What Agile Financial Organizations Have in Common

If the events of 2020 have taught us anything, it is that agility can be a life or death matter for your organization. The ability to assess the situation, set a new course, and take action quickly can be the difference between survival and bankruptcy.

Unfortunately, many businesses are still constrained by slower, often tedious business processes that are designed for a “business as usual” scenario. To survive and thrive in a highly volatile business environment, finance leaders need to adjust their frame of reference and call for a higher standard; information needs to be accurate, reliable, and immediately available.

Sound business decisions begin with asking the right questions. “What will happen if our flagship customers suffer a 20 percent loss in revenue overnight?” “What will our cash flow look like over the next six months if we have to shut down a key line of business?” “What will happen to our inventory levels if demand shifts abruptly?”

If managers can’t get answers to those kinds of questions quickly, the decision-making process grinds to a halt. To make matters worse, business leaders are often presented with several different answers to the same question. How can an organization respond quickly under those circumstances?

In a volatile business climate, the finance and accounting department plays a more critical role than ever before. F&A provides the detailed intelligence that guides the C-suite in mapping the road ahead. When that road is as perilous as it has been recently, organizations simply cannot afford a delay in gathering and analyzing financial intelligence.

So what do agile finance departments have in common? Let’s look at a few of the key factors.

1. They See Strategic Value in Agility

The concept of agility is not new. In 2017, the Association of International Certified Professional Accountants (AICPA) published a report entitled Agile Finance Revealed, describing how finance can manage change and lead businesses through new ways of working, collaboration, and strategic deployment of technology.

An agile finance organization, according that report:

- Works as part of cross-functional, integrated teams that use cloud and digital technologies to deliver improved accounting and efficiency to drive significant business improvements.

- Uses the potential of big data analytics and artificial intelligence in Financial Planning & Analysis (FP&A) to generate competitive and strategic insights.

- Develops new skill sets in areas like data analysis, and forms strong business partnerships to support performance management and timely decision making.

In a highly volatile business environment, analytics are indispensable. With a combination of leading-edge technology tools and an organizational competency for analysis, businesses will be far better positioned to assess, plan, and execute change.

2. They Eliminate Key Barriers to Agility

In many organizations, data is maintained in disconnected software systems and databases, with little or no integration. System-driven reports can often be inconsistent across those various software packages, and no single system can provide a complete picture of the business. To be agile, Finance needs a consolidated view of the enterprise.

Most organizations have dealt with this challenge by learning to work around the limits of disparate, disconnected systems. This often means running reports or data extracts, copying and pasting that information to a spreadsheet, and building an analytical model using Excel.

Those intermediate steps, including the manual copying and pasting of data, are tedious and prone to error. They consume valuable staff time that could be better spent on higher-value analytical tasks. Moreover, the traditional copy/paste approach limits the F&A team to working with outdated information. As soon as information is pulled from the system-generated report and copied to a spreadsheet, it becomes a snapshot of the past.

To get an accurate picture of what is happening in the business right now, F&A leaders need a holistic, real-time view of the enterprise. When analysts are empowered with a world-class set of tools for viewing, analyzing, and presenting information to leaders throughout the organization, they are delivering on the single most important prerequisite for business agility: accurate, real-time insights.

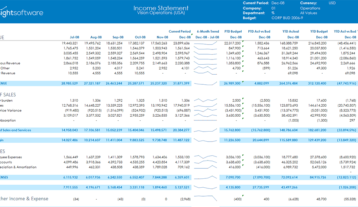

A common real-time reporting platform acts as an information hub, providing a “single source of the truth” that reduces the potential for inconsistencies, errors, and confusion. A consolidated view of the enterprise provides visibility to inconsistencies and inaccuracies as soon as they appear. F&A can spend less time manually consolidating data and can instead focus on analyzing business performance and providing insights for better (and more timely) business decisions.

3. They Empower Their End Users

In agile financial organizations, users do not need to rely on specialists from the IT department or expensive outside consultants to develop or modify custom reports. This is especially important in a period of rapid change and disruption.

In a business-as-usual scenario, decision makers will typically rely on a standard regimen of reports covering sales, cash flow, inventory, and other key metrics. When the business environment changes abruptly, however, leaders need access to new kinds of information quickly. They need answers to questions that might not have been relevant in the past. When a world of possible new scenarios suddenly emerges, leaders will have to look at information in a different way. They will ask new questions that have not been asked before.

When F&A is dependent on IT specialists to design and modify reports, it inevitably results in delays. By providing tools that empower front line F&A workers to do it themselves, agile finance organizations remove friction from the reporting and analysis process. The entire business is better positioned to assess, plan, and respond rapidly.

Agility is a journey, but it begins with a commitment to a different way of thinking and acting throughout the organization. Rapid changes in the business environment have made it abundantly clear that for many businesses, agility will be the difference between survival and bankruptcy.

The insightsoftware integrated suite of real-time reporting and automation tools for ERP solutions offers reporting, analytics, and planning in a single, real-time platform, helping finance organizations become more agile. Pre-built content and reports integrate easily with top ERPs, and an intuitive interface enables end users to access information without IT assistance. And, insightsoftware solutions integrate all your critical business systems so users can easily understand, manage, and predict the business.

Contact us to learn more about how you can build agility in your organization.