How to Optimize Your Oracle EBS Reporting

Napoleon famously said that war is ninety percent information. So too, in business. In a rapidly changing world, it’s essential to have a clear view of what is happening in your business and what lies ahead.

Business leaders face greater challenges than ever before. Changing priorities, dramatic shifts in demand, and changing customer expectations make it necessary to watch key variables closely. This comes at a time when businesses have access to an ever-increasing volume of data. Organizations that don’t have a firm grasp on reporting are, to some extent, flying blind.

Companies running Oracle E-Business Suite (EBS) have many powerful tools available to them for data collection, storage, and retrieval. Yet many managers in these organizations still complain of limited visibility to real-time information and insights. They raise concerns about the high costs and long delays associated with building or modifying the reports they need.

To get better, faster, more efficient results from your Oracle EBS reporting systems, consider implementing some of the following strategies.

1. Leverage Integration

Oracle EBS is complex consisting of many distinct modules. On top of that, most organizations run separate systems for CRM and digital marketing, specialized billing and operations, vendor and customer collaboration, and more. Bringing that information together in a holistic way can be a challenge – especially if you are using some of the native reporting tools that come with EBS.

For each separate module or application, you will need someone with a deep technical understanding of the database. But that’s only the beginning. You’ll need to bring that data together, define the common fields that link information from the different systems, and harmonize it so that it presents a clear and rational picture of your business.

That’s a complex, tedious, and expensive process. Consider leveraging tools that automatically integrate financial and operational data in one place, eliminating the need to search, link, map, and harmonize. In other words, let someone else do the heavy lifting for you.

How-to: Retrieve and Refresh Oracle EBS Data in Excel

Watch Webinar2. Leverage Tools That Already Work Well for You

How many people in your organization already have a solid understanding of how to use Microsoft Excel? For anyone in a decision-making role, it’s close to 100%. There’s a good reason for that; Excel is powerful, flexible, and ubiquitous.

Consider what happens when management asks a question that has never arisen before. What happens if we reconfigure outgoing shipments to load and ship full pallets only? What happens to cash if our retail sales drop 40% over the next quarter? Can we profitably shift to 3PL fulfillment to accommodate increased online sales?

In fact, those kinds of situations were more common in 2020, as disruptive events forced managers to pivot quickly and adjust to the new reality.

The key to business agility is empowering people throughout the organization to act quickly and decisively, without unnecessary processes to slow them down.

Consider a reporting scenario that probably occurred in many companies in 2020. Dramatic changes in demand have caused sharp drops in revenue. Management’s concern is cash. In the past, the VP of Finance has always asked for a one-month rolling cash flow projection. Now you need to produce a one-week rolling projection. How long will it take for IT to make that change? It could be days, potentially weeks if there’s a backlog.

If you have built that report in Excel, you can make that change yourself. You have all the information you need and full control over the outcome. You don’t even need to involve IT. If you pull all the data into Excel manually it would take hours, taking valuable time away from your work day. If your Excel was linked to your EBS, you could refresh your data, keeping your format and formulas. You just need to ensure that the data in your Excel report links back to the data in your EBS system and isn’t static.

3. Make Real-Time Your Mantra

In many organizations, reporting is a bottleneck. When you need to assemble, organize, and harmonize data upfront, it causes a delay between the events that are happening in the business and management’s visibility to those events.

When reports come from a single module, that delay is usually minimized. But when you bring together information from many modules or systems, it usually requires some kind of manual intervention. Often this takes the form of exporting data from the source system, then copying and pasting it into Microsoft Excel so that you can collate, format, and analyze it.

That’s a slow and tedious process. Even worse, it’s very likely to introduce errors.

The process of exporting, filtering, then copying and pasting data is slow. It consumes valuable staff time. When you’ve finished the job, the information is already out of date.

Real-time reporting accesses live data directly and makes that data available within Microsoft Excel so that reports refresh in mere seconds. This gives managers an accurate picture of what’s happening in the business right now. They are able to see the current situation and the road ahead, instead of viewing the business through the rearview mirror.

Replacing Discoverer: Top Ways to Move Forward with Real-Time Data

Watch Now4. Turn Information into Insights

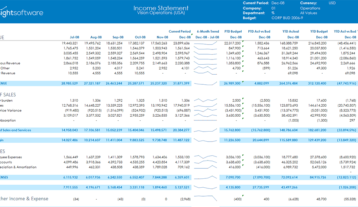

Traditional static reports that simply output numbers are poorly suited to communicating meaningful insights for business managers. Effective reporting tools enable users to create dynamic designs, incorporating visualizations and allowing report recipients to easily spot trends and anomalies. Dynamic reports enable users to investigate and discover by drilling down into the details, asking compelling questions, and finding the answers themselves.

The most effective tools allow users to customize reports for visual appeal and change the layout to present information in a meaningful way.

Traditionally, Oracle has provided reporting tools that need extensive training and expertise, and that require IT to operate them, which offer none of the advantages outlined here. In 2017, Oracle suspended support for its Discoverer reporting tool. While some companies are still using that product, they will eventually need to find an alternative.

If you’d like to take your Oracle EBS financial reporting and analysis to the next level, we’d like to talk with you. We can help you achieve agility, effectiveness, and efficiency. Contact us today to arrange a free demo.