Equity Management

Streamlined Equity Management Software: Balancing Ownership and Growth

Navigate the complexities of equity management with ease. Align the goals of your workforce to company objectives with our comprehensive solutions. Your success story starts here!

"*" indicates required fields

insightsoftware Is Proud to Work With UBS

“Today’s equity management solutions demand more than administrative control – they require intelligent, intuitive technology that delivers transparency and ensures regulatory compliance. We are proud to work with UBS,” said Monica Boydston, General Manager, EPM & Controllership at insightsoftware. “We have made significant investments in Certent Equity Management from insightsoftware. UBS’ decision to leverage this technology reflects our shared vision for the future – where detailed reporting, flexibility, and scale are critical to delivering an exceptional experience for clients and employees. Together, we’re delivering the capabilities and confidence organizations need to lead in a rapidly evolving equity compensation landscape.”

Your Complete Solution for Equity Administration & Reporting

Equity Management

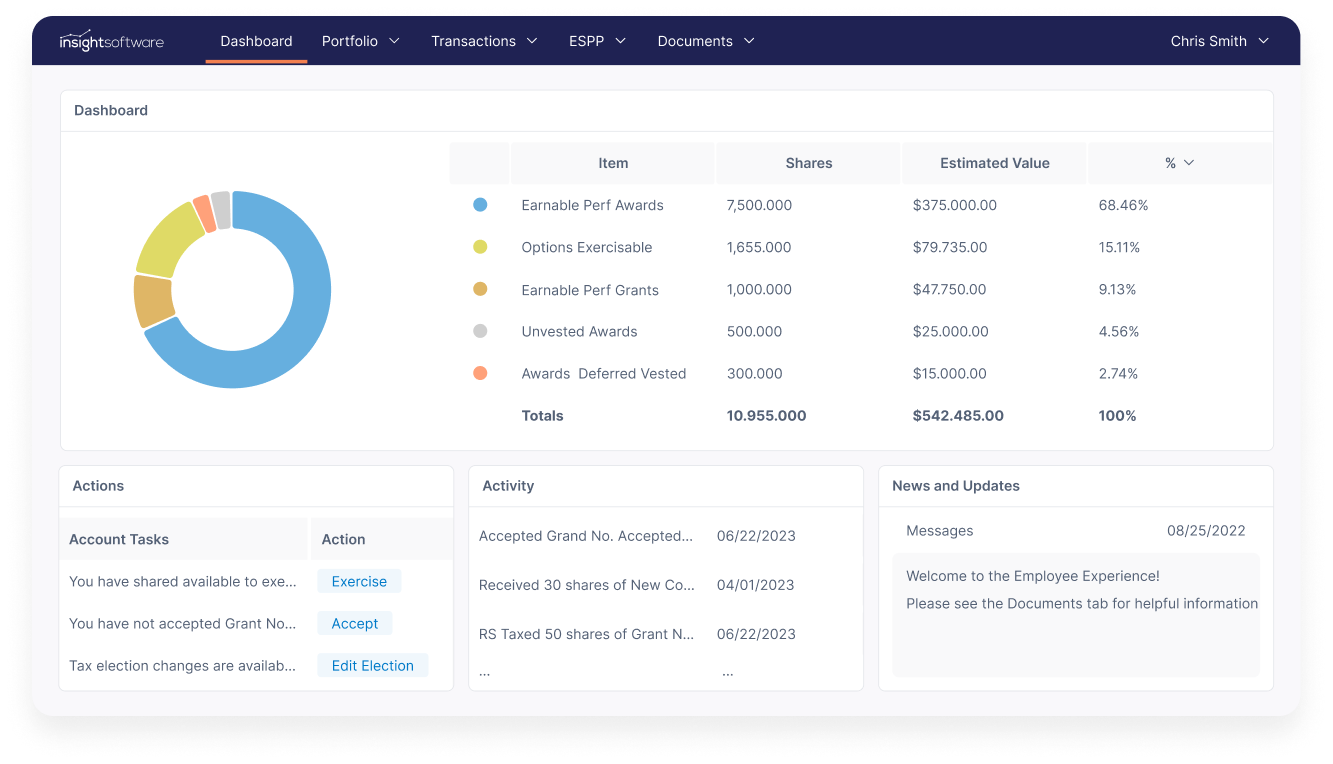

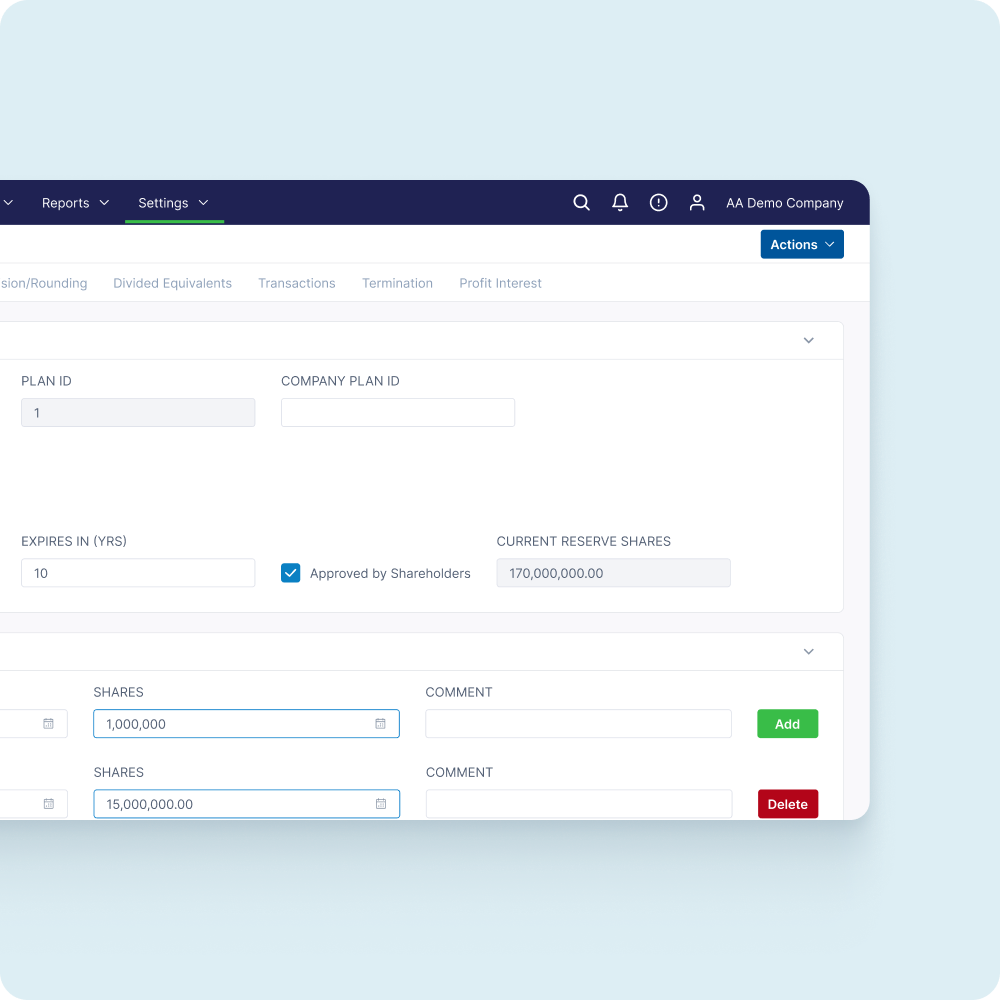

Certent Equity Management offers a simplified web platform for public and private companies with calculations and reporting for SEC, FASB, and IFRS.

Effortless Equity Management: Accuracy, Efficiency, Growth

Our robust equity management solutions help you manage equity administration, improving accuracy, reducing costs, and increasing efficiency. Whether you’re a private or public company, enjoy automated accounting, streamlined administration, cap table management, and secure shareholder engagement.

A Single, Comprehensive Management Platform for All Your Equity Compensation Needs

Experience the power of our all-in-one management solution for equity compensation. Manage, administer, account for, and report seamlessly.

Increase transparency and engagement with shareholders. Our shareholder portal offers a secure place for shareholders to access information and manage their holdings while also facilitating communication between you and your shareholders, fostering trust and engagement.

As equity management software built for your needs, insightsoftware scales with you. Automate equity tasks and grow seamlessly with insightsoftware. Easy broker integration, no platform switch needed. Attract & retain talent with effortless grants.

Automate your ESPP administration for precise record-keeping. Manage eligibility, process purchases, and design flexible plans that meet your needs. Empower participants with web self-service to boost engagement and streamline tasks.

