Financial Planning & Analysis Software

Automate FP&A to Shorten Planning Cycles by 50%

- Live Data – Instant ERP data in Excel and your dashboards. Ditch manual updates and plug into real-time planning.

- Instant Analyses – Analyze your data quickly. Get immediate insights from live data and save time with faster budgeting and forecasting.

- Data Accuracy – Access clean and exact data that enables confident business plans. Eliminate errors and ensure accuracy.

See What FP&A Solutions Work for Your ERP

Operational Reporting for Oracle EBS and OCA

Angles Enterprise for Oracle unlocks powerful insights in your chosen BI tool. 1,800 pre-built, no-code business reports deliver actionable insights.

Operational Reporting for SAP ECC and S/4HANA

Angles Enterprise for SAP transforms critical operational data into actionable insights, with 600+ calculated fields enriching your supply chain data.

Operational Reporting and Distribution

Angles Professional streamlines the creation and distribution of operational insights with pre-built content for Deltek, NetSuite, Oracle EBS/Fusion Cloud ERP.

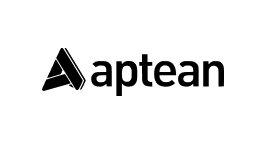

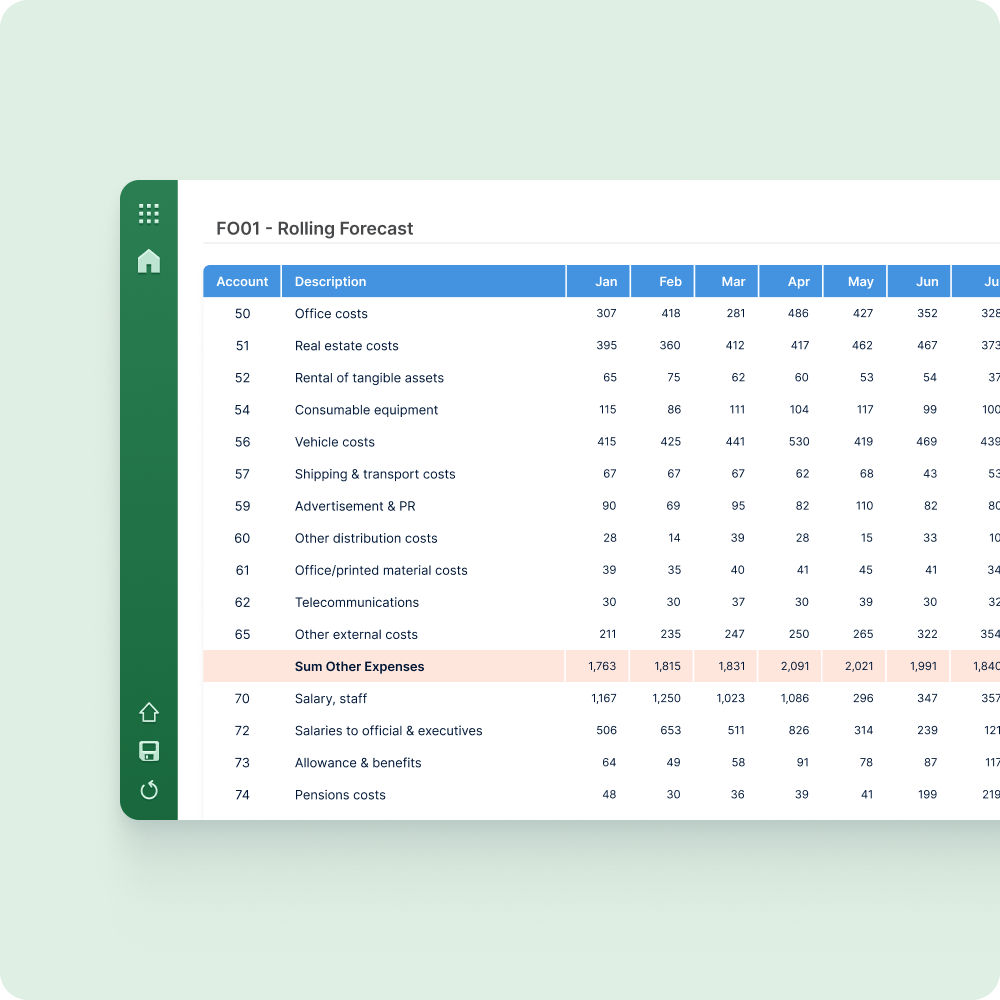

Budgeting & Planning

Budgeting & Planning: Bizview is an integrated and scalable web-based budgeting, planning, and forecasting solution.

