5 Ways to Improve Oracle Financial Reporting Efficiency

Although Oracle E-Business Suite (EBS) provides a centralized hub for financial data, the manual process of exporting data into spreadsheets is both time-consuming and prone to errors, forcing finance teams to spend considerable time verifying numbers. Despite its powerful features, Oracle EBS can present challenges, including complex data management, integration hurdles, and a steep learning curve.

How do you ensure greater efficiency and accuracy for your financial reports? Here are five ways you can improve finance reporting efficiency, backed by our recent research into Oracle-driven finance teams.

1. Embrace Finance Automation

Oracle-driven finance teams contend with a wide range of automated financial reporting needs. According to our latest Finance Team Trends Report for Oracle some tasks, such as financial system maintenance (43%), management report generation (38%), or audit preparation/support (36%), are highly automated. However, many other tasks still require a high level of manual effort due to limitations in automation, increasing inefficiencies, and the risk of mistakes.

Some tasks, such as account reconciliation (38%), ad-hoc custom reports (33%), or data entry (30%), are still conducted manually. The lack of automation exacerbates the burden of time-consuming, manual processes, increasing Oracle finance teams’ inefficiencies and the risk of mistakes.

Due to the lack of automation in tasks such as account reconciliations, accounting, and finance professionals spend more time manually preparing data and reports and less time analyzing account balances, such as reviewing trends from prior years and months and actual versus budgeted trends.

In fact, just recreating reports and transferring information between systems takes up a massive amount of time. At least three-quarters (72%) of Oracle users dedicate a minimum of five to six hours each week to recreating financial reports, equating to up to 24 hours a month or 300 hours per year. This inefficiency highlights the need to streamline processes and improve data management, including automated data integration.

By automating repetitive, manual tasks such as report generation and data integration, finance teams can significantly reduce operational costs, improve data accuracy, and free up valuable time for strategic analysis. Modern financial reporting solutions offer robust capabilities to streamline processes, enhance collaboration, and provide real-time insights. These solutions empower Oracle finance teams to focus on higher-value activities, such as financial planning and analysis, risk management, and driving business growth.

2. Free Finance from IT Over-Reliance

Oracle ERP systems are comprehensive and come with a variety of out-of-the-box reporting tools that cover basic needs. However, organizations’ needs aren’t as modular as an ERP’s native reporting tools. Eventually, you’ll be faced with specific questions that only a custom report can answer.

When this happens, finance teams are left to rely on IT teams or outside consultants with technical expertise to run custom and ad hoc reports. Because IT departments are already busy maintaining your organization’s technical infrastructure, financial reports aren’t a top priority. According to our study, 78% of Oracle-based finance teams felt over-reliant upon IT.

Overdependence on IT creates bottlenecks and slows decision-making. To accelerate financial processes and empower informed choices, finance teams must gain greater autonomy by adopting intuitive, integrated reporting tools. These solutions enable users to create custom reports independently through the familiar interface of Excel, eliminating the need for IT intervention and ensuring timely access to accurate information.

Staying on Oracle EBS? Maximize Your On-Premises Potential

Download Now3. Un-stick Your Data with Real-Time Reporting

Traditional reporting methods often include exporting data from your Oracle ERP into a spreadsheet. This freezes that information at the time when it was exported with no ability to see insights in real-time. And report generation isn’t instant–according to our research, top-level reporting tasks like financial system maintenance, tax preparation, and financial reporting preparation take 30 hours monthly for more than half of organizations. By the time you’re able to share information with your leadership and stakeholders, the reports are already outdated.

When seeking a solution, it’s essential to choose one that seamlessly integrates with Oracle EBS and serves as a single source of truth. Avoid making important decisions based on outdated data. With interactive reporting technology, you can easily refresh your reports to access real-time data, making financial reporting faster, more efficient, and highly accurate.

4. Speed up Financial Planning

Financial planning is vital to making informed decisions. However, it’s a time-consuming process involving extensive data gathering, analysis, and coordination across departments.

According to our recent research, 60% of Oracle-powered finance departments spend five days or longer on budgeting cycles. Time constraints were also listed as the biggest challenge of annual budget creation with Oracle ERPs. Customizing these reports adds even more time to the process.

To address these challenges, organizations must adopt modern budgeting and planning solutions that offer flexibility, agility, and automation. By empowering Oracle finance teams with intuitive tools and real-time data, these solutions enable the creation of dynamic, scenario-based plans that align with strategic objectives.

5. Unite Data Silos

Oracle-driven finance teams have experienced firsthand the rapid proliferation of specialized financial tools over the past two decades. In their quest for efficiency and performance, many organizations have adopted a patchwork of point solutions, often resulting in a complex and fragmented data environment. In fact, our recent research found that 95% of Oracle-driven finance teams use multiple software tools from different software vendors.

This fragmented software landscape creates significant data integration challenges due to incompatible data formats, structures, and systems, making it difficult to consolidate and analyze data effectively. Our findings echo this insight, with the overwhelming majority of Oracle ERP finance teams (98%) experiencing data integration challenges.

Of those Oracle-based teams that reported data integration challenges, 83% say that poor data management or integration is the main obstacle to effective reporting, forecasting, compliance, etc. Integration issues with Oracle ERPs lead to inefficiencies and inaccuracies, ultimately hurting the finance team’s performance.

Addressing these data integration challenges with coherent software strategies can significantly improve efficiency and accuracy. Utilizing flexible, scalable tools that can connect to all current and future data sources will ensure consistency, accuracy, and regulatory compliance. This approach is not only more efficient but also allows Oracle users to spend their time on initiatives that will drive growth.

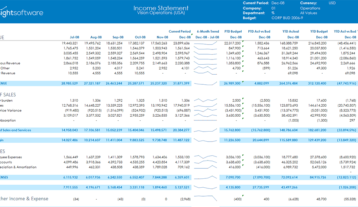

Get More From Your EBS Data with Hubble

With Hubble for Oracle EBS, you can embrace digital transformation with greater efficiency in your reporting, budgeting, and planning. Hubble integrates your critical business systems so users at all levels can interact with live data and return data with extraordinary speed. With this type of visibility and access, everyone can easily understand, manage, and predict business health in the long run.

With Hubble, enjoy:

- Reduced Reliance on IT: No more waiting on IT for custom report creation. Hubble empowers business users with self-service reporting in Excel, reducing the strain on IT and accelerating reporting cycles.

- No More Data Silos and Inaccuracy: Spreadsheets with siloed data can hinder progress. Hubble acts as a central hub, integrating data from various sources. This ensures data accuracy and consistency for informed decision-making.

- Unlimited Visibility and Planning: Traditional reporting methods lack real-time insights. Hubble integrates seamlessly with Oracle EBS, allowing for real-time data analysis and scenario modeling within a familiar interface. This facilitates continuous planning and informed adjustments based on changing market conditions.

Hubble offers a complete real-time reporting & analytics solution for your finance team, including:

- Faster Closing Processes: Reduce month-end and year-end closing times by up to 50% with a streamlined reporting and analytics tool.

- Pre-Built Templates: Access a library of 240 flexible, out-of-the-box report templates that are easy to customize and deploy.

- Real-Time Analytics: Monitor KPIs, analyze trends, and drill down into transactions, allowing for informed decision-making and collaboration.

- Large Data Volume Handling: Efficiently manage and report on large datasets without compromising performance, ensuring quick query responses.

- User Commentary Integration: Capture and display user comments directly within reports, fostering effective communication across teams.

Ready to learn more? Catch our on-demand webinar on how to make the best use of your Hubble toolkit.