Navigating the Maze of the Subledger Close Cycle

The period-end close cycle involves a maze of intrinsic steps that include transaction processing, reconciliations, journal entry capture, and financial statement preparation. Ultimately, the close cycle must achieve a timely and accurate cutoff of financial activities each month, starting with the subledgers. Close cycle delays at the subledger level ultimately impact process efficiency for closing the General Ledger and preparing your financial statement.

According to Deloitte’s “Close, Consolidate and Report” analysis, ERP systems don’t automate the “full, end-to-end close, consolidate, and report process,” which “can lead to a fragmented, manual, and inefficient close, as well as to inefficiencies throughout the accounting period.” Here, we’ll take a look at some of the challenges with closing the subledgers in Oracle E-Business Suite and how to elevate navigation of the close path.

Timing is Everything

The period-end steps applicable to each subledger, with particular emphasis on efficient cut-off and balancing the Subledger to the General Ledger, involve an intricate process that depends on relative timing and your unobstructed access to relevant Oracle transaction and accounting data. Subledger Accounting (SLA), introduced with the release of Oracle E-Business Suite Version R12, aims to streamline the financial close by providing a common link between General Ledger balances and the underlying Subledger transaction data. Real-time access to your SLA data, however, still requires additional report customizations and offers no drill down capability to access substantive data details.

Inefficient Tools and Processes

Lost productivity during the subledger close cycle typically results from repetitive exports of Oracle data to Excel, where you probably spend hours formatting static data that potentially contains errors from the manual process. The previously mentioned Deloitte analysis mentions similar challenges associated with the lack of automated close processes and the lack of data quality from upstream processes or ineffective data aggregation activities.

Modern business intelligence (BI) tools don’t offer a complete solution either, as report data is often old by a day or more when it arrives in the tool, meaning you can’t obtain a complete view of the numbers at crucial intervals during the close cycle. Development of supplementary subledger reports or amendments to deployed versions often takes weeks—possibly months—as they move through your build, test, and deploy cycle with IT resources.

A Mounting Inventory of Frustrations

Timeliness and tools aren’t the only pain points with the subledger close. Your other frustrations might include:

- Reliance on standard Oracle reports that are constrained by a rigid and static format

- Absence of analytical data drill down capability on reports that helps resolve reconciliation differences

- Use of multiple tools to generate critical close reports, coupled with a data merge exercise in Excel

- Necessary use of independent business calculation models in Excel that are decoupled from close reports

- Process inefficiencies generated when period-end tasks are delayed to the last minute as a way to avoid unessential, repetitive report formatting tasks

A Wish List for Finance Teams

What could improve your subledger close process? One surefooted approach is to look for a real-time reporting solution that can automate many of the unproductive and redundant steps in your subledger reporting process and provide a familiar interface for finance teams like Excel. It should also let you “drill down” into transaction specifics and eliminate your need to execute multiple reports to validate detail, which helps avoid the “ineffective procedures for validating results” identified in the Deloitte analysis as yet another closing challenge.

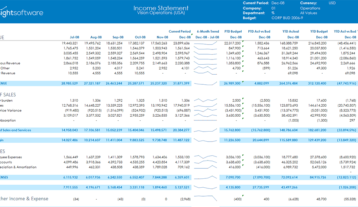

Live subledger reports created with an Excel-based tool aid in tracking the daily or point-in-time progress of your close cycle through real-time dashboards, with key performance indicators like:

- Number and amount of your Payables invoices on hold

- Volume comparison of Payables invoices processed between periods

- Current aggregate of Receivables balances by aging bucket

- Evaluation of top 10 customers based on order volume or value

- Count and value of un-invoiced Purchase Order receipts

- Indicator for the last time “Oracle Create Accounting” was executed

- Period status for the subledgers and General Ledger

With more automated reporting processes through a direct link to the Oracle database, you can better optimize your pathway through the intrinsic maze of the subledger close. In addition to an accelerated arrival, you can rest assured that the data you arrive with is accurate and timely, as it’s derived directly from your single source of truth—the Oracle database.