Data Warehouse Automation for Microsoft Dynamics

Jet Analytics is a complete data preparation, automation, and modeling solution. It’s five times faster than hand coded solutions.

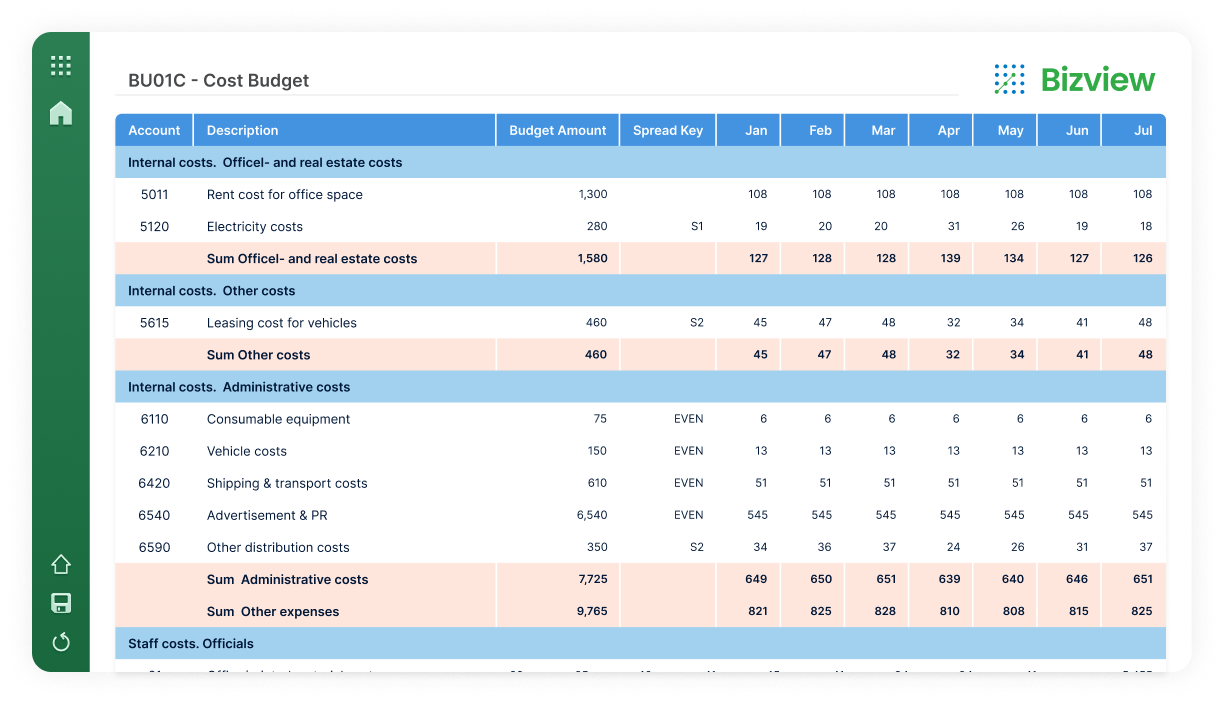

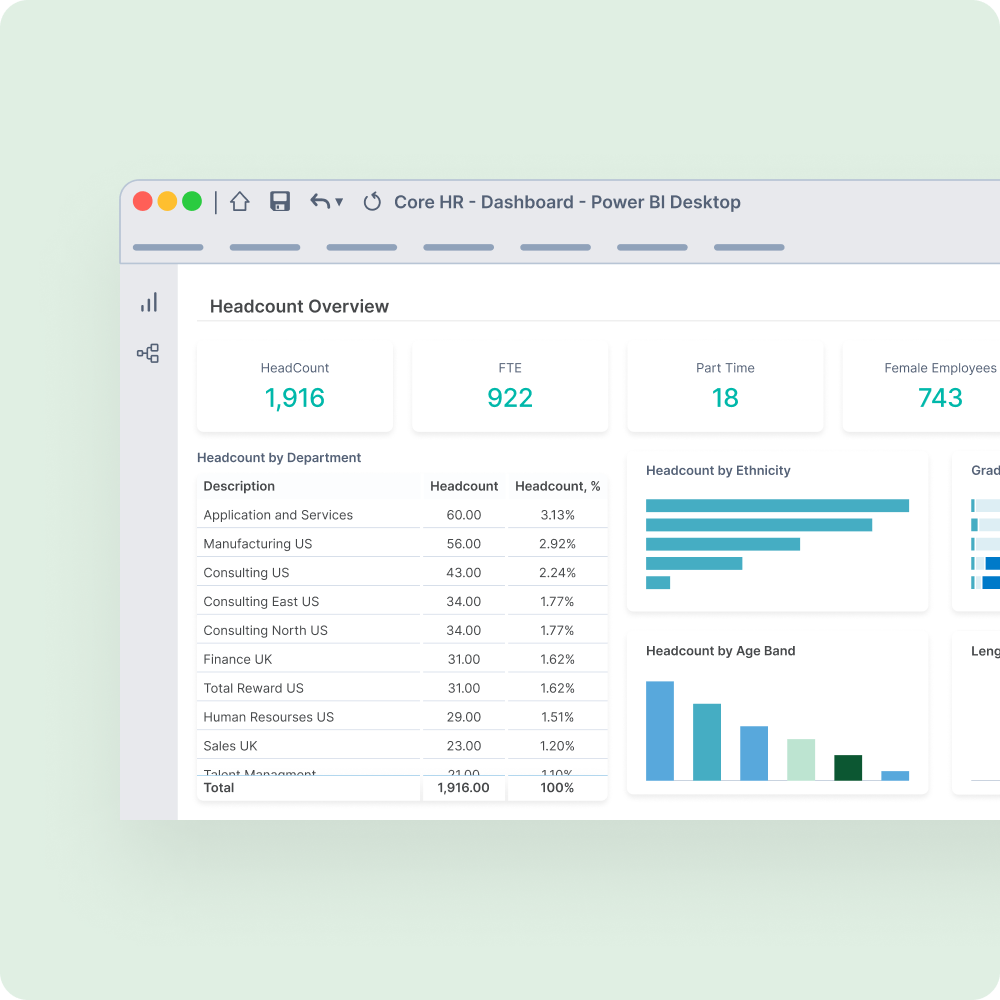

Advanced Analytics and Write-Back for Power BI

