Reconciliation Software

Stop Wrestling With Reconciliation and Start Leading Strategy

- Stress-Free, Error-Free: Make reconciliation headaches a thing of the past with AI that completes the job while you stay in control.

- Excel Made Effortless: End manual matching confusion. Your virtual teammate handles it all, right where you work.

- Smarter Automation: Automate your reconciliation processing without complex rules or IT rescue missions.

Give Your Reconciliation Process a Boost!

Reconciliation Automation

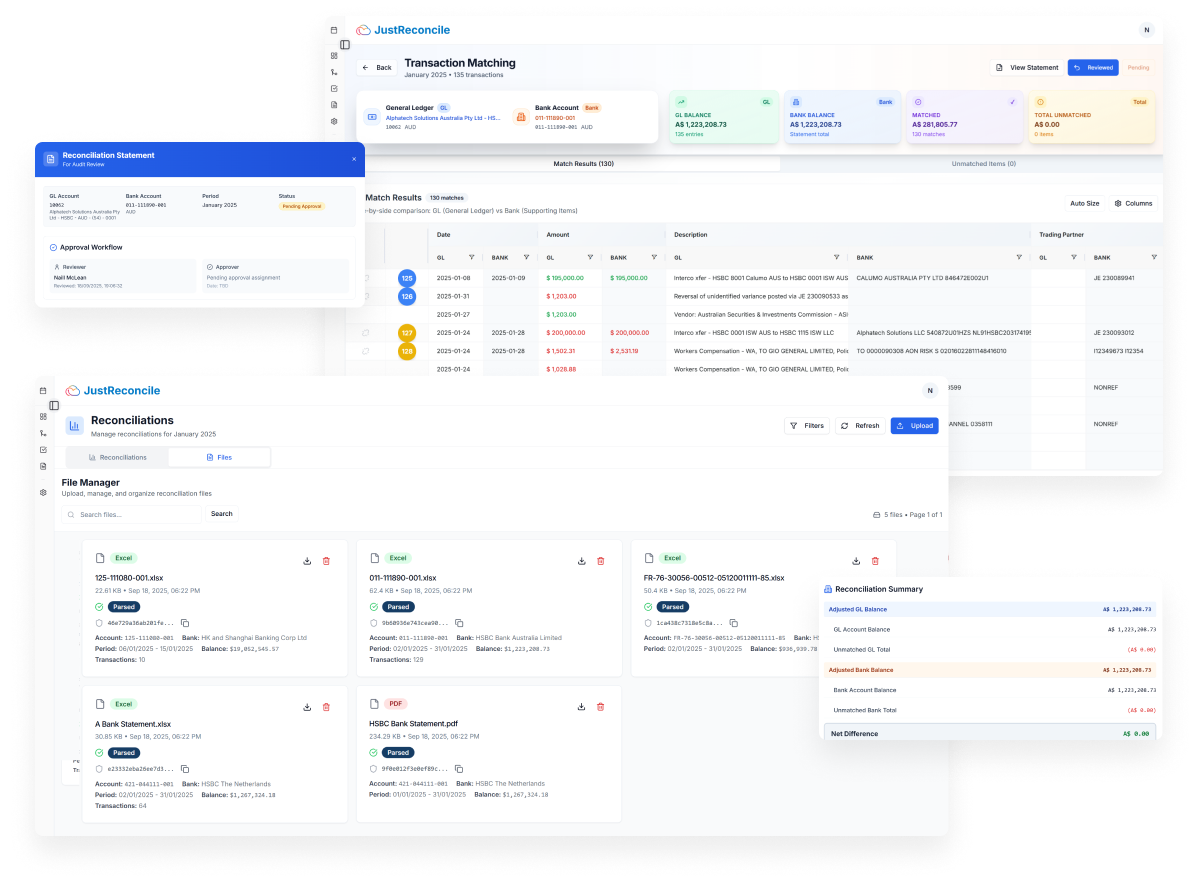

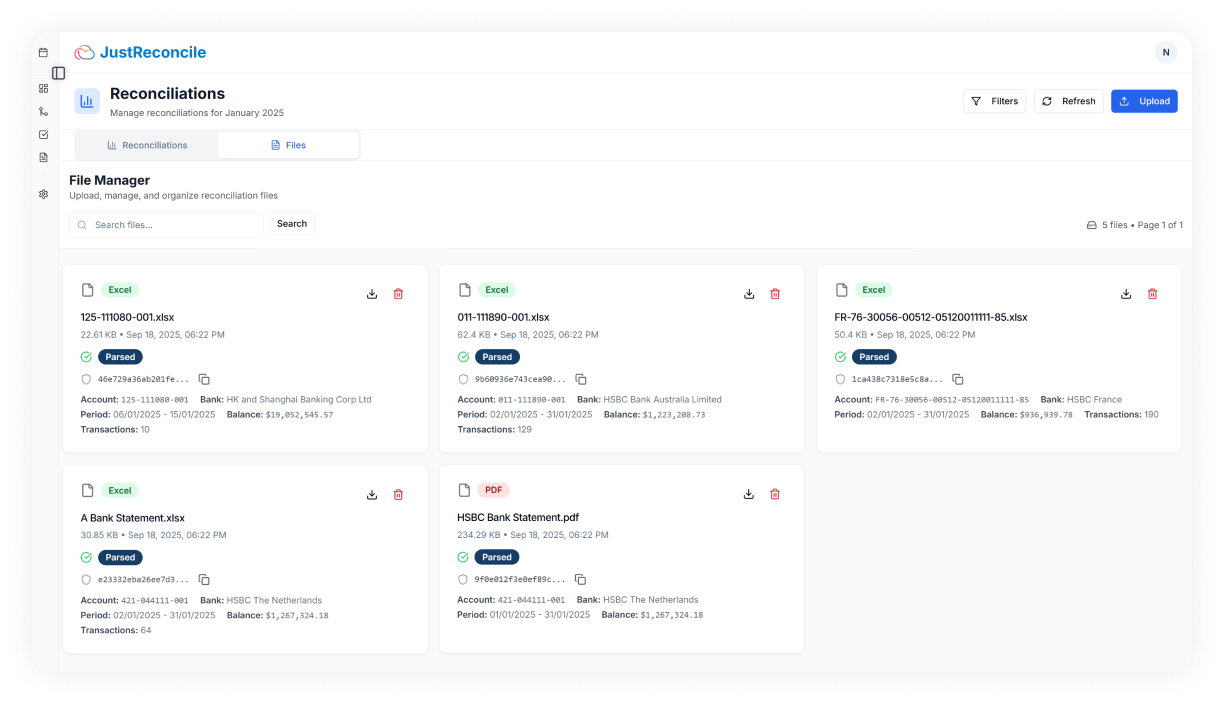

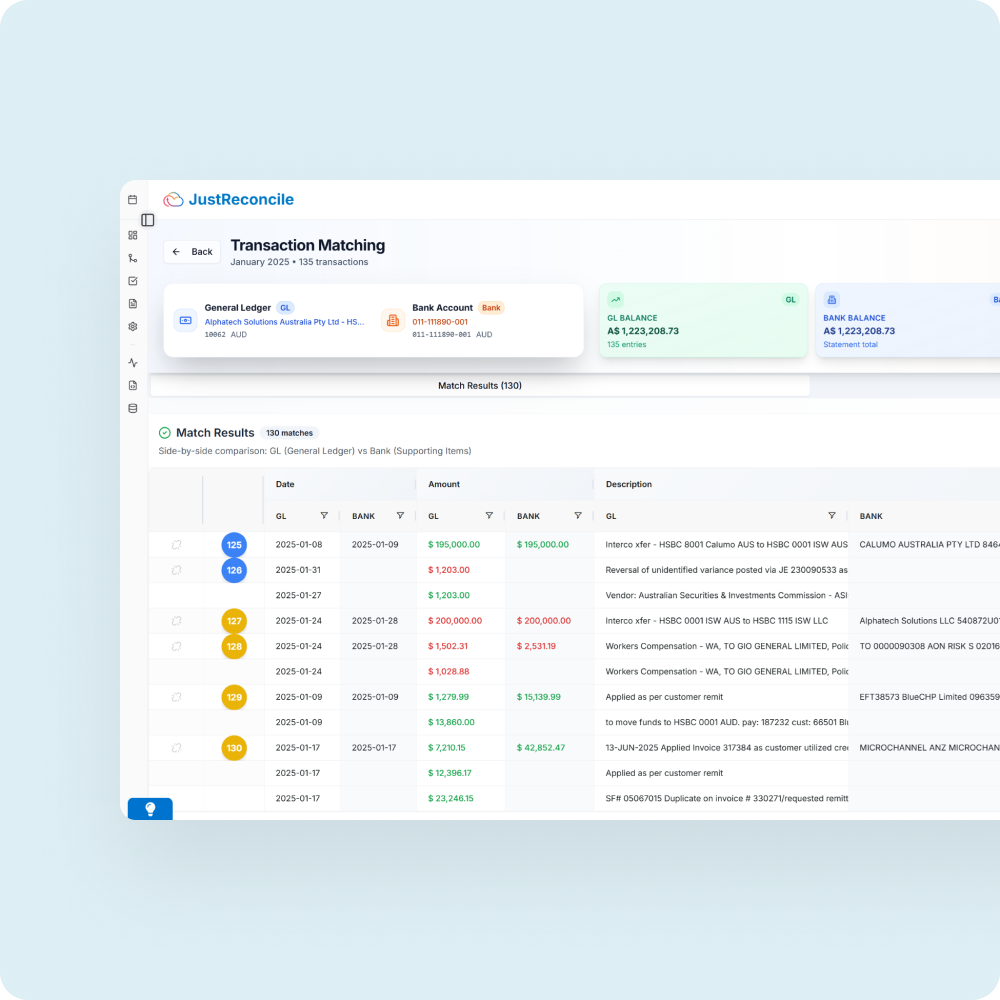

A virtual teammate that completes reconciliations autonomously while you maintain approval authority – no suggestions, no manual matching, just job done.

What’s Really Slowing Your Reconciliation Process Down ?

Smart Tools Still Need Manual Matching Work

Your current tool promised automation but delivered manual headaches. Limited data capacity, endless rule maintenance, constant IT calls, and Excel mapping keep piling up. You invested in efficiency but got stuck with workarounds.

