5 Tips to Manage Cash Flow Pressures

In 2020, businesses around the globe are watching cash more closely than ever. Cash flow is the lifeblood of every business, so there is good reason to keep a watchful eye on liquidity in the current environment. The arrival of the coronavirus brought a level of disruption that many people have never seen before in their lifetimes. While the hope is that the worst of it is over, the road back to normalcy is likely to be long and potentially bumpy.

Although cash flow has always received routine attention in most businesses, liquidity has taken on new importance this year. Things are different now, and smart companies will develop a disciplined approach to monitoring and managing cash carefully for the long term. Let’s look at some best practices that will help companies to develop competency around cash flow management.

1. Dig Deeper

Alongside the P&L and balance sheet, the statement of cash flows is the third (and sometimes overlooked) report in the triad of basic financial statements. Many companies build their cash flow projections around that same report structure, adjusting for any significant upcoming changes that could affect cash.

Now, however, this kind of baseline cash flow projection is no longer a good starting point, because it assumes a certain degree of “business as usual.” Things are fundamentally different now, and many of yesterday’s assumptions may no longer be valid.

Many companies have seen revenue drop precipitously as customer demand has shifted away from luxury goods, discretionary purchases, and even perishable groceries. At the same time, demand has increased elsewhere. Sales of toilet paper, pasta, and hand sanitizer spiked as consumers rushed to stock up. Online sales increased, while revenues for restaurants, airlines, and hotels plummeted.

This has huge implications for cash flow management. We can no longer accept steady-state projections around revenue. Analysts in the finance and accounting department need to dig deeper into the assumptions that drive sales forecasts. That implies taking a closer look at sales pipelines and deal probabilities. That, in turn, requires a disciplined sales team to maintain accurate and up-to-date pipeline information in CRM.

There are other areas that will require closer inspection and monitoring in the coming year. Accounts receivable, for example, also requires deeper analysis, as the customers who owe you money may have liquidity concerns of their own. Be prepared to challenge any data points in the cash flow projection that are driven by an assumption that “business as usual“ will return quickly.

2. Forecast Frequently

Businesses that intend to manage cash flow carefully must also be prepared to examine the numbers frequently. This has implications for the entire organization. As already noted, for example, sales pipeline data needs to be accurate and up to date. In addition, incoming payments must be processed and recorded promptly. Inventory and production planning must be disciplined enough to provide accurate and timely information about expected material requirements and order delivery dates.

When we combine the principle of “dig deeper” with the second principle of “forecast frequently,” it has significant implications for the finance and accounting department. First, it means that data must be pulled from multiple sources, including ERP and CRM. Second, it implies that that data must be up to date, that it must reflect what is happening in business now based on the most recent information available.

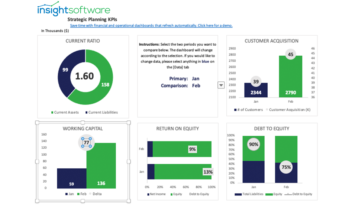

The combination of those two factors mean that for many companies, an investment in more sophisticated reporting and analysis tools is in order. F&A teams need to be able to produce accurate, up-to-date reports in real time, without performing tedious data extraction tasks every time.

3. Aggressively Manage the Day-to-Day Details

CFOs will already be familiar with many of the ways to manage cash day-to-day more effectively. It’s important to keep a close eye on receivables, for example. Monitoring DSO (days sales outstanding) and working toward shortening the cash cycle should be a priority. Customers that go beyond their allotted payment terms need to be contacted immediately. Special attention should be paid to newly delinquent accounts that have previously paid on time.

Payables, likewise, may be extended to improve cash flow. Take care to do this judiciously, however. Relationships with critical suppliers should not be put at risk. Nor should your business’ overall reputation be allowed to suffer. Consider renegotiating terms on a case-by-case basis with some of your larger, more secure vendors that may be in a stronger position to make allowances to keep your business.

4. Re-Visit CapEx Decisions

Not surprisingly, many companies have deferred capital expenditures in the first half of 2020. This is a natural response during times of uncertainty. Smart companies are not halting capital expenditures altogether, though. Many are seeing new opportunities as buying behavior shifts. Likewise, disruption often shakes up the competitive landscape and provides an opening for capturing additional market share. Companies that are willing to invest in efficiency and growth can potentially prosper as the economy shifts into recovery mode.

Automation has become a popular category of investment as businesses have recognized the strategic value of technology and its role as an enabler of agility and resiliency. Effective cash flow management, for example, requires real-time analysis tools that can automate and streamline the process of extracting data from multiple source systems, formatting and analyzing that data, and presenting the resulting information in a meaningful way. Many businesses are choosing to accelerate investments in tools that eliminate manual processes, increase accuracy, and shorten the time required to produce meaningful insights from operational data.

5. Monitor and Adjust

The situation continues to be very fluid, as 2020 has brought a lot of changes. With the passage of the CARES Act in March, the US Congress provided a lifeline for many businesses through the Paycheck Protection Program (PPP), as well as some tax incentives that will provide an immediate cash infusion for many companies. Governments around the world have enacted similar measures.

2020 is an election year in the US, and with the economy still struggling, it is certainly possible that additional stimulus measures could be enacted. Business leaders should be closely following any pending legislation and planning accordingly. While most people are aware of the Paycheck Protection Program, for example, far fewer are aware of the substantial taxes and advantages that became law at the same time. Effective planning is critical for businesses that aim to maximize the value they from such measures.

These principles of effective cash management may be especially important this year, but companies that internalize these five tips as part of their routine business processes will be better positioned to survive and thrive amid the next period of disruption.