Top 22 Real Estate KPIs and Metrics for 2023 Reporting

What is a Real Estate KPI?

A real estate Key Performance Indicator (KPI) or metric is a quantifiable measure used to assess the performance of a business in the real estate industry. These performance metrics can be used to analyze several different business segments from individual realtor performance to investment property potential. In turn, this information can be used to identify weaknesses in your business or help make better business decisions.

Who Should Be Using Real Estate KPIs?

With real estate being one of the largest industries in the world, it should come as no surprise that most market participants use real estate KPIs. Contrary to popular belief, these metrics aren’t just used to track the property sales data that you see in the news. They also track data that pertains to the leasing, management, and development of properties. As such, there are many market participants who have different goals and approach the real estate industry from varying perspectives. In this post, we will be looking at three different real estate industry participants, how real estate KPIs can help them, and the benefits of using a real estate KPI dashboard. These parties are commercial real estate firms, property management firms, REITs (Real Estate Investment Trusts), real estate investors (personal and corporations), real estate agents/brokers, and developers.

Real Estate Investor KPIs

Most average people think of real estate as purchasing a home to live in. However, an even larger part of the real estate market consists of investing in properties and renting them to tenants in order to turn a profit. Here are some real estate investment KPIs that should be taken into consideration before and after purchasing an investment property:

- Payback Period – The payback period KPI is one of the most important real estate investment metrics that exists. This KPI determines the number of years it will take for a property to pay back the initial investment amount. This is one of the first back of the napkin calculations you should do when screening potential properties.Payback Period = Initial Capital Cost for Project / Annual Savings or Earnings from Project

- Return on Investment (ROI) – If you are making an investment in anything, you would want to know how well your investment has performed. Or maybe you want to see how the investment would have performed previously. This real estate investment metric does just that.ROI = (Net Profit / Total Investment) * 100%

- Tenant Turnover – This real estate investment KPI is very important if you own multiple properties. It tells you the rate at which your tenants are leaving. A low turnover rate is desirable as it means that your property is occupied and making you money. A lot of money can be lost in the time between a tenant leaves and when a new one moves in. This is a high-level real estate KPI and is best utilized when calculated on an annual basis.Turnover Rate = (# of Tenants Moved Out / Total # of Tenants) * 100%

- Average Rent Price Per Property – How much are your units renting for? How does this compare to last quarter? Or last year? This real estate metric determines the average monthly rental price to help compare quarterly or annual changes.Average Rent Price Per Property = Total Monthly Revenue / Total # of Properties

- Operating Expense Ratio – How much does it cost you to manage all your properties and maintain them? Is it worth your time? This real estate performance metric can help you make that decision by comparing the operational costs to the rental income. Ideally, this ratio is below 80%.Operating Expense Ratio = ((Total Operating Expenses – Depreciation) / Gross Revenue) * 100%

- Loan to Value (LTV) Ratio – EThis is a key performance indicator that is often used by lenders when determining how much they require as down payment on a mortgage application. As a real estate investor, you want to put as little down as possible while obtaining the best interest rate possible. In most cases, the lowest rate can be obtained with an LTV ratio of 80% or lower.LTV Ratio = Mortgage Amount / Appraised Property Value

- Average Mortgage Rate – As a real estate investor, it is important to keep track of the average mortgage rate across all your properties. This figure can be compared to the current index mortgage rate to help assess if properties should be refinanced or not.Average Mortgage Rate = Sum of Mortgage Rates / # of Mortgages

- Equity to Value Ratio – This real estate metric is probably more commonly known by its more generic name – the equity ratio, which can be applied to any kind of leveraged investment. The equity ratio is used to determine how leveraged a business is. In real estate, it compares the amount of equity you have in a property to its assessed value. Typically, a ratio less than 0.5 indicates that a business is heavily leveraged.Equity to Value Ratio = Total Property Equity / Total Property Value

While this is not an exhaustive list of KPIs that a real estate investor should be looking at, it covers the fundamentally important ones that you should be looking at on a regular basis. However, the number of KPIs you track will eventually grow, and you will want a way to manage them. This bring us to our next point – real estate reporting solutions.