Power ON supercharges Power BI with Excel-like functionality, write-back, and a complete budgeting and planning solution that breaks down silos.

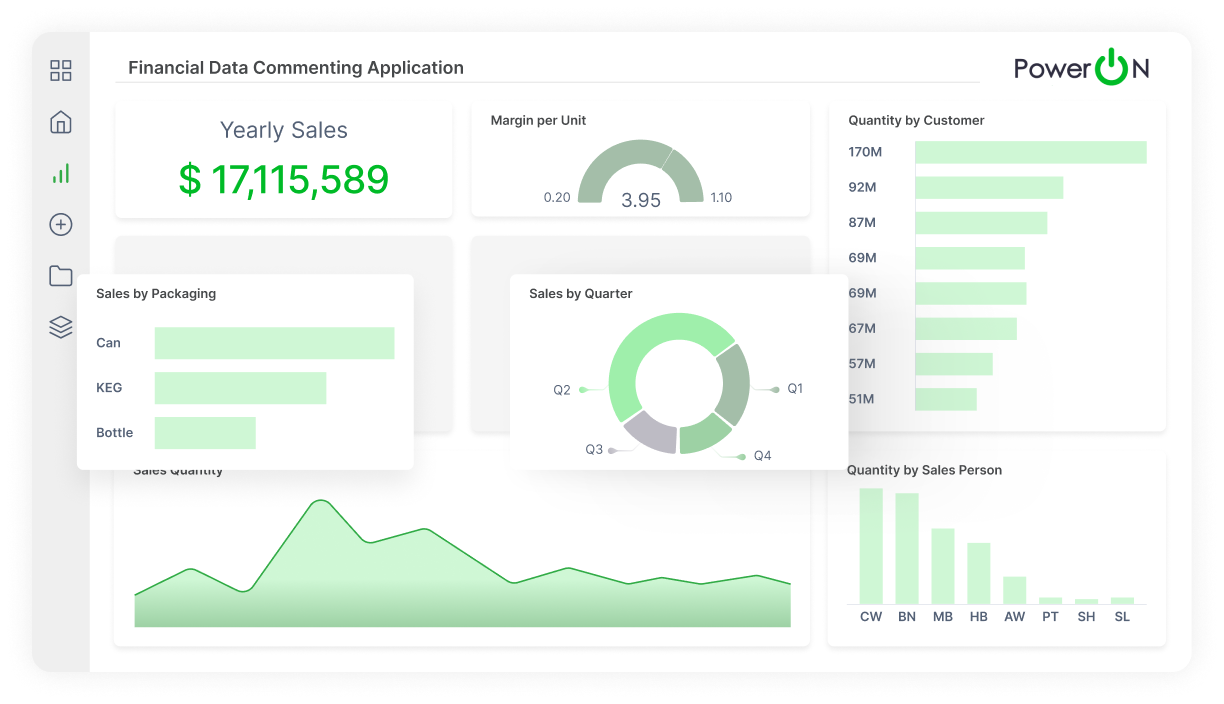

Data Automation for All SAP Modules

Process Runner provides powerful SAP data automation. It automates the movement of SAP data and bypasses error-prone, manual operations.

