Operational Exception Reporting in EBS: Exploring a Better Way

In the wake of disruptive change, business leaders have shifted much of their attention to big-picture challenges. At the same time, the more routine details of running a business still matter a great deal, – perhaps even more than ever. As businesses strive to do more with less, how can managers operate more efficiently?

Management by exception can be an effective strategy for virtually any business. It provides high value relative to the time and resources invested, it benefits every area of the organization, and given the right reporting tools, it is easy to put in place.

What Is Exception Reporting?

In a nutshell, an exception report identifies transactions or performance metrics where actual outcomes deviate significantly from expectations, and flags those outliers for follow-up and resolution. For example, an exception report might list all budget categories in which expenses exceeded the budgeted amount by more than 5%.

When the volume of data within an organization is relatively small, such outliers are easier to spot. As the volume of data grows, however, the value of automated exception reporting quickly becomes clear. As an organization grows (that is, as it processes more transactions and as its complexity increases), people in the company can find it hard to see the forest through all the trees.

In addition, some types of exceptions can be very difficult (if not impossible) to spot without some kind of automated exception process in place. Credit card companies, for example, are applying a kind of exception reporting system whenever they flag potentially fraudulent transactions. Their algorithms must assess the number of transactions on an account, the monetary value of those transactions, the geographical location, online versus off-line origination, past purchase history with the merchant, the designated ship-to address for each transaction, and more.

While that may be a complicated example, it has parallels among more common business scenarios. If someone in your company initiates a purchase transaction, for example, and the same person later approves or pays that transaction, it could be a sign that an employee is misappropriating company funds by paying a fictitious vendor. That’s not the kind of information that shows up on a standard report.

An exception report could provide a list of such cases on a daily, weekly, or monthly basis. It’s a far simpler exercise than the sophisticated fraud detection algorithms used by credit card companies, but it’s not likely that you could uncover such fraud without having some kind of exception reporting process in place.fe

Exception reporting acts as a kind of early warning system; the exceptions flagged by this kind of reporting can often be a leading indicator of bigger problems ahead. For many organizations, exception reporting serves as a mechanism for alerting management when the organization is at risk of missing key performance targets. When days sales outstanding (DSO) increases beyond a pre-set threshold, for example, it may help to uncover larger issues with accounts receivable, and it provides decisions makers the opportunity to proactively address potential cash flow issues on the horizon.

Exception reporting is not just for high-level KPIs, though; it has a significant role to play in an operational context as well. Here are some examples of how exception reporting can help people throughout your organization to operate more efficiently and effectively.

Data Quality

According to Gartner, poor data quality costs the average company about $15 million each year. Missing data, duplicate records, and outdated information all contribute to the problem. Operational exception reporting can help in several ways.

Exception reporting can flag instances where information is incomplete. If a customer record is lacking address information, for example, it could result in late deliveries, misdelivered invoices, and eventual payment delays. Missing or incorrect postal codes often result in financial penalties from shipping companies, which can add up to significant costs if the problem occurs at scale.

Incomplete information can result in regulatory penalties, as well. In the UK, for example, employee records with missing information can lead to compliance issues, if pension contribution opt-out information is not recorded properly. By flagging these kinds of exceptions proactively, companies can get ahead of the problem and ensure that they remain compliant.

You can also use exception reporting to detect duplicate master records. It’s very common, for example, for many records to exist for the same customer. That can lead to further data quality problems. If you record a change of address for one instance of a customer’s record, but the next sales order is sent to the old address attached to a different customer record, that will cost money and result in delays. Duplicate addresses can translate to wasted money for the marketing department as well, by prompting them to send out multiple promotional mailers to a single address. On a large scale, that adds up.

Other Examples of Operational Exception Reporting

For accounting and finance, exception reporting provides many opportunities to increase efficiency and effectiveness. In credit and collections, for example, an exception report might list customers who have outstanding invoices exceeding 80% of their credit limit, and who also have aged debt over 45 days. You can share that information with the sales department so that account reps have visibility to potential upcoming credit holds.

In the accounts payable department, you can use exception reporting to identify prompt payment discounts that may be at risk of expiring. By moving those invoices to the front of the line for payment, the company can take advantage of discounts and save money.

In purchasing, you can use exception reporting to identify invoices for which there is no corresponding purchase order. Those could indicate cases of unapproved spending. Unapproved spending can hamper efforts to accurately forecast cash flow, and it may be a sign of inadequate internal controls.

You can also use exception reporting to facilitate workflows throughout the organization. You can then flag unapproved purchase orders, for example, for follow-up. When transactions are delayed by missing approvals, that can slow the business down. Delays to supplier deliveries can have a cascading effect throughout the organization, ultimately resulting in missed deliveries to customers.

Exception Reporting in Oracle E-Business Suite (EBS)

Unfortunately, operational exception reporting in Oracle EBS can be a challenge because it often requires pulling data from many EBS modules and then combining and filtering for analysis. Oracle’s native reporting tools do not easily lend themselves this requiring multiple concurrent requests or screen exports. To capture all the data needed for exception reporting, users need to have deep technical expertise to understand the data structures of Oracle EBS. A typical scenario could require an expert user to spend hours performing complex database joins to get all of the information they need.

Another major problem is that there are limits to Oracle’s standard report filters. This means that to get an exception report, a user would need to export transactions to an external tool (such as Microsoft Excel), and then apply filters to highlight exceptions in the data set. This is a tedious process; in many respects, it defeats the purpose of exception reporting, which is to operate more efficiently. At worst, it delays the discovery of exceptions until it’s too late to do anything about them.

Automation is a key element of good exception reporting. Unfortunately, Oracle’s native reporting tools don’t make it easy. EBS includes a feature called Oracle Alert, but it is not widely used due to its complexity, and because of the substantial security risks that it introduces due to lack of security and that it allows you to update tables in an unsupported way.

Fortunately, there are enterprise-grade reporting and analysis tools that can do the job better, faster, and cheaper.

Operational Exception Reporting Made Easy

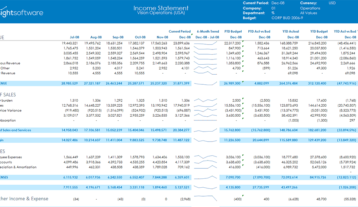

Reports Wand for Oracle EBS enables operational exception reporting throughout your organization. The product comes with a library of pre-built content, providing immediate value to users throughout the enterprise. Reports Wand provides access to data from any module in EBS, empowering users to combine, manipulate, and analyze that information in real-time, without needing a detailed technical understanding of the EBS database.

Because Reports Wand is tightly integrated into Microsoft Excel, it enables almost anyone in the organization to design, change, and update reports – without help from the IT department. Users can add new columns and filters to view precisely the data that they need and can use calculations and conditional format to highlight exceptions.

Reports Wand for Oracle EBS allows you to schedule and automatically distribute reports to authorized users on a routine basis so that all the right people in the organization have visibility into their exception reports. Because Reports Wand leverages existing EBS security automatically, your critical business information remains safe.

If you’d like to learn more about how exception reporting can help people throughout your organization operate more effectively and efficiently, contact us for a free demo.