How to Build Real Estate KPI Dashboards

View Guide NowReal Estate Agent KPIs

Real estate agents play a vital role in the real estate industry. They are integral to facilitating property transactions, and some of them also act as property managers for clients. Here are some real estate metrics that can help determine the performance of a real estate office, or individual agent:

- Listing to Meeting Ratio – This real estate performance indicator gives a measure of how effectively you are using your time when acquiring listings. This ratio compares the number of listings you acquire against the number of prospective listing meetings you have. This metric can help incentivize agents to work on their sales pitch.Listing to Meeting Ratio = Total # of Listings Acquired / Total # of Vendor Meetings

- Average Commission per Sale – How much money are you making on each sale? Selling any property takes a large amount of time and effort. Thus, is it more efficient to sell higher priced properties when your commission is a percentage. Ideally, this real estate metric would be increasing over time.Average Commission Per Sale = Total Commission Value / # of Sales

- Number of Properties Advertised per Real Estate Agent – Most real estate agents work in an office with other real estate agents and support staff. This real estate KPI can help foster friendly competition in the office and give an indication of which agents are putting in the effort to pick up new clients.

- Sold Homes per Available Inventory – This real estate metric can help shed some light into the current market conditions for a specific region. It analyzes how many homes are sold and compares it to the number of properties listed in that region.Sold Homes per Available Inventory = Total # Homes Sold / Total # of Homes Listed

- Year-over-Year (YoY) Variance of Average Sold Price – The YoY variance performance metric is a very common way to assess a regional market’s condition. An increasing YoY rate indicates that a region is experiencing an increase in demand, while a declining YoY rate can signal a slump in demand. YoY Variance of Average Sold Price = ((Current Year Avg. Price – Previous Year Avg. Price) / Previous Year Avg. Price) * 100%

- Number of Days on Market – This real estate key performance metric is used to keep track of market conditions or identify properties that might be open to price negotiation. There is often more room for negotiation with a seller if the property has been on the market for a long time as they may become desperate.

- Revenue Growth – Everyone wants their revenue to grow. A higher revenue typically comes with a higher net profit. As such, it is important to track monthly, quarterly, and annual revenue growth to monitor your performance and compare it to market conditions.

- Number of Calls Made – You don’t make money by doing nothing. This real estate key performance indicator measures how actively agents are prospecting and actively seeking out leads.

- Client Feedback Ratings – After a deal has been closed, you think it is job done, right? Not so fast. Getting feedback from a client is very important and should be integrated into the deal closing process. Client feedback is important for two reasons: first, if your client liked you, they are likely to refer other potential clients to you. Second, a surprising amount of sales volume comes from repeat clients.

The key performance indicators mentioned above should be helpful in assessing the performance of real estate agents as well as market conditions. This ties directly into the next market participant we are going to look at – the real estate investor.