SAP Financial Data Entry Automation

Process Runner GLSU automates more than 40 SAP transactions with support for large journal entries, payroll, purchase orders, etc. – without a single call to IT.

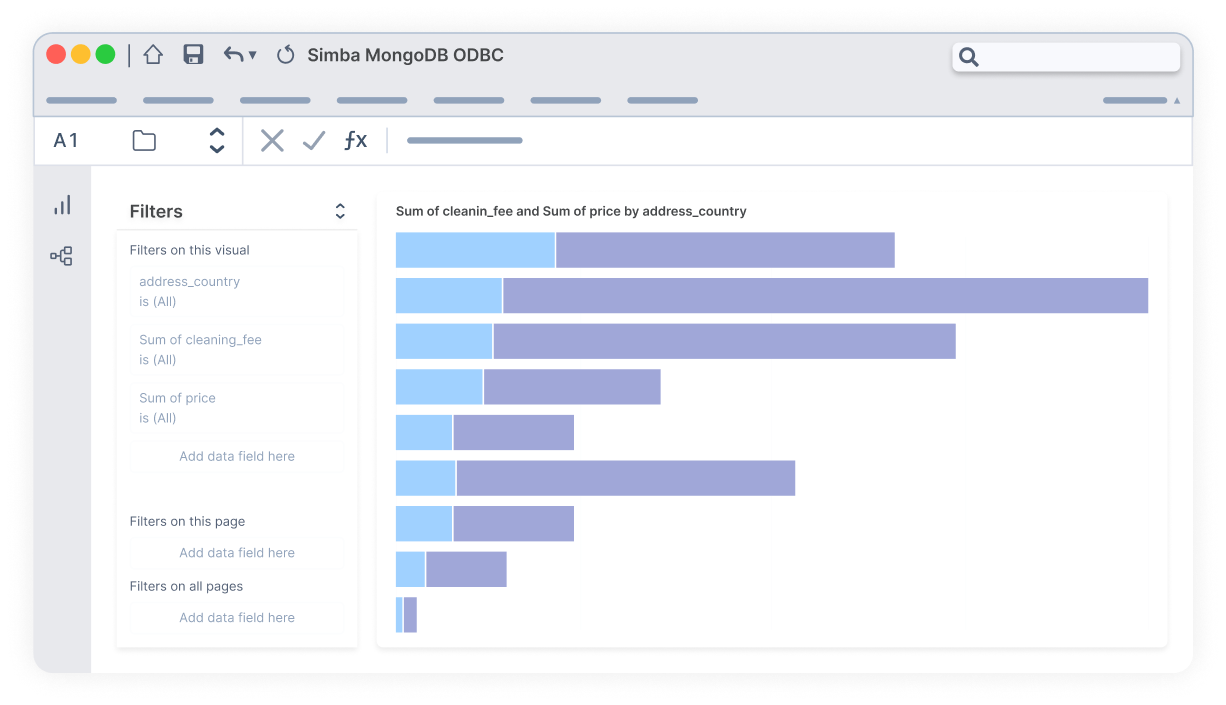

Data Connectivity

Simba boosts BI and ETL with advanced drivers and an SDK offering seamless data integration, deeper real-time insights, and efficient cloud migration.

Advanced Analytics and Write-Back for Qlik

Vizlib unleashes the full power of Qlik Sense and Qlik Cloud with advanced visualization functionality and write-back for effective data-driven decisions.

Overcome Financial Data Headaches

Inability to Respond to Change

Your ability to predict and actively plan for change impacts your business success more than ever. To stay competitive, you need to move beyond rigid, annual planning cycles. This requires agile processes so you can quickly update forecasts and make informed, sound business decisions. With intuitive workflows and automated data updates, you can anticipate disruption, model potential outcomes, and guide your organization through change and uncertainty with confidence.