Experience dynamic business insights with our advanced cap table management software. Generate precise cap tables for a comprehensive view of stakeholder equity. Create detailed waterfalls to identify security payouts at any exit amount, facilitating term sheet modeling and capitalization outcome analysis.

Our equity management platform integrates with brokers’ platforms to provide seamless and secure data exchange, enabling brokers to offer their clients a comprehensive and user-friendly solution for managing their equity plans and participants.

See for yourself why 500K+ users are using insightsoftware to draw instant data insights, react swiftly to market changes, and outpace their competition

Why Leading Organizations Trust Our Equity Management Platform

Equity management is a cornerstone in diverse industries, optimizing ownership structures and catalyzing business growth across roles. See for yourself below how our equity management solution helps CFOs and finance teams across a wide variety of different industries:

Frequently Asked Questions About Equity Management

Equity management involves handling company shares or ownership stakes. It includes processes like granting stock options, vesting schedules, and managing employee stock ownership plans (ESOPs). Effective equity management also ensures compliance with financial regulations, supports transparent stakeholder reporting, and plays a key role in talent retention through strategic compensation planning.

Employees should stay informed about their equity grants, understand vesting schedules, and consider tax implications. Diversifying investments beyond company stock is also essential.

Modern equity management software automates essential processes such as stock plan administration, cap table maintenance, ESPP tracking, and regulatory reporting. This saves time and reduces manual workloads for finance, HR, and legal teams, all while ensuring data accuracy and real-time visibility.

Equity compensation is essential for attracting and retaining talent. As startups scale, equity management becomes more complex, involving multiple rounds of funding, investor reporting, and varied share classes. When done efficiently, equity management ensures accurate record-keeping, compliance, and smooth processes during company growth.

Granting share options: Distributing new equity grants to team members. This includes specifying details like grant owner’s name, number of share options, grant date, strike price, vesting schedule, and expiration date.

Cap table management: Handling complex scenarios involving different share classes and preferences. Managing the cap table ensures accurate ownership representation during liquidity events (e.g., sales or public listings).

Beyond those, other essential equity management processes include payout modeling, shareholder communications, and audit-ready financial reporting—all of which contribute to transparency and operational efficiency.