Streamline Your Real Estate Reporting Processes

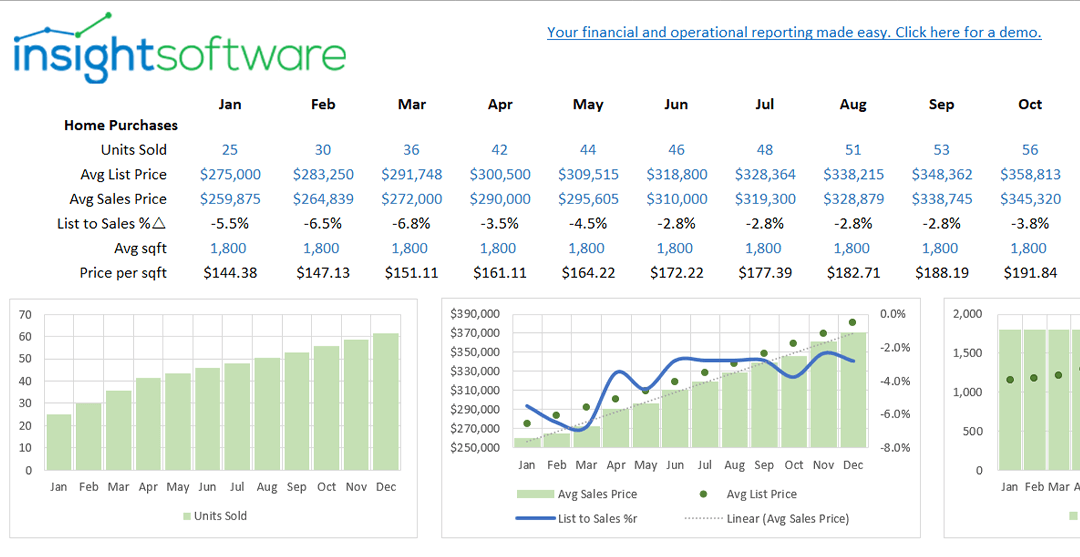

It should be very evident that keeping track of KPIs can be a laborious task that eats into resources that could otherwise be used to earn more revenue. insightsoftware offers a simple solution to this problem through the use of specialized reporting software. Here are some of the ways in which our software can help:

- Interface with other Services. Don’t worry about an expensive system overhaul and implementation. Our real estate reporting software is able to interface with your existing ERP and automatically collect data.

- Data Consolidation. Our dashboard makes all your data accessible from one easy interface.

- Prebuilt KPI templates. insightsoftware’s reporting solutions come out-of-the-box ready to use with prebuilt KPI templates.

- Generate reports instantly. With all your data constantly being automatically updated and stored in one central location, up-to-date reports can be generated with the click of a button.

Regardless of whether your business is large or small, it is very easy to see the benefits of using a real estate reporting solution to streamline your reporting process.

Personalized Real Estate Reporting Software Demo

Request Demo NowReal Estate Developer KPIs

Real estate developers have a lot at stake when they decide to start a project. As such, it is very important that they thoroughly analyze the market conditions and project costs. Here are some real estate developer KPIs that can help with the decision-making process:

- Internal Rate of Return (IRR) – This is one of the classic real estate developer metrics that any company should take into consideration before developing a property. This metric is used to evaluate the attractiveness of a project, by calculating what rate of return (IRR) would result in a net present value of zero. If this is higher than the company’s required rate of return, the project should be taken into consideration.

- Interest Coverage Ratio – Most real estate developers are not developing properties with cash they have on hand; they are taking out a loan. The minimum that you are required to pay is the interest on your loan. This real estate developer KPI specifically measures a company’s ability to cover its expenses with its earnings before interest and taxes (EBIT). Due to the complex nature of accounting, one of the best ways to track this KPI is using financial KPI software.Interest Coverage = EBIT / Interest Expense

- Percentage Presale Sold – This real estate developer KPI tracks the percentage of units in a building that are accounted for during a presale vs once construction is finished. While it is often used by developers when deciding which market has favorable conditions, it can also be used by agents or investors to gauge market conditions.

- Real Estate Demand Growth – Market conditions matter. You wouldn’t develop a region with no demand. This is one of the fundamental real estate developer KPIs that you need to think about before starting a project. While demand growth is hard to forecast, it can be estimated by using mortgage application numbers, population trends, and construction permit data.

- Construction Cost Per Square Foot – Whenever prospective buyers are interested in a property, they want to know how much they are paying per square foot. As such, it should come as no surprise that developers like to track the construction cost per square foot for their projects according to the construction financial KPIs. This real estate developer metric is helpful in project budgeting and deciding unit sale prices. Construction Cost Per Square Foot = Total Construction Cost / Total Area

We hope that you found these top 22 real estate KPIs and metrics for reporting helpful in gaining an insight into what your company should be analyzing. If you are interested in learning more about real estate reporting solutions contact us here for a personalized demo.