Four Factors to Consider When Choosing Capital Planning Software

Effective capital planning is fraught with many of the same challenges as traditional profit and loss (P&L) budgeting. Departments request budget allocations, usually with some promised benefits attached, and managers must sort through those various proposals and ferret out the ones that most strongly support the company’s objectives. The challenge, very often, lies in comparing a multitude of “apples and oranges” scenarios, making some attempt to evaluate them, and allocating limited resources to the ones that seem to make the most sense.

That process typically begins with collecting detailed information from multiple stakeholders, comparing budget requests to historical numbers, determining the veracity of the promised benefits, and attempting to make a fair side-by-side comparison to pick out the most promising proposals. That often involves multiple revisions and updates, struggling with version control and distribution of current budgets to stakeholders up and down the chain of command. Without the right tools, the process can be extraordinarily time-consuming and cumbersome.

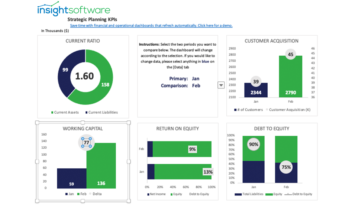

Enter capital planning software. While most companies spend a considerable amount of time every year developing and refining their operating budgets, relatively few have taken the next step toward rationalizing and improving their capital planning processes. The best capital planning software makes it possible for companies to look to the future, allocate resources proactively and intentionally, and ultimately produce better business results. Perhaps just as importantly, capital planning software enables organizations to measure and monitor the performance of their capex investments to better understand which assets are performing to expectations and which are not.

Companies that use capital planning software benefit from having a consistent set of data for capex proposals that aligns to a common structure and format. This supports better decisions and transparency throughout the entire capex asset lifecycle.

Stop Wasting Time with your Budgeting and Planning

Access ResourceBottom-Up vs. Top-Down? Look for Both

Smaller companies typically start out with fairly rudimentary processes for capital planning. Business leaders generally evaluate Investments in real estate, machinery, or other fixed assets on a standalone basis. Will the investment generate positive return on investment (ROI), or is it essential to business operations? If leaders expect a positive ROI, then how quickly will the investment pay for itself? What are the tax implications? How will the investment affect liquidity and indebtedness?

In most cases, business leaders perform a kind of back-of-the-napkin analysis to prioritize capex spending based on a handful of proposals, pressing business requirements, and expected returns. Just as traditional P&L budgeting often starts with a baseline built on last year’s budget, this “top-down” approach depends on available resources and a relatively unstructured approach toward back of the napkin evaluation of individual projects or investments.

Status quo thinking drives top-down budgets, which is not to say that they are necessarily bad. However, they can sometimes be overly simplistic when compared to a more intentional “bottom-up” approach. In fact, top-down budgeting is relatively fast and efficient because it requires less up-front data collection and analysis.

Bottom-up budgets, in contrast, allow for a more strategic selection process in which you view and compare the merits of various projects side-by-side according to a common set of evaluation criteria. These typically require more effort, but they allow business leaders to focus the organization’s resources on the most promising investments. Instead of asking the question “Is this project (or that project) worthwhile?”, executives can ferret out the most promising investments from an array of proposed positive-ROI projects.

The best capital planning software should support both of these methodologies (that is, bottom-up and top-down) and should allow for a blended approach in which some projects and business units use one method, and smaller investments may be handled using the other methodology.

Visibility to Your Entire Capex Portfolio

Another characteristic of smaller, less mature organizations is the tendency to collect and analyze capital planning data in spreadsheets. While this might work well for startups, it lacks many of the benefits of a capex planning solution. Good capital planning software will provide clear visibility to your entire portfolio of assets and planned investments, including metrics that provide business leaders with visibility to both expected performance and actual returns.

This holistic view enables organizations to refine their capex planning processes, assess their performance against the original expectations for each investment, and dispose of underperforming or non-performing assets.

Integration

One of the key factors standing in the way of effective capital planning is the lack of integration between existing business management systems (such as enterprise resource planning (ERP) software) and the planning software itself. Because so many companies begin their capex planning processes using Excel spreadsheets or similar manual tools, finance teams usually take it for granted that capital planning must necessarily involve exporting data from one or more systems, importing it into a spreadsheet, and manipulating it using formulas and manually entered data.

Fortunately, those kinds of tedious manual processes are no longer necessary. With the right capital planning software solution, organizations can integrate data from multiple sources and update that information in real time, ensuring that the latest revision of the capital plan is always in sync with what is actually happening in the business. Capital planning software that integrates with multiple ERP systems is a strong plus.

Collaboration

Another pain point that many users take for granted is the need to pass spreadsheets back and forth among stakeholders throughout the organization, often via email or on a shared drive that can be accessed by multiple users. Version control is frequently a challenge under these circumstances, and it’s not unheard of to have updated files overwritten unintentionally, resulting in lost data.

Collaboration is an important aspect of the budgeting and planning process. With manual spreadsheet-based systems, it’s common for discussions to happen via email or in one-on-one discussions. Those kinds of conversational threads can be difficult to follow, and information often gets lost in the process.

Although it’s possible to add comments to a spreadsheet-based capex plan, the process of reading, acknowledging, and following up on those discussion threads depends on the diligence of individual users. In most cases, it’s simply too difficult to instill the discipline necessary to capture and follow through on important comments and feedback. Effective capital planning software will accommodate this need by providing robust collaboration features.

If your organization is seeking to raise the bar in its capital planning processes, insightsoftware would love to speak with you. To learn more about our planning and budgeting solutions, including dedicated capital planning software, contact us today to discuss your needs.