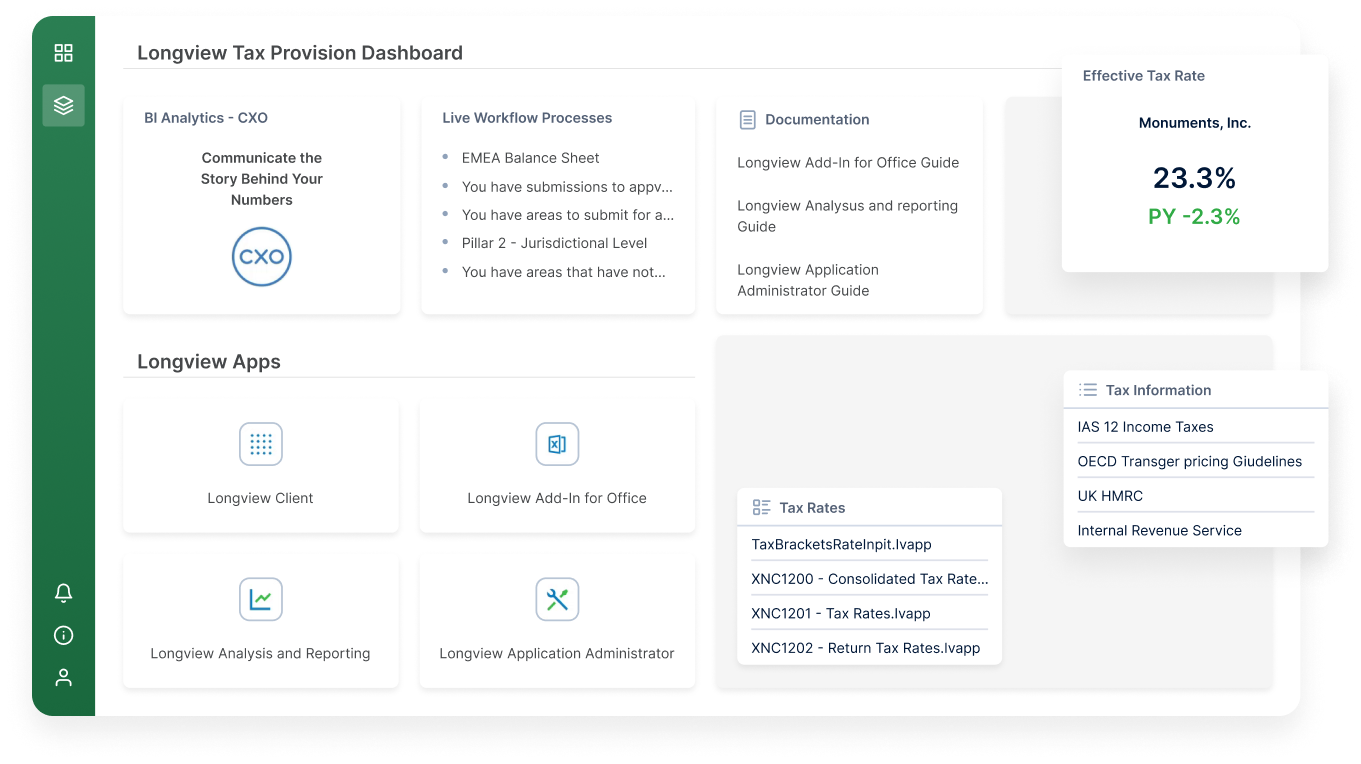

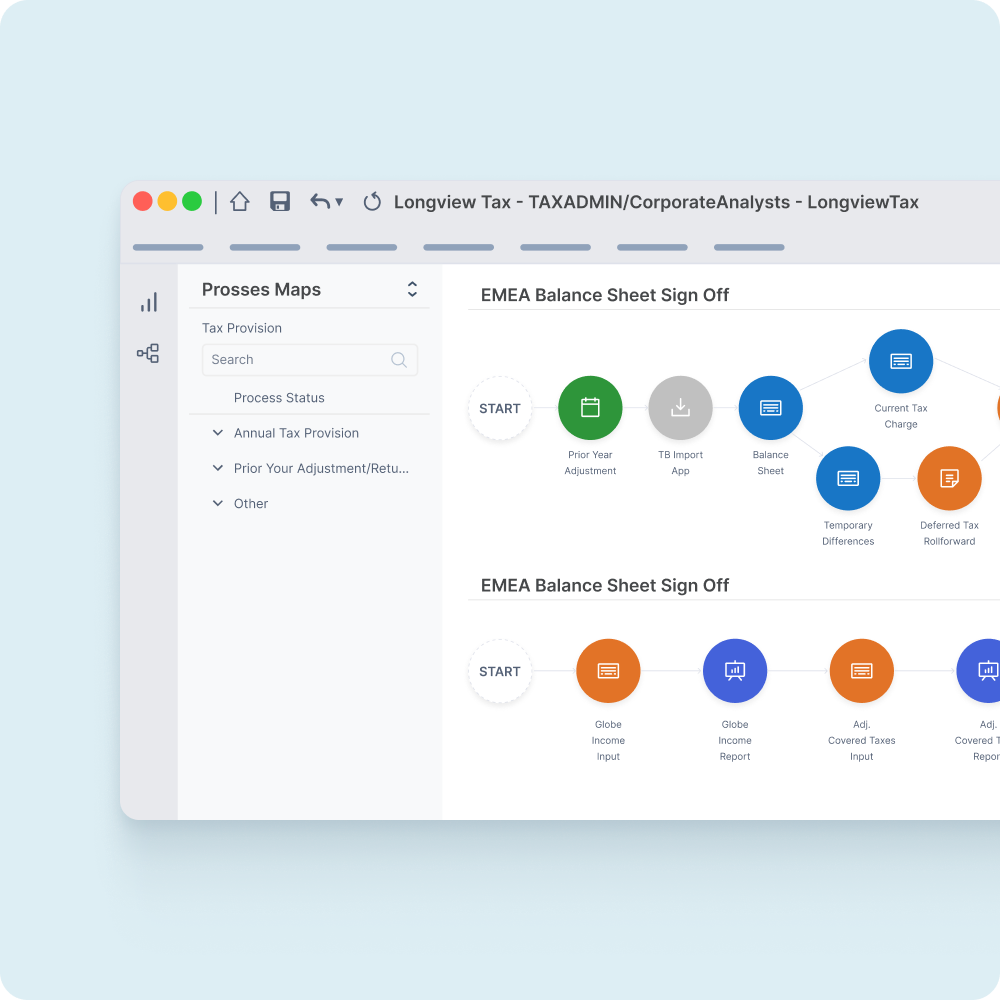

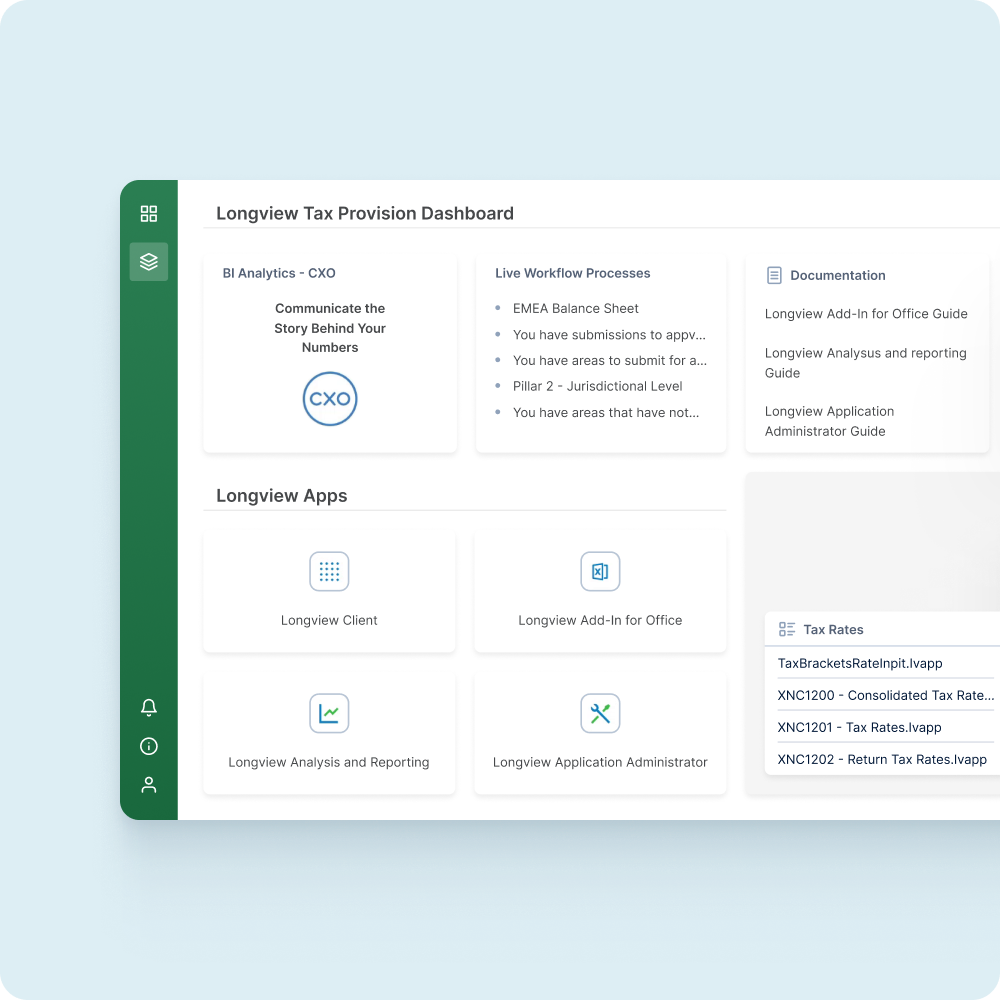

Elevate your tax workflows and processes with Longview Tax, a comprehensive solution designed to streamline your processes. Benefit from expedited provisioning as data is available in real-time, eliminating the delays associated with manual data consolidation or processing. Bid farewell to data and reporting discrepancies with Longview Tax’s unified source of truth and dashboards, ensuring accuracy and consistency across all your tax-related activities.

Get Instant Demo

Stay Ahead of the Curve

Take your tax management to the next level with Longview Tax’s cutting-edge features. Experience the time-savings of dynamic, intelligent, and real-time consolidation, which allows you to stay ahead of the game and make informed decisions more quickly. With Longview Tax, your team can further take back control of your time by harnessing its rapid-reporting capabilities, allowing for more focus on strategic, value-added activities rather than getting bogged down in manual processes. Embrace efficiency and productivity, empowering your team to achieve more and drive success across your tax operations.

Get Instant Demo

Built for Tax Teams

By empowering your internal teams, Longview Tax ensures that tax provisioning and reporting are expertly modeled and managed by those who understand your business best. With Longview Tax, you can efficiently set up and manage the system with minimal IT involvement and without the need for additional outside consultants. This streamlined approach not only saves time and resources, but also allows for greater control and customization tailored to your specific business structure and needs.

Get Instant Demo

Real-Time Tax Data for Corporations

Longview Tax acts as the centralized hub for your enterprise’s tax management and operations. By automating tax data consolidation, improving scalability, and providing deep analytical insights, it empowers tax teams to reduce risk, increase accuracy, and respond to strategic challenges with confidence.