Chasing After Operations Data

Valuable planning time is often wasted chasing down data, emails, and other information instead of building and analyzing forecasts. Centralize your operational and financial data collection in a unified view that enables frontline workers to become key contributors for inputting and updating metrics. Stronger collaboration while maintaining financial control of planning results in faster cycles, better forecasts, and more time dedicated to strategic analysis instead of manual consolidation.

Keep Plan B in Your Back Pocket

Scenario planning is often neglected because of its complexity and time-consuming nature, but this can leave organizations vulnerable when the unexpected occurs. It’s important to build out best-case, worst-case, and everything-in-between plans, but this can be daunting when tackled manually. Instead, make these processes less cumbersome with a robust, flexible system for data centralization that streamlines financial planning for faster, more accurate forecasting and analysis.

Access Business-Critical Financial Data in Real Time

Automate FP&A to Streamline Planning Cycles

- Single source of truth that updates on demand on any device

- Intuitive and easy-to-use web-based interface

- Automation of tasks, requests, and workflows to reduce cycle times

- Continuous monitoring and reforecasting throughout the year for faster insights and greater agility

- Standard and repeatable process that easily updates to reflect ERP system changes (with audit trails)

Taconic Shortens Reporting Process

to 2 Days

Month-End Reporting Shortened

AVR Realty’s Backup Reports Reduced

Cross-Functional Collaboration and Planning

- Extend planning beyond the finance team

- Integrate planning across departments for greater accuracy and strategic impact

- Increase forecasting accuracy by applying planning to other business areas using driver-based modeling and advanced forecasting techniques

- Enable those who understand your core business to participate in the planning process

- Effectively manage workflows across teams with audit trails

Taconic Shortens Reporting Process

to 2 Days

Month-End Reporting Shortened

AVR Realty’s Backup Reports Reduced

Scale and Adapt with Simple, Flexible FP&A

- Easily add new planning forms, reports, and users to adjust to business use cases and changing scenarios

- Improve workflows, analytics, and dashboarding to integrate across departments for more effective reporting

- Multilevel approvals provide more control

- Boost productivity with powerful spread rules, system-proposed forecasting based on actuals and other variables, and automatic consolidation of data

Taconic Shortens Reporting Process

to 2 Days

Month-End Reporting Shortened

AVR Realty’s Backup Reports Reduced

Get the Details on FP&A

It is often difficult to select the ideal financial reporting tools for your organization. To learn the most effective questions used to evaluate FP&A vendors, download our Financial Reporting Buyer’s Guide below:

Additional FP&A Resources

Guide to Financial Planning in 2025

How to Modernize Your Financial Planning & Analysis

xP&A: The Evolution of Financial Planning?

Financial Planning & Analysis FAQs

FP&A (or Financial Planning and Analysis) is the umbrella term for activities that support an organization’s business decisions and financial health. This includes forecasting, budgeting, reporting, scenario modeling, and other processes that inform financial decisions and help plan for the future.

Interested in learning more about this topic? Read our guide to FP&A here.

Software built to streamline FP&A processes enables financial teams to create more accurate forecasts, easily consolidate data from across departments, and model different scenarios to prepare for uncertainty. These tools also facilitate cross-department collaboration, automate manual tasks (e.g. data entry and report building), and bolster performance analysis for more informed decision-making.

Effective FP&A tools should be able to seamlessly integrate with ERPs, CRMs, HRIS, and other systems to automatically connect and centralize data from across the business. Other important features for financial planning solutions include driver-based forecasting, scenario planning, collaborative workflows, customizable reports, and audit trails. When comparing these tools, you should also consider characteristics like how scalable and user-friendly they are, because these will impact how successful a new tool’s adoption is.

Want to dig deeper into comparing financial planning tools? Read our article on how to evaluate FP&A software here.

With insightsoftware, you can boost efficiency and accuracy in your financial reporting. Our tools allow you to effortlessly generate financial statements while minimizing human error, and build trust across your organization with comprehensive, data-driven reports automatically compiled from diverse sources.

Harness the power of real-time data with automated reporting software. Our tools seamlessly integrate with your data sources for up-to-date financial analysis, dynamic visualizations, and readily shareable reports and dashboards. Drive data-driven decision-making and promote financial transparency across your organization with insightsoftware’s cutting-edge platforms.

Navigate regulatory complexities with confidence using automated financial reporting software. Built-in templates, predefined formats, and automatic calculations ensure your reports adhere to the latest GAAP, IFRS, and regional standards, minimizing errors and reducing business risk.

Streamline financial reporting and foster seamless collaboration with our automated software. These tools centralize your reporting process, manage user permissions, track changes with version control, and automate workflows – empowering your teams across the organization with the right information at the right time.