Top Financial Reporting Challenges and How to Solve Them

Being a finance professional is stimulating and rewarding, but it comes with a set of unique challenges. The accuracy and timeliness of information is essential, yet for most organizations, the volume and complexity of financial information is growing continuously. Simply working harder doesn’t seem to solve the problem; issues in corporate financial reporting require finance professionals to work smarter, applying the right tools to get the job done quickly, efficiently, and accurately.

This article explores the three biggest challenges associated with financial reporting. You’ll learn how leading finance teams apply technology to the task of producing fast, accurate reports, eliminating tedious manual effort, giving managers visibility to real-time organizational metrics, and instilling confidence in stakeholders throughout the company. Below we’ll explain the major issues and challenges in corporate financial reporting and how to resolve them.

Challenge 1. ERP Complexity

Enterprise Resource Planning (ERP) software plays a central role in the finance function. Years ago, ERP systems at many companies focused primarily on core accounting functions such as General Ledger, Accounts Payable, and Accounts Receivable. As computing technology became ubiquitous, an array of new accounting and ERP products emerged, and the functional complexity of such systems grew. Inventory management, MRP, project management, and customer relationship management (CRM) are now commonplace, extending or integrating with existing ERP software.

That brings tremendous benefits for small and midsize businesses, but it also leads to increased challenges arising from the inherent complexity of the underlying data. Moreover, this trend continues apace, as more companies than ever connect their ERP systems with standalone e-commerce platforms, mobile applications, and cloud-based services.

Even when you limit reporting to an isolated ERP system, complexity can be a formidable challenge. As the functionality of the software increases, you must store more and more information in the underlying database. Many of these systems have grown to comprise hundreds or even thousands of tables, often with arcane naming conventions and fields that contain cryptic information. Deciphering all of that information, consolidating it, and then making it useful and meaningful to a general audience is no easy task.

Database designs are not generally intuitive to end-users. Yet those very same business users want access to the important information that’s locked up in their ERP database. Fortunately, there is a solution to this problem. The best purpose-built reporting tools can translate arcane database tables and fields into a familiar and meaningful format for typical business users. This serves as a kind of translation layer, making it possible to navigate complex ERP information quickly and easily and produce ad hoc reports virtually on demand.

Challenge 2. Slow Manual Processes

The second key challenge arises from the fact that many ERP systems lack a robust built-in reporting mechanism. The off-the-shelf reporting tools that come with most enterprise software are somewhat inflexible, very difficult to master, or both. As a result, many finance teams turn to a cumbersome workaround; they export data from their ERP software, then import it into a spreadsheet program where they can manipulate, filter, and format it to suit their needs.

Unfortunately, manually exporting, formatting, and preparing data in spreadsheets is an inefficient use of resources. Simply moving data from one place to another consumes valuable staff time — time spent performing an activity that doesn’t add value.

Such manual processes also tend to introduce errors into the data. When you copy and paste information into an existing spreadsheet, for example, the addition of one extra row may render existing formulas inaccurate. If you don’t discover the error until later, this could result in bad information being disseminated to stakeholders in your organization. That undermines confidence in the finance team’s ability to produce accurate reports, and it can ultimately lead to bad business decisions.

There is yet another problem with manual processes: the resulting reports only reflect a snapshot in time. As soon as you export data from your ERP software or other business systems, it’s obsolete. New transactions will not be reflected in your report unless you go through the entire process of exporting, copying, and pasting information all over again.

The solution to this challenge is purpose-built reporting software that automatically accesses the source data in your ERP system, preferably in real time. Your finance team can access accurate, up-to-date reports anytime like a flash report, without performing any manual processes. That saves time and frees up the members of your team to focus on higher-value activities.

Challenge 3. Dependency on Expensive Consultants or the IT Department

Finance professionals have a special talent for understanding and interpreting the numbers, but they shouldn’t have to develop the kind of specialized IT skills required to develop and maintain reports using complex tools. In most organizations, finance relies upon the IT department to do that, or they pay expensive outside consultants to get the job done. Unfortunately, both of those approaches come with distinct disadvantages.

In most companies, IT has limited bandwidth. A request for a new report is often simply added to the queue. It could take days, or even weeks, to see the results. If anything in the request gets lost in translation, finance may need to wait yet again until IT has time for another revision.

Outside consulting firms can often be more responsive, but with that comes a very high cost. In the case of highly specialized reporting tools, it may be difficult to find qualified experts, which drives costs up even further.

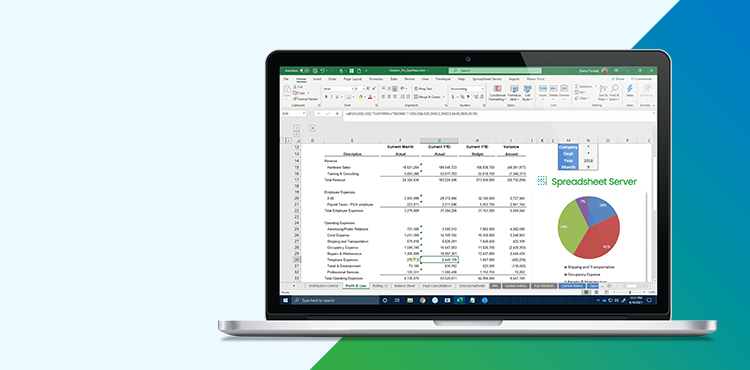

Solve Financial Reporting Challenges with Spreadsheet Server

With the right tools, finance teams can overcome all three of these challenges, achieving greater speed and agility while freeing up their valuable time so they can focus on what matters most. Spreadsheet Server from insightsoftware empowers finance professionals to build ad hoc reports, accessing real-time information from over 140 different ERP systems, without depending on IT to get the job done. Spreadsheet Server offers an intuitive way to access and analyze critical business information directly within Microsoft Excel, eliminating manual processes and making your team more productive.