D365 F&SCM Finance Team Wish List for 2023

Microsoft Dynamics 365 Finance & Supply Chain Management (D365 F&SCM) offers robust capabilities for mid-sized businesses and large enterprises. Customers have several options for financial reporting in D365 F&SCM, but unfortunately, each of them has some shortcomings.

- Read: 5 Reasons You Need to Add Atlas to Microsoft Dynamics

- Watch: Use the Tools You Already Have to Create the Financial Report Your Board Needs Right Now

- Read: Optimize Order-to-Cash Cycles with Microsoft Dynamics and Atlas

Here we will review some of the most common pain points we hear from Microsoft Dynamics customers using Microsoft’s Financial Reporter and Power BI, and we’ll review the finance team’s wishlist for D365 F&SCM reporting in 2023.

1. Easy Excel Connectivity

Most finance and accounting professionals love to work in Microsoft Excel. After all, it is extraordinarily flexible, and in the hands of a power user, virtually any kind of analysis is possible. For most people in finance, Excel is like a Swiss Army knife—applicable to virtually any task.

Unfortunately, you can’t do much with Excel until you have moved data into it from whatever source system (or systems) you want to analyze. It’s common practice to run reports from an accounting or ERP system, or perhaps from CRM, and then dump the resulting data into a CSV file and import them into Excel for analysis. That can be a cumbersome process, but it’s one that many people have come to accept as a necessary evil, simply part of the process that is unlikely to ever go away.

There are some significant problems with the traditional export/import approach, however. If source file formats change unexpectedly, it can render the results of a time-consuming analysis process incorrect. Moreover, once the data are imported into Excel, they are immediately rendered obsolete. Any subsequent changes to the source system (for example, if someone posts a new transaction or makes an adjusting entry) are not reflected in the analysis. To bring an Excel spreadsheet up-to-date, members of the finance team have to then repeat the tedious process of exporting and then re-importing data while taking great care to make sure they don’t miss anything in the process.

The other common scenario is copying and pasting data. That presents all of the same difficulties, and one more besides. If data are accidentally pasted into the wrong place (for example, if a row has been added or omitted in the new version of the data), then the entire analysis can be rendered incorrect.

Many people expect that because D365 F&SCM is a Microsoft product, it must have strong integration with Excel. Unfortunately, that isn’t true. Finance teams using D365 F&SCM for the first time have expressed a strong desire for easy, seamless integration between Microsoft Excel and D365 F&SCM.

Many customers have already discovered that those capabilities already exist in solutions offered by insightsoftware, including Atlas, which makes it easy to develop sophisticated financial reports that fully integrate with Microsoft Excel.

2. Consolidations

For companies that operate multiple corporate entities, the most common approach is to create distinct companies within D365 F&SCM, each with its own set of books. That way, accounting systems remain clearly separated, company ledgers are always in balance, and internal controls can be applied cleanly across the various corporate entities.

Unfortunately, D365’s native tool for financial reporting (aptly named “Financial Reporter”) lacks the capability to report against multiple corporate entities. As a result, most Microsoft Dynamics customers resort to one of two strategies: (1) they create a single company that all other entities roll up to, and then they write reports against that single company; or (2) they dump financial reports from each individual entity into Excel and build a consolidated financial statement there.

That brings us back to the problem addressed in wish list item one: When it is a manual process to export, import, copy, or paste information, it costs time and effort, and it potentially introduces errors.

To add to the frustration, Financial Reporter offers no capability for drilling down to transactional detail. Moreover, it can only access general ledger data, so it has a very limited view of transactions within the ERP system.

Financial Reporter is reaching the end of its life as a product. That probably won’t come as a surprise to people who have used it to create financial reports. Microsoft’s proposed replacement, however, is Power BI.

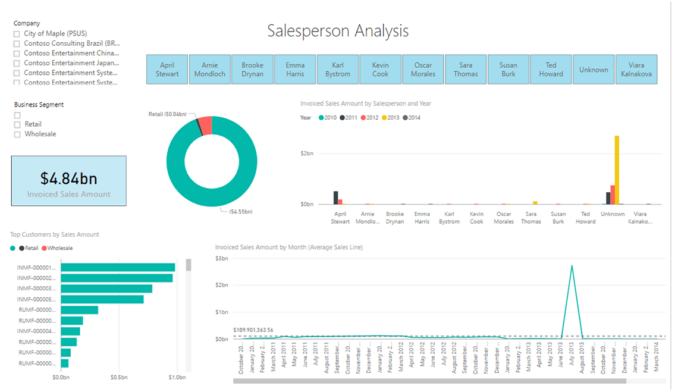

Power BI is designed primarily as a data visualization tool. In other words, its main purpose is to vividly represent information in the form of graphs, pie charts, and dashboards. That’s very different from the kind of traditional financial reporting needed to produce an income statement, balance sheet, or statement of cash flows.