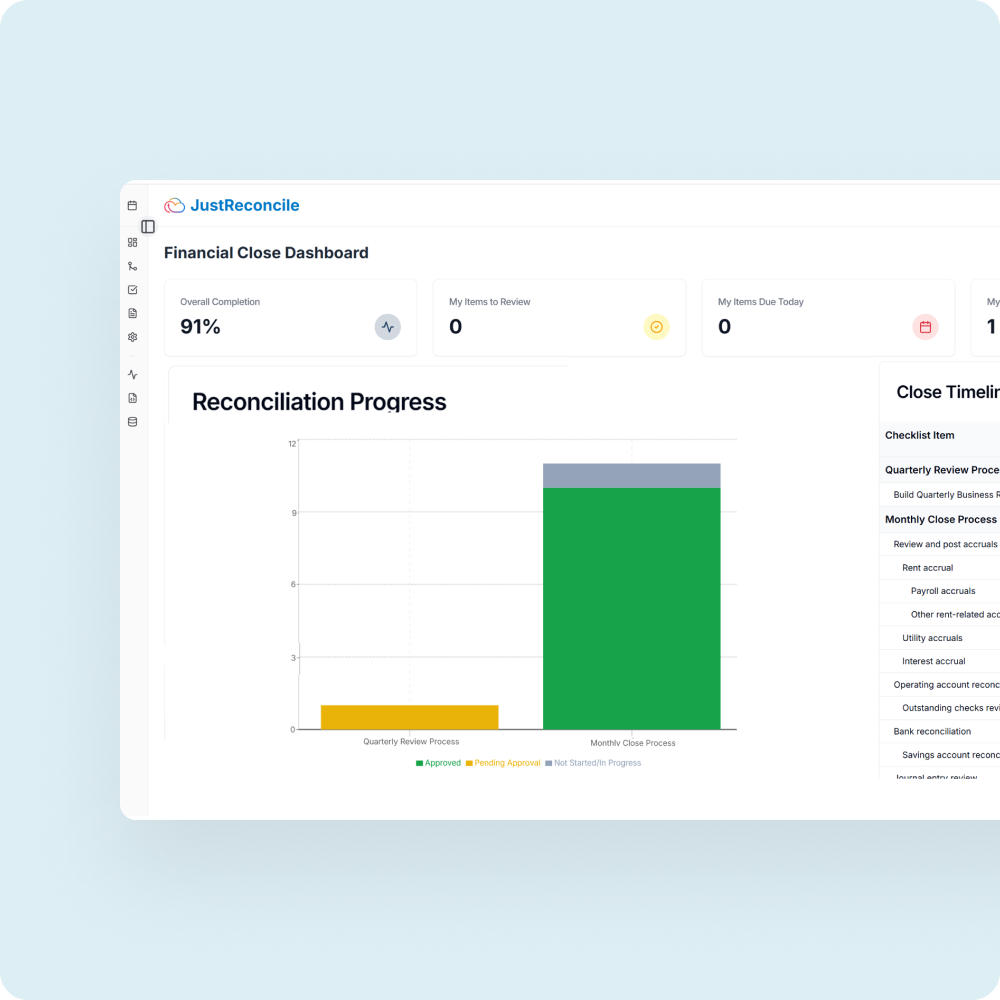

No Visibility Into Month-End Close Progress

Every month-end you’re chasing team members for updates and trying to find bottlenecks before deadlines slip. Dashboards show data but not the real-time insights you need to manage proactively.

Hours Spent Reviewing Transactions in Excel

Your team burns hours each cycle manually matching transactions, chasing discrepancies, and double-checking totals. That pulls your best people away from the analysis and strategic planning that drive growth.

