Financial Reporting Challenges for CFOs in 2023

Financial professionals encounter periods of high activity throughout the year. Whether you serve as a CFO, specialize in taxation, or contribute to the team responsible for closing financial records and generating year-end reports, any time can become crunch time. These intervals demand long hours at the office (or working evenings from your home office) as you diligently tackle the extensive list of tasks that require immediate attention.

For CFOs, this may be an especially challenging time. Financial leaders must not only look to see that the job gets done, but must also consider the impact of high stress on their teams. Now, CFOs are faced with the twin challenges of hiring and retaining qualified staff. The technology landscape is shifting rapidly as well, compelling leaders to allocate valuable time and attention to keeping up with the pace of change.

Here’s a look at some of the top challenges faced by CFOs this year:

1. The 2023 Talent Shortage and the Great Resignation

Much has been written in recent months about the difficulty that certified public accountant (CPA) firms and corporate finance departments are having as they search for qualified employees with adequate experience. The job market has shifted dramatically since the onset of the global health pandemic. Many of the baby boomers employed in finance have already left. These seasoned employees, just on the cusp of retirement age, have chosen to leave the workforce altogether. Continued uncertainty about the future prompting them to retire earlier than they might have otherwise.

At the same time, there’s a shortage of new talent to fill in the gaps left by departing veterans. According to the American Institute of Certified Public Accountants (AICPA), the number of young people taking the CPA exam has fallen precipitously over the past decade. For many young people, the profession suffers from an image problem; it lacks the glamor and get-rich-quick aura that millennials often associate with other executive roles or technical positions.

Many firms have responded by building greater flexibility into their business practices. For some, that includes outsourcing some portion of their financial management activities. For others, technology upgrades have provided relief by making it possible to automate tedious manual tasks and free remaining team members to work on higher value activities.

2. Keeping Remote Talent Engaged

A closely related trend centers around the shift away from traditional office environments toward remote work. After enjoying the benefits of working from home, many employees have decided they don’t want to go back to an office–at least not every day.

Many view remote work as a means of boosting productivity. After all, it eliminates commuting time altogether and tends to minimize many of the unproductive activities that take place in a typical office setting.

At the same time, many feel something important is lost when a workforce goes fully remote. Time spent chatting around the water cooler might seem wasteful, but it also creates a critical sense of cohesion and reinforces a shared commitment to the organization’s purpose.

In the context of the aforementioned labor shortage, remote work can be a big advantage. It offers flexibility and work-life balance that many of today’s employees are seeking. For financial leaders, the key challenge is to keep these workers engaged, while still offering that perk.

To achieve that, many are using collaboration tools such as online meetings, project management software, and cloud-based communication tools. For financial teams in particular, there are robust collaboration tools to facilitate better communication. Dedicated financial planning and budgeting software, for example, may allow for the kind of collaboration simple spreadsheets do not. Working efficiently through a single source of truth can go a long way toward maintaining cohesion and team focus in the finance department.

Empower Your Remote Finance Team with Excel Based Reporting

Access Resource3. Where Finance Meets Technology

More than ever before, the office of the CFO is tightly connected to the world of technology–so much so, that some organizations have even combined the CFO and CIO positions into a single job. As finance leaders look to achieve more with less, technology is filling the gap.

Much has been written over the past year about robotic process automation (RPA). On the face of it, that sounds expensive and complicated, but it doesn’t necessarily need to be. Since its inception, software technology has been about achieving better results with fewer resources. Today’s situation is no different, except that the technology is continuing to get better and do more.

Over the past three decades or so, spreadsheet software has been transformative for finance teams. Teams can now perform tasks that once consumed hours of time in just minutes. Yet so many of these tasks could be executed more efficiently using purpose-built tools that incorporate stronger collaboration features and workflows.

Many organizations routinely perform ad hoc analysis and financial reporting using Microsoft Excel. Most get their data into spreadsheets using comma-delimited data exported from their enterprise resource planning (ERP) system or other software. Another common method is to copy and paste data from external sources into Excel.

Unfortunately, these methods are tedious and time-consuming. They often require a user to reformat their data, add formulas, and validate their totals. This process carries a high risk of manual error. Copying and pasting a batch of data into an existing spreadsheet, for example, can be a problem if you add new rows in the process. You must adjust formulas, and if you happen to overlook anything, you may end up with a report or analysis that’s simply wrong.

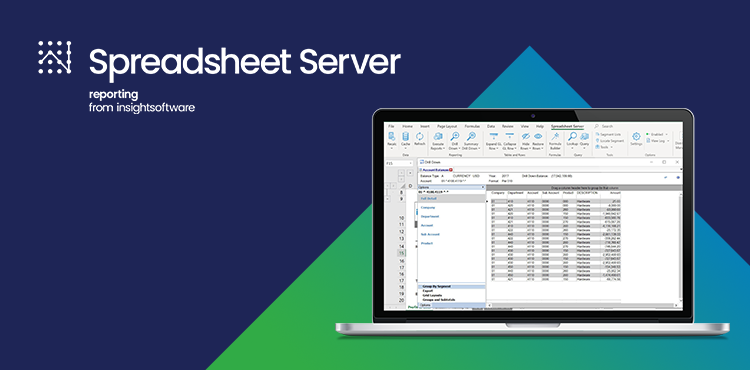

Here’s the good news: a spreadsheet can still work well as an ad hoc reporting tool. Robust, purpose-designed tools, like Spreadsheet Server, understand your ERP data and provide live links between the spreadsheet and the information in your ERP system. With real-time insight into your ERP data, you can save untold hours spent manipulating and reformatting data. Your finance team can spend their valuable time analyzing information rather than simply moving it around. Technology handles the rest automatically.

In 2023, CFOs are challenged to do more with less and manage a workforce with rapidly changing needs. By using technology to support the human element in the accounting process, CFOs can put their teams on course for a winning strategy this year.

insightsoftware provides CFOs with the technology tools they need to make the most of their existing talent pool and maintain strong financial and operational reporting processes at the same time.