Plan, Close, Disclose

Your Finance Workflows, Powered by AI Teammates

From planning to close and disclosure, work smarter with AI teammates that handle the heavy lifting. Spend less time on manual tasks and more on insights that drive decisions.

"*" indicates required fields

Integrate Planning, Close, & Disclosure

Connect planning, closing, disclosure, and reporting in one system. Automate routine tasks, reduce manual errors, and get real-time visibility across your financial processes. Finance teams spend less time on data reconciliation and more time on strategic analysis that drives business decisions.

Applications that Simplify and Strengthen Your Financial Processes

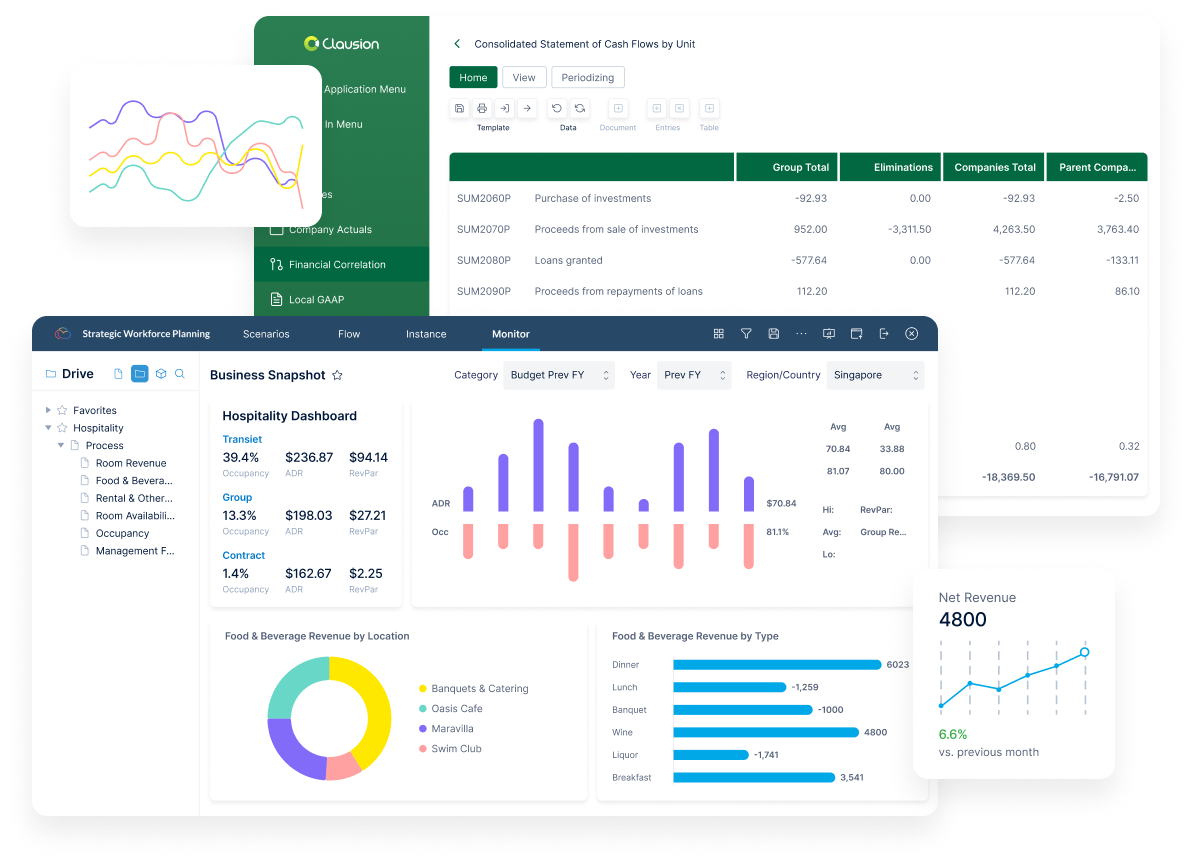

Planning, Forecasting, and Financial Close

JustPerform puts business users in control of planning, closing, and reporting. Pick up any process in under 5 minutes. Roll out confidently, knowing everyone sees only what they need.