Delegate the Busywork, Boost Performance

Your Virtual Teammate Handles Everything Start to Finish

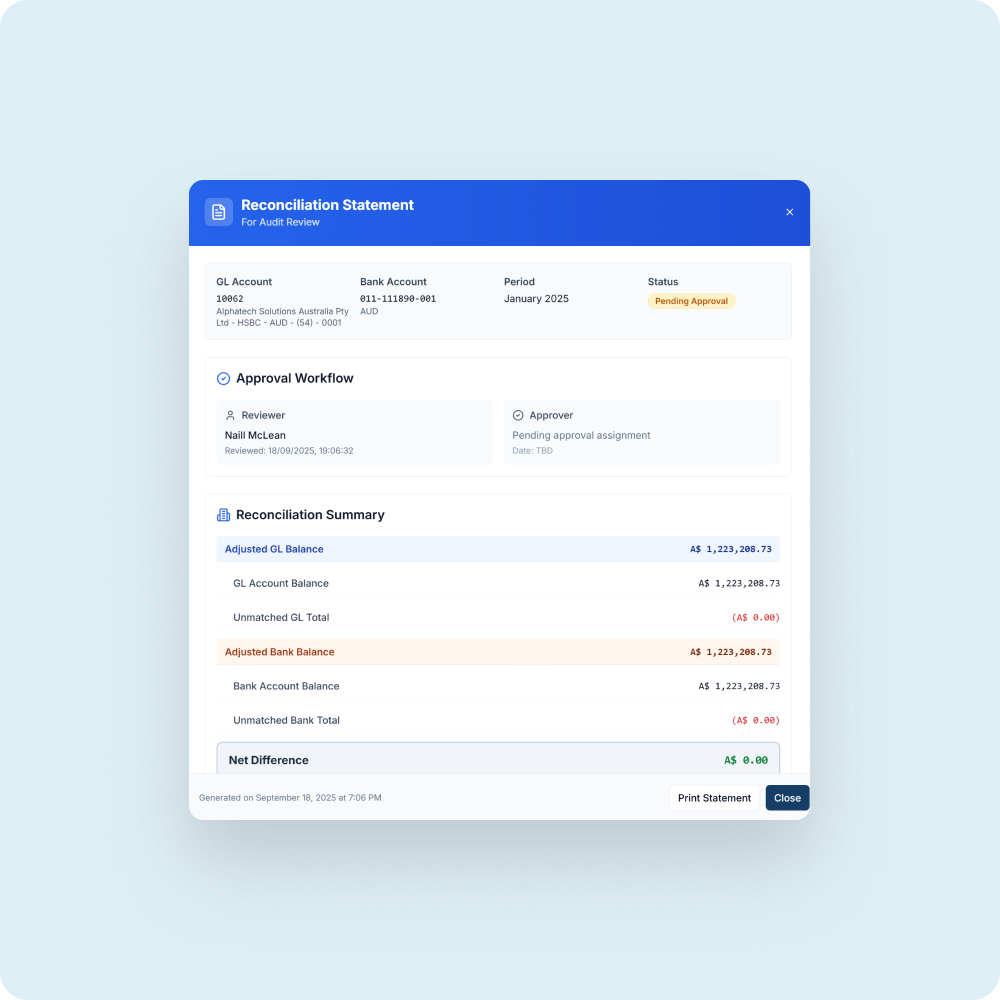

No suggestions, no manual matching, just job done. High-confidence matches complete autonomously with full transparency and audit trails, so approvals stay with finance. Upload your source files, wake up to finished reconciliations, and focus on analysis instead of transaction matching.

Key Benefits

- 60–80% efficiency gains across recurring reconciliations

- Real-time close visibility replaces status meetings and email chains

- Human oversight via configurable thresholds, routing, and approvals

Get Instant Demo

Autonomous completion rate

Time reduction in reconciliation

Less manual work frees up review time

Stop Month-End Delays From Reconciliation Bottlenecks

When reconciliation and consolidation run separately, timelines stall. With built-in EPM integration, completed reconciliations trigger the next close steps automatically, with no manual handoffs or delays.

Seamless Integration

- No rekeying or spreadsheets: Results flow directly into close tasks.

- One data backbone: Reconciled balances tie out where consolidation occurs.

- Predictable timelines: Dependencies clear faster, so close dates hold.

Autonomous completion rate

Time reduction in reconciliation

Less manual work frees up review time

AI That Works With You, Not Against Your Team

Black-box AI creates more questions than answers. Here, every automated action is explainable and traceable.

How It Works

- Transparent decisions: Confidence scores and rationales for each match.

- Complete audit trails: Who did what, when, and why, logged end to end.

- Built-in approvals: Segregation of duties keeps authority with finance.

Autonomous completion rate

Time reduction in reconciliation

Less manual work frees up review time

See Your Virtual Teammate at Work

Struggling to keep reconciliations accurate and efficient while your team drowns in manual work? See how complete automation transforms month-end chaos into streamlined processes your finance team controls.

Frequently Asked Questions

Suggestion-based tools still leave the heavy lifting to your team. Here, high-confidence matches complete autonomously with explanations and audit logs, then route for approval.

New entities, accounts, or formats are learned without rebuilding brittle rule sets. Confidence thresholds and reviews remain in place so changes don’t break your process.

Completed reconciliations trigger downstream tasks and keep consolidation tied to the same reconciled balances, removing handoffs and duplicate checks.

Yes. Approvals, thresholds, and roles keep final authority with finance. You decide where autonomy applies and where human review is required.

Every automated and manual action is logged with user, timestamp, and rationale. Approval workflows and segregation of duties support your audit posture.