Minimize IT Dependence With Self-Service Financial Reporting

Finance teams are taking on new challenges and responsibilities in light of the uncertain economic climate that surfaced in the wake of the global pandemic, supply chain disruptions, price inflation, and the wholesale workforce exodus known as the “Great Resignation.”

Now more than ever, organizational leadership is looking to the Office of the CFO to be a strategic partner in building an overall business strategy. Finance is now tasked with providing timely planning, forecasting, and reporting that informs business decisions in the moment.

Considering these rapidly expanding responsibilities and the tasks that accompany them, insightsoftware judged it an excellent time to check in with finance leaders in North America and EMEA to better understand the challenges the Office of the CFO is facing and how finance leaders are addressing them.

In partnership with Hanover Research, insightsoftware surveyed 514 finance decision-makers across multiple industries to get a clear view of the trends that are shaping finance teams today.

That survey led to the publication of our second annual Financial Team Trends Report.

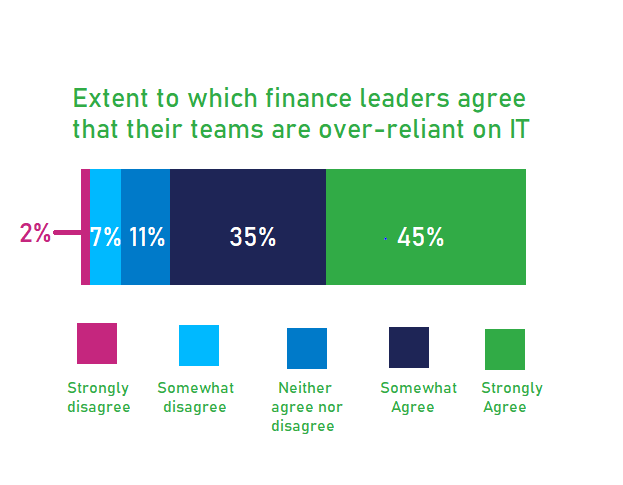

One of the most significant findings among respondents across multiple industries was that a vast majority of finance leaders (80 percent) feel that their team is over-reliant on their IT department.

The Relationship Between Finance and IT

That is not to say that there is an adversarial relationship between Finance and IT. On the contrary, 88 percent of finance leaders are satisfied with the relationship they have with IT, understanding that collaboration with IT is necessary to jump some of the hurdles that have been placed in their path to digital transformation.

Finance leaders identified several challenges that can be conquered with the help of IT, such as:

- Adoption of new technology (41 percent)

- Data limitations and inaccuracies (33 percent)

- Changing reporting criteria (35 percent)

Collaboration is considered a positive thing—with a few caveats. The reason 80 percent of finance leaders believe they’re over-reliant on IT is that they’re feeling the pain of having to wait on another department for the data or custom analysis they need to do their own jobs effectively and efficiently.

When roadblocks happen, the finance team is constrained not only by their own deadlines, but also by the deadlines of a department over which they have little or no control. In short, over-reliance on IT is an agility killer for Finance.

At a time when agility is a major priority for organizations everywhere, over-reliance on IT is a critical weakness for modern finance teams.

How to Minimize IT Dependence

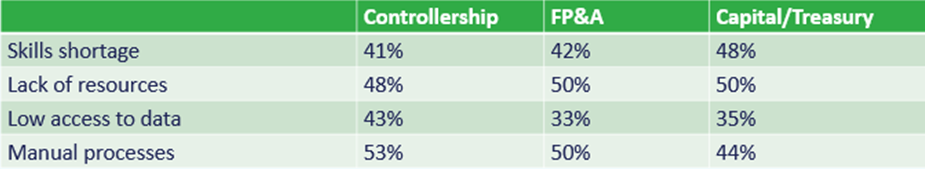

Too much IT dependence typically results from four main root issues:

- Skills shortage on the finance team

- Lack of resources

- Low access to data

- Manual processes

Here’s a look at the percentage of finance leaders who identified these challenges and their impact on three major areas of responsibility for the Office of the CFO:

To minimize IT dependence, finance teams must address the root causes of it head-on. One strategy, in particular, stands out as an answer to each of these root causes: automation.