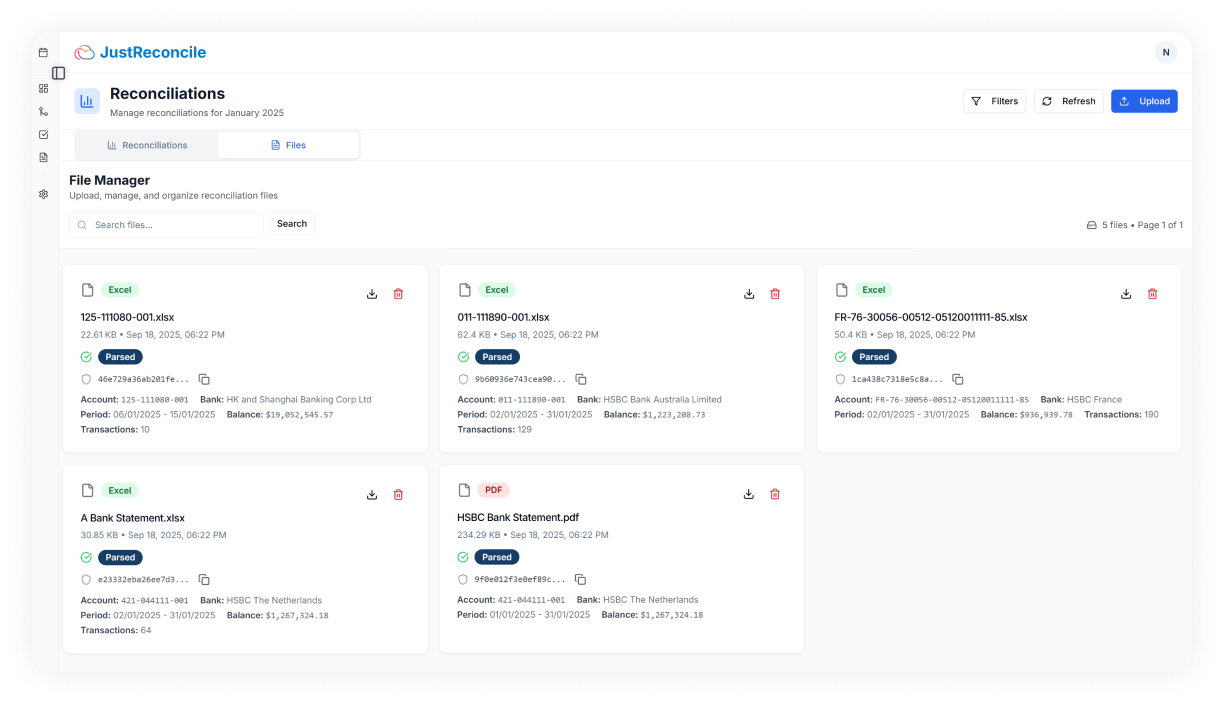

Reconciliation Automation

A virtual teammate that completes reconciliations autonomously while you maintain approval authority – no suggestions, no manual matching, just job done.

