7 Keys to Effective Planning, Budgeting, and Forecasting

Fourth quarter is the time of year when most organizations are looking to the future in earnest, gathering detailed information on the current year’s performance, assembling a wish-list for the road ahead, and kicking off the planning and budgeting process all over again.

In most companies, planning, budgeting, and forecasting processes are fairly well-established, but just because you’ve always done things a certain way doesn’t mean you can’t improve them. Given the relative scarcity of finance talent these days and the power of technology to help organize and streamline these processes, it makes more sense than ever to take a fresh look at the way you perform planning, budgeting, and forecasting.

Here are seven keys to managing those processes effectively:

1. Start With Strategic Goals

The most effective budgets center around a clear set of strategic priorities. These stem from an executive-level vision for the organization, outlining the company’s aspirations for the medium and long term, and defining a clear path to achieve those goals. There is usually a strong analytical component to the strategic goal-setting process; executives must understand market size, the competitive environment, and the inherent strengths that can differentiate the company from the competition.

In the end, strategic priorities provide that top-level filter that determines how organizations allocate resources during the planning and budgeting process, including cash flow planning. In many respects, strategy is as much about deciding what is less important as it is about specifying what is most important. In a world where so many things seem significant, strategic priorities clearly establish the line between the initiatives that deserve investment and those that do not.

2. Determine Your Methodology

It’s also important to carefully consider the budgeting methodology you want to apply. The traditional approach to budgeting calls for a standard uplift from the prior year’s numbers, followed by some adjustments to account for shifting priorities or rapidly rising costs in one category or another. Although this approach requires less work than some other methodologies, it is often criticized for its tendency to promote “business as usual” thinking.

Zero-based budgeting (ZBB) challenges the status quo by forcing department heads to justify their entire budget allocation, rather than simply lobbying for increases to support new initiatives. Although ZBB offers a “start from scratch” approach that can potentially eliminate waste from the budget, it can also require considerably more effort than the traditional approach.

Other innovations such as driver-based budgeting (DBB) offer greater flexibility and help the companies that adopt them to adjust to rapidly changing business conditions. DBB identifies the key factors that drive business results, and then models the expenses and resource allocations necessary to support the company’s activities as those drivers fluctuate.

Whichever approach you choose, be clear about the effort required, the benefits you expect from adopting a new methodology, and the associated learning curve for people in your organization.

Driver-Based Budgeting and Planning: A Guide for Finance Teams

Access Resource3. Build in Flexibility

In the midst of a rapidly changing business environment, sometimes leaders must make adjustments on the fly. Developing meaningful financial plans makes it less likely that your organization will have to deviate from them later. Nevertheless, it pays to adopt systems that allow for flexibility as external business conditions change.

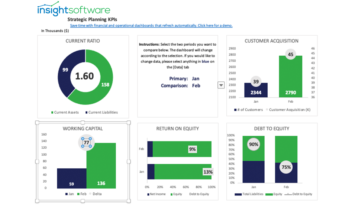

To do this, executives need access to up-to-the-minute information about the key performance indicators that drive the company’s success. To understand whether you need course corrections, leaders must first have timely and trustworthy access to meaningful information. Executive dashboards are powerful tools to help key people in the organization understand what’s happening in real time.

Some planning and budgeting methodologies, such as DBB, are well-suited to companies that face rapidly changing conditions. In any case, planning and budgeting should allow for some degree of flexibility as the year progresses.

4. Make It a Collaborative Process

Planning and budgeting are collaborative by nature. C-level business leaders need the input of line-of-business managers or department heads. They, in turn, rely on key players within their departments for input on costs, commitments, timelines, and expected outcomes.

The entire process typically requires a lot of back-and-forth dialogue, which often takes place across a mix of different contexts–sometimes via e-mail, as comments within spreadsheet files, ideas embedded within slide presentations, or simply in person-to-person conversations around the office or over the phone.

The best planning and budgeting software incorporates collaboration tools that support effective group dynamics, capturing and preserving the back-and-forth conversations that ultimately lead to a completed annual budget. It is all too easy to forget those kinds of conversations, or remember them differently than the other participants. Good collaboration tools ensure that all the right people share communications that matter to them, and that the organization preserves the results so that everyone involved is clear about the commitments they made during the planning and budgeting process.

5. Use Scenario Modeling

Scenario modeling enables decision-makers to compare potential outcomes under a variety of conditions. In many cases, it is used to evaluate best case, worst case, and likely estimates. That, in turn, helps leaders to plan effectively for a range of circumstances, allowing for greater flexibility to accommodate uncertainty.

Scenario modeling can often be useful in the early stages of planning and budgeting, supporting the strategic planning process that serves as a starting point for resource allocation. It can also be valuable later on, after you finalize the budget. As the finance team monitors results and evaluates potential adjustments to the plan, scenario modeling can help guide leaders as they consider course corrections for the business.

6. Monitor, Forecast, and Adjust

The next key to success is to continuously monitor performance in real time, forecast outcomes based on current conditions and expectations, and adjust to optimize outcomes in the context of the current business environment.

Unfortunately, this may be easier said than done–especially for those businesses with rigid planning and budgeting tools or tools not designed for the purpose. Many companies choose to develop their budgets in Microsoft Excel simply because it is so familiar and flexible, but this choice can incur into budgeting problems in fiscal planning.

As a standalone tool, spreadsheet programs have some drawbacks. Updating an Excel file with the latest sales or inventory data, for example, can be a tedious process if performed manually. It can be easy to introduce errors, especially if a user copies and pastes information that they exported from their ERP. Look for software that provides real-time links to transactional details, eliminating the need to compile manual updates when monitoring performance or developing forecasts.

7. Sharpen Your Tools

The final key to success is to invest in good tools and make sure that your finance team has the resources they need to work efficiently and accurately.

If your organization relies on a standalone spreadsheet to develop budgets and forecasts, you’ll be familiar with some of the challenges inherent in that approach. When users email multiple versions of a file back and forth, for example, they will inevitably run into problems with version control. One user may overwrite another person’s changes, or an executive might spend time poring over an adjusted budget, only to later learn that it was an outdated version of the file.

When planning and budgeting solutions have built-in collaboration tools, stakeholders can communicate more clearly and consistently, without allowing key information to slip through the cracks. Workflows and approvals ensure that the right people are prompted to take action when needed, and that their input is tracked and managed centrally, rather than in a disjointed collection of email messages.

If your organization is adopting a new budgeting methodology such as ZBB or DBB, then you have even more reason to adopt software that’s purpose-built for planning, budgeting, and forecasting. The best financial planning software supports these kinds of innovative approaches by providing a structured framework for alternate budgeting methodologies.

The idea of changing your approach to planning, budgeting, and forecasting may seem daunting. After all, it’s a far-reaching process that involves multiple stakeholders throughout your organization. Nevertheless, if you select good software for planning, budgeting, and analysis, the benefits will clearly outweigh the costs.

To mitigate risks and challenges, many companies choose to take a phased approach to rolling out meaningful changes to their planning and budgeting processes, often beginning with a single department or business unit and expanding the program in subsequent years.

Regardless of how you begin that process, it’s worthwhile to evaluate planning, budgeting, and forecasting software that can help your team work together more effectively to achieve your business objectives.