Intelligent, Real-Time Tax Consolidation

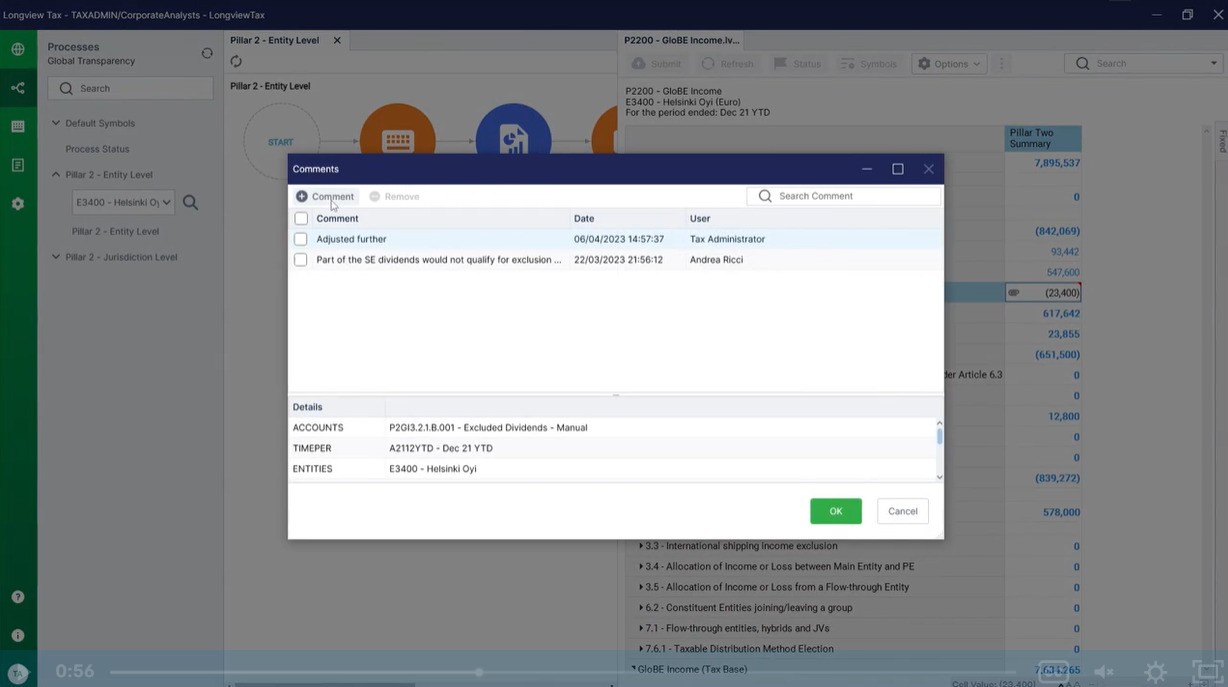

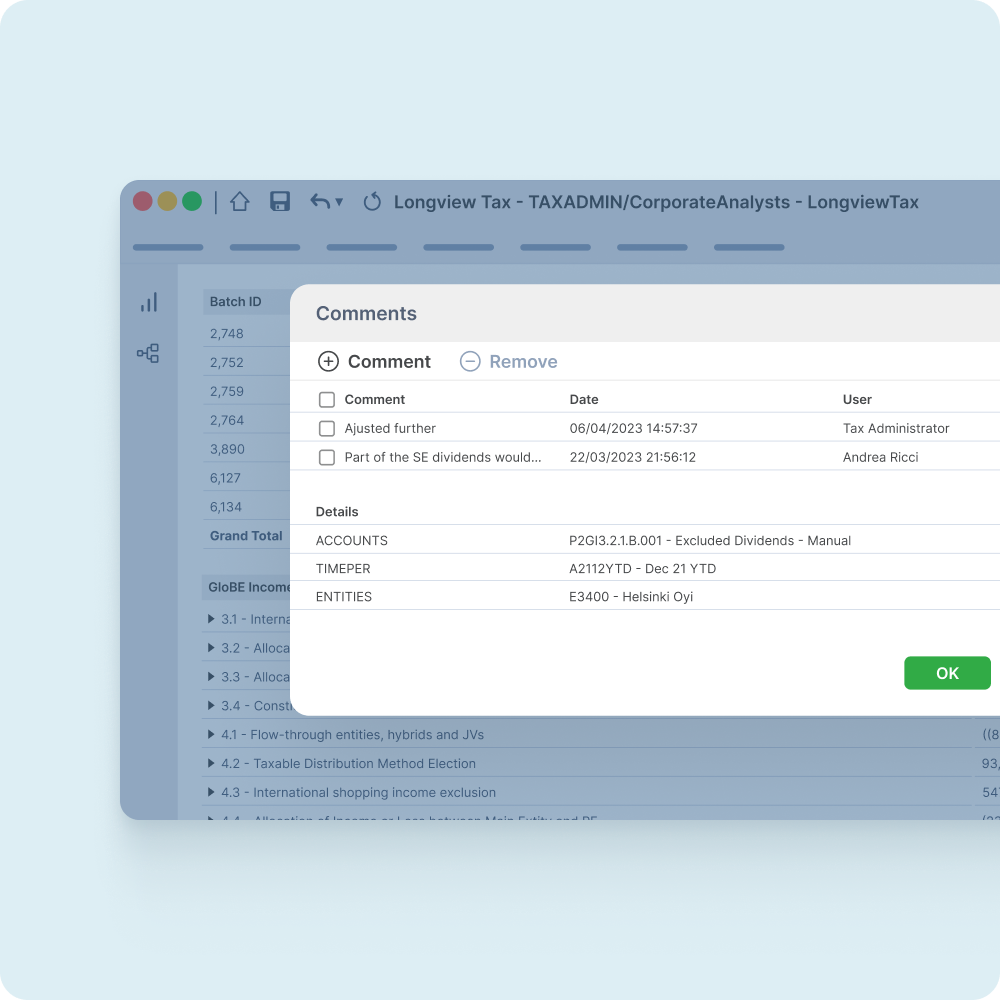

Longview Tax provides dynamic, real-time data consolidation to eliminate delays and inconsistencies in tax reporting. Unlike traditional systems that rely on batch processing, Longview Tax continuously updates and recalculates data as new information becomes available. It automatically combines figures from multiple financial systems and entities, verifying accuracy and consistency across all of your tax reports. This results in faster provisioning, more accurate forecasts, improved decision-making, and reduced risk of misstatements.

Scalable Tax Management for Global Enterprises

Built to support the complexities of multinational operations and high-volume tax environments, Longview Tax scales to accommodate growing data sets, changing regulations, and your individual organizational intricacies. Its flexible architecture allows for quick adaptation and easy configuration for new tax jurisdictions, foreign exchange requirements, and entity structures without the need for heavy IT involvement. The platform’s centralized framework also enables consistent reporting across multiple regions and business units while maintaining compliance with local and international tax laws.

Advanced Reporting & Actionable Tax Insights

Longview Tax’s built-in reporting and analytics capabilities give tax teams clear visibility into their data and performance. The platform includes a powerful, industry-leading Excel Add-in with write-back functionality. This allows tax professionals to work from within a familiar interface while accessing real-time data and analysis. Customizable dashboards and automated variance analysis help flag trends, forecast liabilities, and identify anomalies. Longview Tax also supports complex multi-layer reporting, providing detailed insights into regional and global tax positions.

The insightsoftware Platform

Your data, connected. When and where you need it. From every major ERP, data warehouse, modern data stack, and cloud vendor, we connect to 200+ environments with pre-built content and logic for your business. Our platform is an Al-enabled integrated solution for the Office of the CFO built on an advanced data virtualization layer.

