Financial Intelligence vs. Business Intelligence: What’s the Difference?

Several decades ago, most finance professionals were thinking about their internal systems as “accounting software.” Over time, accounting software evolved to include inventory management, human resources, and even CRM. Along came ERP, and new opportunities opened up for greater efficiency and growth. Finance leaders that were quick to recognize the new paradigm got a head start, using the new technology to make their organizations more efficient and profitable.

CRM software has gone through a similar transformation, starting with sales force automation, and more recently evolving into a new breed of products that support digital marketing campaigns through email, social media, and online advertising. Again, the new CRM paradigm has presented an opportunity for those who were early to identify it and to fully understand the ramifications.

Software tools that support real-time analysis are undergoing a similar transformation today. A new paradigm in reporting and analysis is emerging. Business leaders who understand that shift will be well-positioned to take full advantage of it. They stand to emerge as strategic thought-leaders, instrumental in driving the success of their teams and the organizations of which they are part.

What Is Financial Intelligence?

For much of history, finance and accounting were about recordkeeping, first and foremost. There was always a delay between the events being recorded in financial systems (for example, the purchase of a product or service) and the ability to put that information in context and draw useful conclusions from it (for example, a weekly sales report).

Over the past few decades, however, technology has been closing that gap. First, accounting moved into the digital age and made it possible for data to be processed and summarized more efficiently. Spreadsheets enabled finance professionals to access data faster and to crunch the numbers with much greater ease. For larger organizations, data warehouses have been used to collect, collate, and stage large volumes of data for further analysis.

Today’s technology takes this evolution a step further. The new paradigm provides the ability to access data that lives in different software systems, sometimes even on different continents, as soon as a transaction is recorded in the source system. This capability for real-time analysis is transformative. It is what distinguishes top-tier finance organizations from the rest of the crowd. Real-time analysis is the seed for what we call “financial intelligence.”

In short, financial intelligence is a higher-order thought process about organizations and how they consume both internal and external information. At the heart of the FI paradigm is the ability to bring together data from multiple systems and to make sense of that information in a way that creates value for the organization.

Whereas business intelligence is tactical, financial intelligence is strategic.

The Real-Time Paradigm

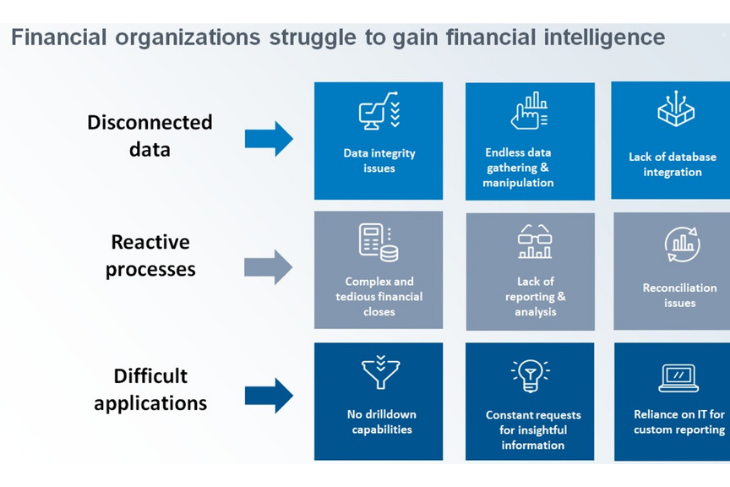

As organizations have deployed an array of different systems to address their business requirements, the challenges of understanding that data have increased exponentially. Such systems typically function as reporting “silos.” Each of those silos comes with a collection of canned reports that provide information on the system in question; inventory reports come from the ERP system, pipeline reports come from the CRM system, and revenue detail comes from an industry-specific software package.

A few decades ago, technology professionals developed methods for collecting, aggregating, and staging their most important information into data warehouses. This practice, together with powerful OLAP (online analytical processing) tools, grew into a body of practice that we call “business intelligence.” It enabled finance professionals to view, filter, and analyze their data along multiple dimensions.

Unfortunately, many business intelligence tools and methodologies are often still constrained by the problem of static data. Historically, companies have resorted to data warehousing whenever they were faced with large volumes of data residing in different systems. To bring that data under one roof, they have relied upon elaborate ETL (data extraction, transformation, and loading) processes to perform periodic updates of the data warehouse from all of the systems that feed it. Such BI methodologies are built on a snapshot of what happened in the past.

This kind of thinking—and the methodology that is built around it—is based on an outdated mindset in which organizational needs are served by reporting on past events. Financial intelligence is different; it sees the organization as a living, breathing entity. It seeks to optimize performance by identifying opportunities and challenges as soon as they emerge. Financial intelligence reports on the past and present, with an eye to better understanding the future.

Making Sense of Disparate Systems

In the new paradigm, real-time financial reporting tools sit at the center of the business, connecting all of the systems that keep the enterprise running smoothly. These tools provide a window to the performance of the organization, with the ability to look at high-level summary data and dashboards (“the 50,000-foot view”) as well as the detailed granular data that make up that picture.

More importantly, financial intelligence puts that information in context and serves as a beacon to light the road ahead. All of your data is visible to real-time reporting tools at the very moment that it is recorded in the source system. That capability is transformative, but only if you recognize the opportunity.

In the new paradigm, the finance and accounting team owns the reporting system; they can design and modify reports without relying on their IT department or costly external consultants. The agility of an organization relies on its ability to understand the past, put it in the context of current trends, and see what’s coming in the future. Organizational agility requires robust, flexible systems. In the real-time paradigm, that can only happen when the business managers (including finance and accounting) have full ownership of the reporting system that serves as the information hub of their organization.

Succeeding in the New Paradigm

Organizational psychologist and author Edgar Schein famously said, “The only thing of real importance that leaders do is to create and manage culture.” The way in which teams think about information and systems in the context of their organization’s goals will determine their ability to adapt and succeed in the face of rapid change.

Business intelligence is tactical. Financial intelligence is strategic. Business intelligence views the business through the rear-view mirror. Financial intelligence is focused on the road ahead.

In a rapidly changing world, agility is key. Businesses can no longer afford to be fixated on the rear-view mirror. Past performance and current conditions are critically important; but without a view to the road ahead, business leaders risk being blindsided by unexpected developments.

insightsoftware has been helping business leaders transform their organizations by unleashing the power of financial intelligence. Request a free demo and take the first step to leveling-up your organization.