Automation makes it possible to:

1. Dig Out of the Manual Process Hole

For a significant number of finance teams, manual processes are sucking up time that could be better spent on value-added analysis.

Forward-thinking finance leaders are looking for ways to speed their digital transformation, automating processes when possible to recoup time and resources. Why are you hiring trained financial professionals to crunch data? It’s 2022; let the computers do it for them. You will see a drastic increase in your team’s engagement as they leverage the analysis skills they spent years developing.

2. Optimize Resource Utilization

Automation also alleviates some of the weight of limited resources. For example, automating time-consuming tasks such as financial planning and analysis enables finance leaders to reallocate tasks and responsibilities to optimize staff scheduling. That is especially helpful for the 17 percent of finance leaders who expect to see staff reductions in the coming two years.

However, even if your team is planning to expand in the next two years, like 72 percent of survey respondents, optimizing the way you consume resources by automating in every aspect of your department is still the right move to make with the added responsibilities your team will be shouldering.

3. Enable Self-Service Reporting and Analysis With Real-Time Data

Leveraging tech tools that enable business users to generate reports using real-time data pulled from multiple existing systems helps to reduce reliance on IT. Look for tools that do not require extensive customization. Tools with a familiar interface are also a good idea if you want to empower your finance team to create their own reports via advanced tech.

Automation represents a significant step toward the ultimate goal of self-service reporting for finance teams. Automation makes excellent use of sometimes limited resources, alleviates much of the pain that comes with staff shortages, and eliminates tedious manual tasks.

Case study: kolb Automates Financial Processes to Reduce Load on IT

kolb Cleaning Technology prides itself on fast delivery times. As a global leader in the cleaning machinery manufacturing market with 50 employees, the business has a reputation for acting quickly and efficiently. Where competitors maintain a 20-30 week lead time, kolb can deliver in six to eight weeks while producing a high-quality result.

However, the company previously relied on manual processes during month-end and year-end close. In addition to being time-consuming for the financial team, the business relied on IT to customize and generate ad hoc reports. Because its IT staff were tasked with other critical duties, they were unable to prioritize finance needs, causing considerable delays to the close process.

“We didn’t have a data culture before Jet Reports,” Christian Ortmann, CEO of kolb Cleaning Technology said. “In the past, the IT department was responsible for data management. At the time, we had to go to IT and explain what we needed and why we needed it. IT often didn’t have time to run the reports quickly.”

Jet Reports helped relieve the company’s overtaxed IT department while putting the power to run reports into the hands of those who needed them most.

“We have more people feeling comfortable designing in Jet Reports,” explained Ortmann. “And it’s not IT people; it’s people in finance, engineering, and sales. There are no IT people who program now. Instead, Jet designers in our company run reports because they know precisely what they need. Jet Reports generates accurate numbers for them.”

kolb uses Jet Hub to schedule reports automatically. Overall, the business saves a full day every week on scheduling and administrative tasks with the solution’s automation capabilities.

“We have a lot of complex reports that take 45 minutes to an hour to generate,” said Ortmann. “When you report manually, you address tasks to people, but you also have to check the report at the right time because some reports, like inventory, must be generated at the right time. With Jet Hub, here are a lot of things we don’t have to think about now. It saves us a minimum 1.5 days per week. You don’t have to be reminded of which reports to run at the right time because Jet Hub automates that process.”

Break Free from IT Over-Dependence With insightsoftware

insightsoftware works with thousands of finance teams across multiple industries to provide the tools and support they need to execute against all their growing responsibilities. insightsoftware products connect directly to your ERP for live data analysis through an easy-to-understand interface. Our products come equipped with a suite of pre-built content to ensure finance teams are able to hit the ground running.

Learn more about current finance team trends and how insightsoftware is helping the Office of Finance to manage the current landscape and plan for the future when you download “2022 Finance Teams Trends Report”.