Longview Tax & Tax Management FAQs

Tax management is the process of overseeing a company’s tax-related activities, including compliance, reporting, and provisioning, to ensure accuracy and minimize risk. Effective modern tax management relies on real-time data for accuracy, automated processes for efficiency, and centralized reporting for strategic decision-making.

Tax optimization involves strategically reducing an organization’s tax liability while remaining compliant with regulations. This too requires accurate, real-time insights and the ability to model different scenarios quickly to identify opportunities for reducing tax exposure and proactively adjusting strategies.

Tax planning involves forecasting future tax liabilities and obligations, then developing strategies to effectively manage these. The process heavily relies on dynamic and reliable data and analysis, so tax teams can anticipate outcomes, make decisions, and adapt tax strategies as needed.

Corporate tax planning optimizes a company’s tax strategy at an enterprise level, often across multiple jurisdictions and business units. A centralized approach with consistent, up-to-date reporting keeps corporations compliant and strategically aligned while simplifying complex cross-border tax positions.

Unlike some tools, Longview Tax allows tax teams to manage and customize the system without relying on IT, offers an adaptable Excel integration with write-back capabilities, and provides deep visibility into complex global tax structures. It combines dynamic real-time consolidation, powerful analytics, and flexible scalability in a single, user-friendly interface, ideal for enterprise use.

Longview Tax integrates with a variety of ERP systems, financial platforms, and other data sources you’re probably already using to enable real-time data consolidation and reporting. This means that tax teams can work with current financial data, reducing manual data entry and improving overall accuracy and efficiency. Some examples of Longview Tax integrations are Oracle E-Business Suite, Microsoft Dynamics, NetSuite, SAP, Infor, Workday, Peoplesoft, and more.