Although Power BI certainly has a role to play in many enterprises, it has a very steep learning curve, a complex architecture, and an extended development cycle for new reports. That’s a far cry from what most finance teams need, which is flexibility, speed, accuracy, and ease of use.

As of today, Microsoft simply does not offer D365 F&SCM customers a simple and affordable way to create consolidated financials. If you need that, we’d encourage you to look at Atlas.

3. Drill-Down Capability

The process of producing financial statements inevitably involves a lot of investigation. In an ideal world, a user would be able to display a financial report on-screen and simply double-click on a line-item to see the details comprising that number.

If product returns were unusually high in a particular month, for example, the user could double-click on that number to see detailed transactions from the GL trial balance. From there, let’s imagine the user notices two unusually high numbers. By double-clicking on each of those, the customer can drill down further to see the credit documents from the D365 F&SCM sales order module.

D365’s Financial Reporter doesn’t provide that capability. Nor does Power BI out of the box. Drill-down saves time on the routine tasks that finance and accounting personnel must repeat hundreds of times throughout the course of a period closing process. With the right reporting tool, drill-down capabilities can save finance teams a lot of time and headaches.

4. Practical Tools That Make Closing Easier

So many of the routine period closing tasks performed every month are easily automated. At the very least, Microsoft Excel worksheets can be used to reconcile external numbers against general ledger account balances and to automatically calculate the necessary adjusting journal entries.

With real-time links from Excel to Microsoft D365 F&SCM, much of that process can be automated because balances can be automatically updated to templated worksheets. If you’re using manual processes to do that, you run the risk of creating journal entries based on outdated information or manually entered numbers that may be incorrect.

Atlas from insightsoftware provides that kind of simplicity, but even better, it offers a bulk upload of journals from Excel back into Microsoft Dynamics 365, further automating the process, saving time and increasing accuracy.

When you’re ready to distribute reports, Atlas makes it easy to automate that process, too. Whether you want to run reports and upload automation tasks every five minutes or on the first business day of every month (or both), Atlas’ flexible scheduling and task automation have you covered. Finance and accounting users can easily schedule and distribute reports to team members across the organization and automate the upload of journals into Microsoft Dynamics with the click of a button.

5. Eliminate the Delays and Bottlenecks

Whether you are implementing D365 F&SCM for the first time or upgrading from Microsoft Dynamics AX, chances are you will experience some delays in getting the reports you need. Software implementation projects can be daunting, and they consume inordinate amounts of time from the IT department. Unfortunately, the task of developing and upgrading all of the custom reports required by finance often gets pushed to the back burner.

In many implementations and upgrades, report specifications are collected early on in the project lifecycle. The resulting reports, however, are usually not delivered until very late in the process. When the outcome isn’t exactly as expected, it requires another cycle of revisions, which consumes more IT resources. For the finance team, that often amounts to extensive delays, particularly if the IT department has a backlog of unfinished projects.

For most finance and accounting teams, the best answer is to eliminate the dependency on IT altogether. With self-service tools that make it easy for a non-specialist to develop or customize reports, the bottlenecks can be eliminated and reports can be produced quickly and easily.

6. Eliminate the High Costs

Custom reports can also be tremendously expensive, especially when you consider the long-term costs of updating them over time. In some respects, this is a consequence of the previous item on the wish list, eliminating bottlenecks. In this case, however, you consider the high costs of hiring and retaining IT specialists, or worse yet, the cost of paying expensive outside consultants to do the job for you.

If your organization has recently implemented D365 F&SCM, or if you are planning a project in the near future, we encourage you to reach out to us to get a free demo of Atlas. Finance teams that have struggled with the existing reporting tools available for D365 F&SCM consistently tell us that Atlas checks all the boxes on their financial reporting wish list. Contact us today to talk about your project and get a live demo.