EPM Best Practices: One System To Manage Your Strategy

One of the ongoing challenges for large enterprises face is ensuring that top-level business strategies align with the everyday operations that actually drive their business forward. For example, businesses often struggle with evaluating how financial resources are allocated and whether or not those resources are helping the company achieve its financial goals. However, with the planning and monitoring that Enterprise Performance Management (EPM) offers, these issues can be effectively mitigated.

What Is EPM?

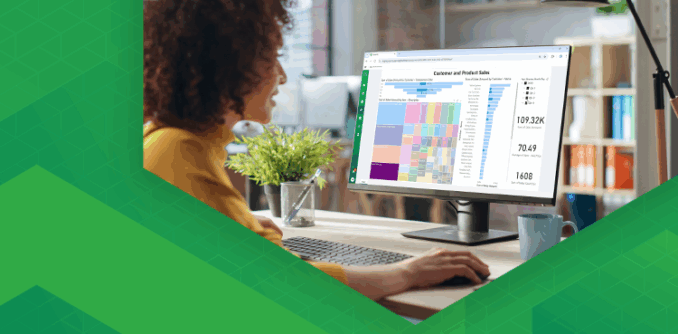

While EPM is a general business process that can guide decision makers, it is usually executed through a combination of tools and systems that aid organizations in their efforts to align on strategic goals and manage performance across departments. Practically speaking, this looks like defining quantifiable metrics and key performance indicators (KPIs), and monitoring, measuring, and analyzing their subsequent performance. With the real-time insights that an effective EPM system can provide, financial executives can continue driving growth for their businesses.

How an EPM System Can Help Your Business

You may be questioning whether or not an EPM system is the right fit for your business needs. The truth is, if you have ever needed to plan, monitor, or analyze your company’s financial performance at scale, your enterprise can benefit from an EPM solution. Still unconvinced? Here are a few more ways EPMs help businesses function:

- Consolidates all of your organization’s data, which in turn eliminates the need for your finance team to pull data or create sheets for each of your organization’s departments.

- Establish data trends and isolate them for future forecasts, allowing your team to accurately measure performance.

- Address government compliance concerns before they become larger issues.

- Create models to prepare for potential changes in the economy, making certain your enterprise is planning for each outcome.

With an effective EPM system, finance business leaders can reduce their internal processes, improve their decision-making, and secure even better results. In such a competitive landscape, EPM software is not just beneficial but critical for success.

Maximizing Financial Efficiency: Unveiling the Power of insightsoftware EPM

Download NowEPM Best Practices and Process Steps

When considering how to maximize the benefits of an EPM, it is valuable to keep the following best practices in mind. Additionally, if you’re contemplating whether or not your team can implement these processes independently, it may be worth your time to pursue an automated EPM software.

1. Strategic Goal Setting and Forecasting

The most effective EPM plans begin with setting clear and measurable strategic goals. Ideally, they will align with your organization’s overarching vision and long-term plans. Typically, these goals are set by comparing the possible financial outcomes of various goals against one another to see what would be most valuable to the organization’s operations and profitability. Common considerations include revenue, sales, or gross profit margins.

2. Planning and Budgeting

Once strategic goals are set, financial plans can be established. Practically speaking, this involves setting financial targets, projecting revenue and expenses, and finally, allocating funding to prioritized initiatives. If this process is done correctly, your team will be able to monitor costs, ensuring that your organization remains profitable.

3. Consolidation

Planning and budgeting are only valuable if you can follow what has been laid out. This is where consolidation comes into play. At the end of each accounting period, whether that be monthly or quarterly, financial data from each department is aggregated into financial statements. From there, income statements, balance sheets, and cash flow statements are generated, and statements are finalized for that accounting period.

4. Reporting

After the financial statements are consolidated, an organization’s financial team can then go in and create reports that key stakeholders will use to guide their future business decisions.

5. Analyze Performance

With financial reports in hand, an organization’s leaders will compare their company’s actual performance to the strategic goals and projections they had originally planned for. They will attempt to reconcile those goals and subsequent performance, as well as craft better forecasts for the future.

6. Evaluate Resource Allocation

Once the company’s performance is analyzed, the process begins to repeat itself, starting first with resource allocation. With the most accurate reporting on hand, an organization’s leadership will decide where funding and effort should be directed for the upcoming periods.

Benefits of an Effective EPM System

With an effective EPM, your team will reap countless benefits that will help your organization perform better and adapt to changes in the marketplace even faster. The following is a list of a few key benefits your organization could reap from a well-functioning EPM:

- Improved decision-making: An EPM system can automate the lengthy process of gathering and analyzing data, resulting in time saved, as well as more accurate and informed decision-making.

- Automated financial accounting: Reconciling financial data at the end of a period can be tedious and time-consuming. However, with the right EPM system, that process can be streamlined without sacrificing the accuracy your organization needs to form its analyses or plan for the future.

- Increased visibility across departments: With a singular, accessible EPM system, leaders across an organization can collaborate to measure performance. In turn, this ensures that your organization’s goals are comprehensive and shared.

- Improved risk management: A centralized EPM system will help your organization identify any issues, as well as mitigate them before they affect your bottom line.

What to Look for in Your EPM Solution

If your team has decided to incorporate an EPM system into your organizational processes, you’re likely trying to determine what you should prioritize when choosing your solution. At the very least, your EPM solution should help you forecast, budget, plan, report, and analyze performance. Ideally, it should also be able to integrate with your existing financial systems so you can benefit from all of its features.

JustPerform can meet all your EPM needs in one tool. With an intuitive interface and no-code capabilities, JustPerform enables business leaders to collect, organize, and analyze financial data seamlessly. For an even better reporting experience, JustPerform integrates with more than 80 existing systems, including SAP, Oracle, and Microsoft Dynamics. Whether it be planning, budgeting, or reporting, JustPerform meets all your business needs to keep you focused on achieving your performance goals rather than on data management.

Choose JustPerform today to streamline your financial processes and equip your organization to confidently plan for the challenges of tomorrow’s business landscape.