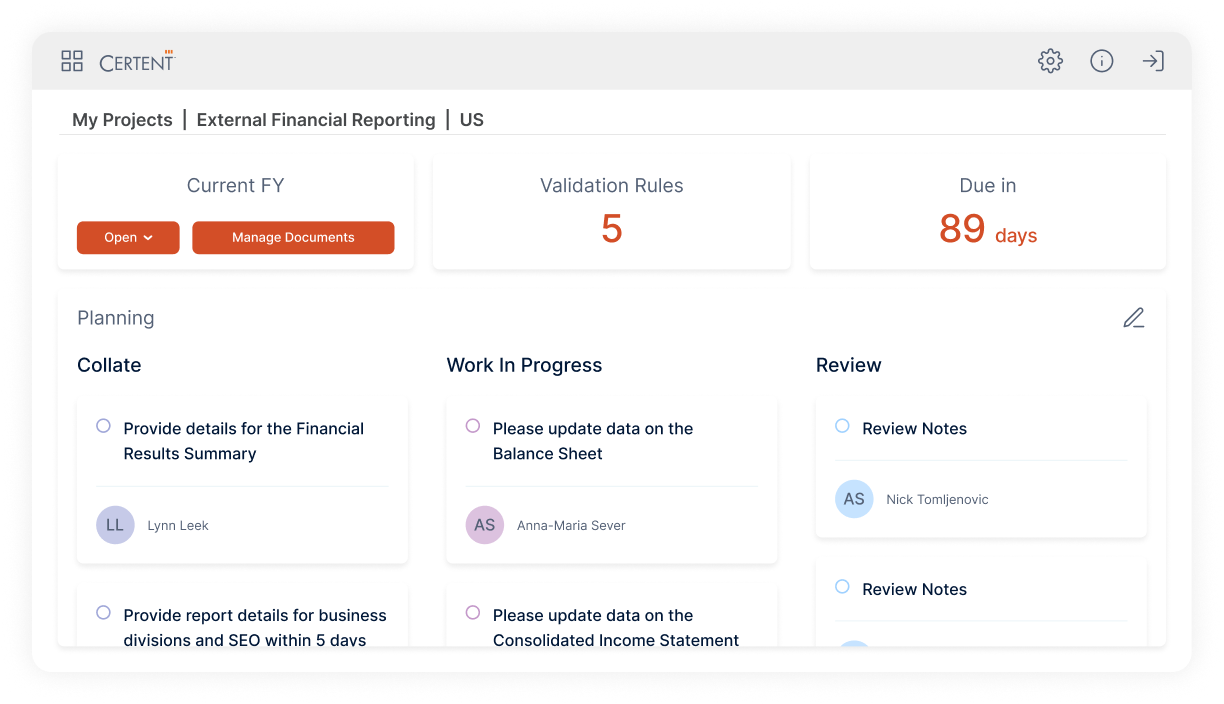

Disclosure Management and Regulatory Reporting

Certent Disclosure Management is an all-in-one system built on Microsoft Office for external regulatory reporting and internal narrative report creation.

Transform Finance Operations for Better Decisions and Results

Our solutions reduce manual work, improve accuracy, and accelerate financial close cycles. Finance teams gain the time and insights needed to drive strategic business decisions.

Account reconciliation shouldn’t eat up days every month. A virtual teammate completes your reconciliations autonomously—matching transactions, processing data, and delivering finished work ready for your approval. Reduce reconciliation time by 80-90% while maintaining full control and transparency.

Closing the books doesn’t have to take weeks. Automations handle consolidations and financial close tasks, so you get accurate results faster and can dig into what those numbers really mean for your business. Focus on analysis, not administrative work

Budgeting and forecasting just got smarter. With tools that do the heavy lifting, like updating numbers and running “what if” scenarios in real time, you’ll always be ready to adapt and make solid decisions without second-guessing.

Need to file a report? Whether it’s for regulators or your internal team, you can count on automated workflows to keep it all secure, polished, and error-free. No last-minute scrambles, just smooth collaboration and clear results.

Use Cases for Financial Planning, Close & Disclosure Management Software

Frequently Asked Questions

Combining planning, close, and disclosure functions into one streamlined process reduces manual errors, boosts efficiency, supports compliance, and enables real-time decision-making. This holistic approach builds confidence in your financial outcomes.

insightsoftware prioritizes data security and compliance, offering encryption, access controls, audit trails, and regular updates to ensure data integrity at all times.

Yes, insightsoftware’s scalable solutions fit the needs of companies of all sizes and industries, offering flexibility to meet your unique financial and regulatory demands.

Budgeting and planning software is a technology solution that helps organizations create, manage, and analyze budgets and financial plans. It automates manual processes, provides advanced modeling capabilities, and enables collaboration and data-driven decision-making.

Budgeting and planning software streamlines processes, boosts accuracy, and offers real-time insights. Align budgets with strategy, foster collaboration, and gain a clear view of potential outcomes with robust scenario analysis.

Budgeting and planning software can integrate with various systems, such as ERP systems, data warehouses, and financial reporting tools. This integration allows for seamless data transfer, real-time updates, and leveraging existing data sources for budgeting and planning.

Yes, budgeting and planning software can accommodate different budgeting methodologies, such as top-down, bottom-up, zero-based budgeting, or driver-based budgeting. The software provides flexibility in defining budgeting structures, allocating resources, and incorporating different forecasting techniques to suit an organization’s specific budgeting approach.

Yes, budgeting and planning software is designed to be scalable and can be used by organizations of various sizes and industries. It can cater to different sectors’ specific needs and complexities, whether manufacturing, healthcare, retail, or nonprofit. It can handle the budgeting and planning requirements of small and large enterprises.

A cloud-based solution can offer several benefits, such as lower upfront costs, faster implementation, scalability, security, accessibility, and automatic updates.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers seamless integration that can easily connect to your primary data sources, such as ERP systems, spreadsheets, databases, or cloud applications, and that they are able to extract, transform, and load this data into their software platform.

Choose close and consolidation software that is designed to be owned and managed by the finance team. Look for software that enables you to easily adapt workflows and templates to support data collection, validation, consolidation, and reporting, without needing IT or specialist help. Check that you can easily modify rules and validations to ensure the consistency and quality of your data.

Disclosure Management Software is a tool that helps organizations automate, manage, and streamline their report production and filing processes. It aids in the creation of public financial documents and ensures compliance with regulatory standards.

Finance and accounting teams within organizations, particularly those that are publicly traded and have complex reporting requirements.

Yes, security is a top priority for us. We include features like access controls, encryption, and audit trails to ensure data integrity and security.

The software is regularly updated to reflect changes in regulatory standards. This ensures that your organization remains compliant with the latest regulations.

Yes, we handle a variety of regulatory standards, including GAAP, IFRS, and SEC regulations.